Question 12 Costs that are capitalized: O Show up as an expense on the income statement without ever being recorded on the balance sheet O None of the possible choices O Will initially be recorded as an asset on the balance sheet O Never exist as part of accrual accounting

Question 12 Costs that are capitalized: O Show up as an expense on the income statement without ever being recorded on the balance sheet O None of the possible choices O Will initially be recorded as an asset on the balance sheet O Never exist as part of accrual accounting

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter11: Depreciation, Depletion, Impairment, And Disposal

Section: Chapter Questions

Problem 23GI: (Appendix 11.1) Why might depreciation on a companys financial statements be different from...

Related questions

Question

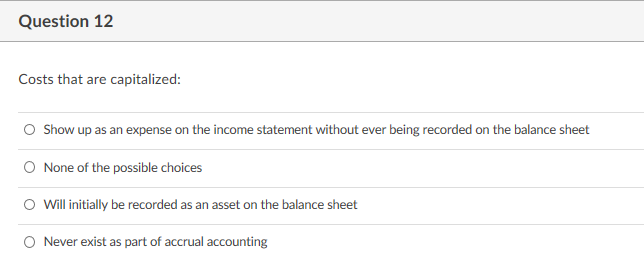

Transcribed Image Text:Question 12

Costs that are capitalized:

O Show up as an expense on the income statement without ever being recorded on the balance sheet

O None of the possible choices

O Will initially be recorded as an asset on the balance sheet

O Never exist as part of accrual accounting

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,