Question 28 of 50. Carlos is single and required to file a return. During the year, he received $900 in interest from a certificate of deposit held with his local bank. He also received $725 in interest from U.S. Treasury securities and $300 in municipal bond interest. Where on his tax return will Carlos report this income? Form 1099-INT. Directly on Form 1040, page 1. The Qualified Dividends and Capital Gain Tax Worksheet. Schedule B. Mark for follow up

Question 28 of 50. Carlos is single and required to file a return. During the year, he received $900 in interest from a certificate of deposit held with his local bank. He also received $725 in interest from U.S. Treasury securities and $300 in municipal bond interest. Where on his tax return will Carlos report this income? Form 1099-INT. Directly on Form 1040, page 1. The Qualified Dividends and Capital Gain Tax Worksheet. Schedule B. Mark for follow up

Fundamentals of Financial Management (MindTap Course List)

14th Edition

ISBN:9781285867977

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 8P: PERSONAL TAXES Joe and Jane Keller are a married couple who file a joint income tax return, where...

Related questions

Question

100%

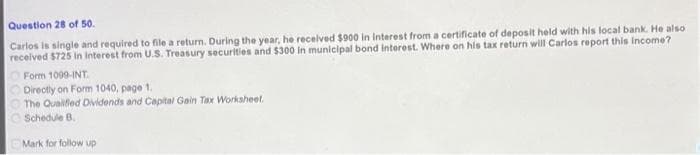

Transcribed Image Text:Question 28 of 50.

Carlos is single and required to file a return. During the year, he received $900 in interest from a certificate of deposit held with his local bank. He also

received $725 in interest from U.S. Treasury securities and $300 in municipal bond interest. Where on his tax return will Carlos report this income?

Form 1099-INT.

Directly on Form 1040, page 1.

The Qualified Dividends and Capital Gain Tax Worksheet.

Schedule B.

Mark for follow up

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781285867977

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals of Financial Management, Concise Edi…

Finance

ISBN:

9781305635937

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning