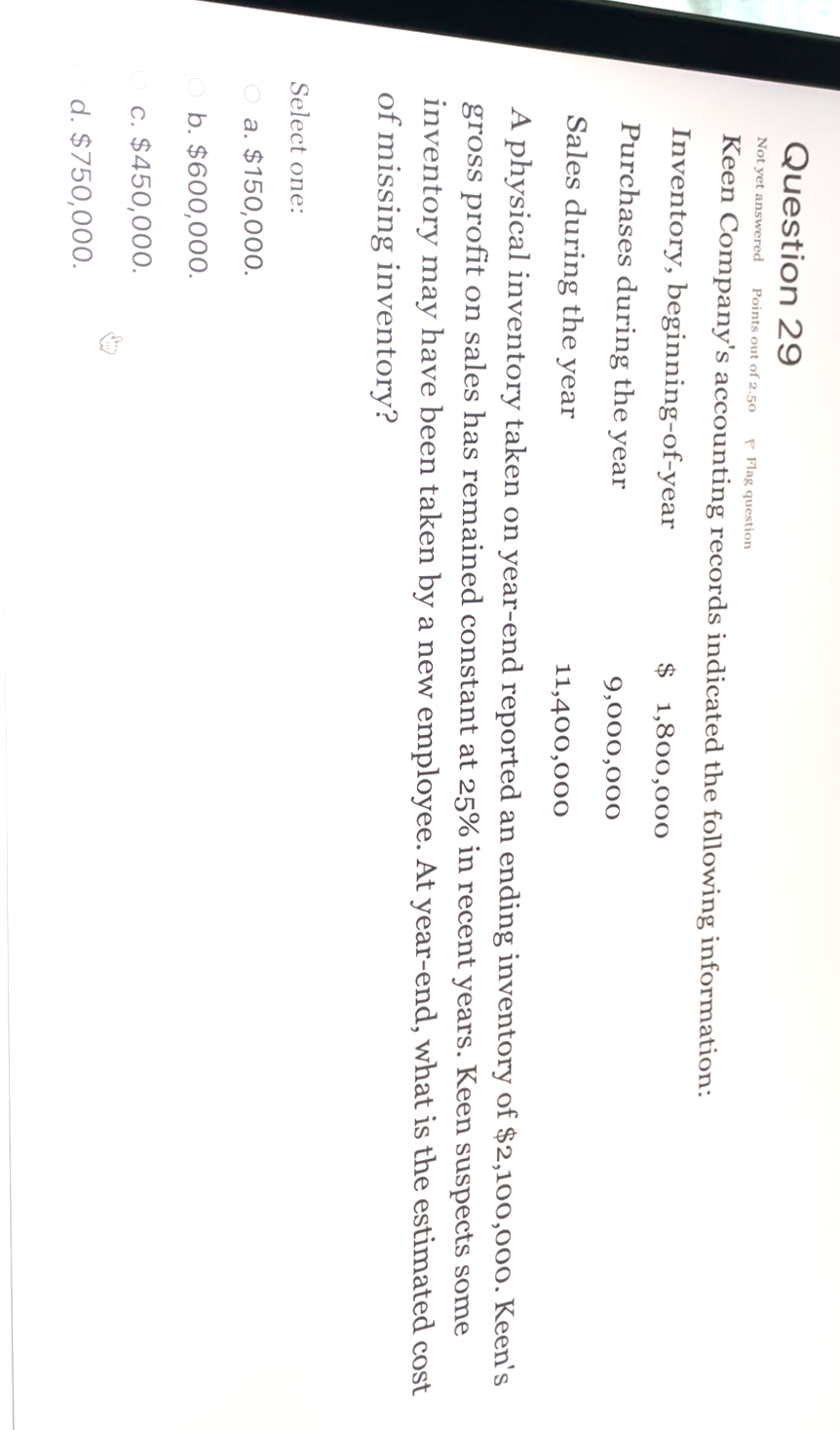

Question 29 Not yet answered Points out of 2.50 P Flag question Keen Company's accounting records indicated the following information: Inventory, beginning-of-year $ 1,800,000 Purchases during the year 9,000,000 Sales during the year 11,400,000 A physical inventory taken on year-end reported an ending inventory of $2,100,000. Keen's gross profit on sales has remained constant at 25% in recent years. Keen suspects some inventory may have been taken by a new employee. At year-end, what is the estimated cost of missing inventory? Select one: O a. $150,000. O b. $600,000. c. $450,000. d. $750,000.

Question 29 Not yet answered Points out of 2.50 P Flag question Keen Company's accounting records indicated the following information: Inventory, beginning-of-year $ 1,800,000 Purchases during the year 9,000,000 Sales during the year 11,400,000 A physical inventory taken on year-end reported an ending inventory of $2,100,000. Keen's gross profit on sales has remained constant at 25% in recent years. Keen suspects some inventory may have been taken by a new employee. At year-end, what is the estimated cost of missing inventory? Select one: O a. $150,000. O b. $600,000. c. $450,000. d. $750,000.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter9: Long-term Assets: Fixed And Intangible

Section: Chapter Questions

Problem 9.12EX

Related questions

Question

Transcribed Image Text:Question 29

Not yet answered

Points out of 2.50

P Flag question

Keen Company's accounting records indicated the following information:

Inventory, beginning-of-year

$ 1,800,000

Purchases during the year

9,000,000

Sales during the year

11,400,000

A physical inventory taken on year-end reported an ending inventory of $2,100,000. Keen's

gross profit on sales has remained constant at 25% in recent years. Keen suspects some

inventory may have been taken by a new employee. At year-end, what is the estimated cost

of missing inventory?

Select one:

O a. $150,000.

b. $600,000.

c. $450,000.

d. $750,000.

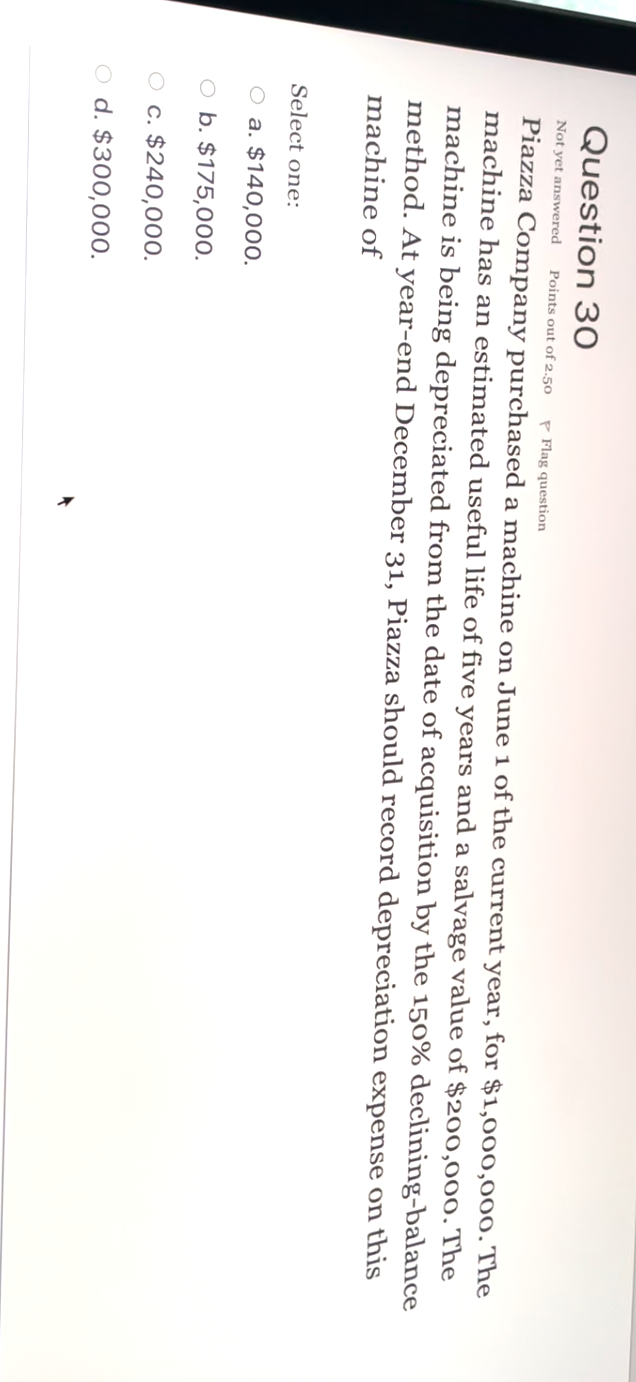

Transcribed Image Text:Question 30

Not yet answered

Points out of 2.50

P Flag question

Piazza Company purchased a machine on June 1 of the current year, for $1,000,000. The

machine has an estimated useful life of five years and a salvage value of $200,000. The

machine is being depreciated from the date of acquisition by the 150% declining-balance

method. At year-end December 31, Piazza should record depreciation expense on this

machine of

Select one:

O a. $140,000.

O b. $175,000.

O c. $240,000.

O d. $300,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning