QUESTION 12 Today, markef interest rates on US Treasury securities are 3 8% on one yoar (maturity) Treasury bill and 5 6% on two yo (maury Troasury note If investors expect an interest rate on one yoar Treasury bill to become 42% one yoar later, then acconding to the liquidity premium theory, a liquidity premium on the two-yoar Treasury note should be place without % sign eg 12.3) %today (Answ up to the fest decimal

QUESTION 12 Today, markef interest rates on US Treasury securities are 3 8% on one yoar (maturity) Treasury bill and 5 6% on two yo (maury Troasury note If investors expect an interest rate on one yoar Treasury bill to become 42% one yoar later, then acconding to the liquidity premium theory, a liquidity premium on the two-yoar Treasury note should be place without % sign eg 12.3) %today (Answ up to the fest decimal

Chapter5: The Cost Of Money (interest Rates)

Section: Chapter Questions

Problem 20PROB

Related questions

Question

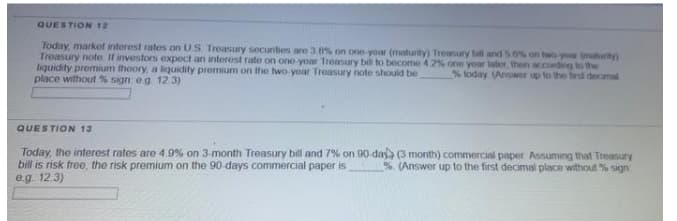

Transcribed Image Text:QUESTION 12

Today, market interest rates on US Treasury secunties are 3.8% on one yoar (maturity) Treasury bil and 5 6% on two yow (mahurity)

Treasury note If investors expect an interest rate on one yoar Treasury bill to become 4 2% one year later, then according to the

liquidity premium theory, a liquidity premium on the two-yoar Treasury note should be

place without % sign: eg 12.3)

% today (Answer up to the fiest decimal

QUESTION 13

Today, the interest rates are 4.9% on 3-month Treasury bill and 7% on 90-daya (3 month) commercial paper. Assuming that Treasury

bill is risk free, the risk premium on the 90-days commercial paper is

eg. 12.3)

%. (Answer up to the first decimal place without % sign

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you