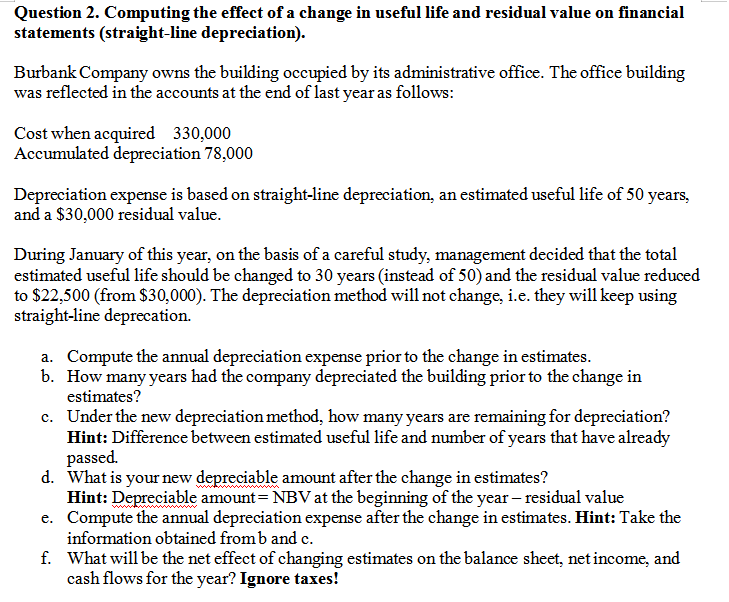

Question 2. Computing the effect of a change in useful life and residual value on financial statements (straight-line depreciation). Burbank Company owns the building occupied by its administrative office. The office building was reflected in the accounts at the end of last year as follows: Cost when acquired 330,000 Accumulated depreciation 78,000 Depreciation expense is based on straight-line depreciation, an estimated useful life of 50 years, and a $30,000 residual value. During January of this year, on the basis of a careful study, management decided that the total estimated useful life should be changed to 30 years (instead of 50) and the residual value reduced to $22,500 (from $30,000). The depreciation method will not change, i.e. they will keep using straight-line deprecation. a. Compute the annual depreciation expense prior to the change in estimates. b. How many years had the company depreciated the building prior to the change in estimates? c. Under the new depreciation method, how many years are remaining for depreciation? Hint: Difference between estimated useful life and number of years that have already passed. d. What is your new depreciable amount after the change in estimates? Hint: Depreciable amount= NBV at the beginning of the year – residual value e. Compute the annual depreciation expense after the change in estimates. Hint: Take the information obtained from b and c. f. What will be the net effect of changing estimates on the balance sheet, net income, and cash flows for the year? Ignore taxes!

Question 2. Computing the effect of a change in useful life and residual value on financial statements (straight-line depreciation). Burbank Company owns the building occupied by its administrative office. The office building was reflected in the accounts at the end of last year as follows: Cost when acquired 330,000 Accumulated depreciation 78,000 Depreciation expense is based on straight-line depreciation, an estimated useful life of 50 years, and a $30,000 residual value. During January of this year, on the basis of a careful study, management decided that the total estimated useful life should be changed to 30 years (instead of 50) and the residual value reduced to $22,500 (from $30,000). The depreciation method will not change, i.e. they will keep using straight-line deprecation. a. Compute the annual depreciation expense prior to the change in estimates. b. How many years had the company depreciated the building prior to the change in estimates? c. Under the new depreciation method, how many years are remaining for depreciation? Hint: Difference between estimated useful life and number of years that have already passed. d. What is your new depreciable amount after the change in estimates? Hint: Depreciable amount= NBV at the beginning of the year – residual value e. Compute the annual depreciation expense after the change in estimates. Hint: Take the information obtained from b and c. f. What will be the net effect of changing estimates on the balance sheet, net income, and cash flows for the year? Ignore taxes!

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter9: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 1TIF: Revising depreciation estimates Hard Bodies Co. is a fitness chain that has just completed its...

Related questions

Question

please answer the question d e f , i have some concern with d,e,f. thank you.

Transcribed Image Text:Question 2. Computing the effect of a change in useful life and residual value on financial

statements (straight-line depreciation).

Burbank Company owns the building occupied by its administrative office. The office building

was reflected in the accounts at the end of last year as follows:

Cost when acquired 330,000

Accumulated depreciation 78,000

Depreciation expense is based on straight-line depreciation, an estimated useful life of 50 years,

and a $30,000 residual value.

During January of this year, on the basis of a careful study, management decided that the total

estimated useful life should be changed to 30 years (instead of 50) and the residual value reduced

to $22,500 (from $30,000). The depreciation method will not change, i.e. they will keep using

straight-line deprecation.

a. Compute the annual depreciation expense prior to the change in estimates.

b. How many years had the company depreciated the building prior to the change in

estimates?

c. Under the new depreciation method, how many years are remaining for depreciation?

Hint: Difference between estimated useful life and number of years that have already

passed.

d. What is your new depreciable amount after the change in estimates?

Hint: Depreciable amount= NBV at the beginning of the year – residual value

e. Compute the annual depreciation expense after the change in estimates. Hint: Take the

information obtained from b and c.

f. What will be the net effect of changing estimates on the balance sheet, net income, and

cash flows for the year? Ignore taxes!

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Step 1 Introduction

VIEWStep 2 d) Computation of new depreciable amount after the change in estimates

VIEWStep 3 d) Answer

VIEWStep 4 e) Computation of annual depreciation after the change in estimates

VIEWStep 5 e) Answer

VIEWStep 6 F) Effect of change in depreciation on balance sheet, net income and cash flows

VIEWTrending now

This is a popular solution!

Step by step

Solved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage