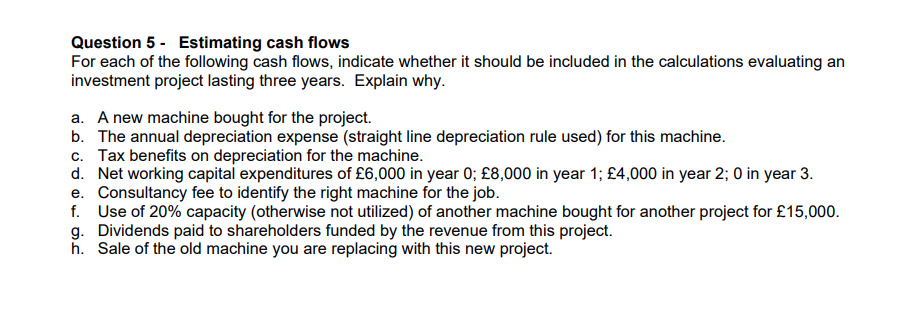

Question 5 - Estimating cash flows For each of the following cash flows, indicate whether it should be included in the calculations evaluating an investment project lasting three years. Explain why. a. A new machine bought for the project. b. The annual depreciation expense (straight line depreciation rule used) for this machine. c. Tax benefits on depreciation for the machine. d. Net working capital expenditures of £6,000 in year 0; £8,000 in year 1; £4,000 in year 2; 0 in year 3. e. Consultancy fee to identify the right machine for the job. f. Use of 20% capacity (otherwise not utilized) of another machine bought for another project for £15,000. g. Dividends paid to shareholders funded by the revenue from this project. h. Sale of the old machine you are replacing with this new project.

Question 5 - Estimating cash flows For each of the following cash flows, indicate whether it should be included in the calculations evaluating an investment project lasting three years. Explain why. a. A new machine bought for the project. b. The annual depreciation expense (straight line depreciation rule used) for this machine. c. Tax benefits on depreciation for the machine. d. Net working capital expenditures of £6,000 in year 0; £8,000 in year 1; £4,000 in year 2; 0 in year 3. e. Consultancy fee to identify the right machine for the job. f. Use of 20% capacity (otherwise not utilized) of another machine bought for another project for £15,000. g. Dividends paid to shareholders funded by the revenue from this project. h. Sale of the old machine you are replacing with this new project.

Fundamentals Of Financial Management, Concise Edition (mindtap Course List)

10th Edition

ISBN:9781337902571

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter3: Financial Statements, Cash Flow, And Taxes

Section: Chapter Questions

Problem 12P

Related questions

Question

Transcribed Image Text:Question 5 - Estimating cash flows

For each of the following cash flows, indicate whether it should be included in the calculations evaluating an

investment project lasting three years. Explain why.

a. A new machine bought for the project.

b. The annual depreciation expense (straight line depreciation rule used) for this machine.

c. Tax benefits on depreciation for the machine.

d. Net working capital expenditures of £6,000 in year 0; £8,000 in year 1; £4,000 in year 2; 0 in year 3.

e. Consultancy fee to identify the right machine for the job.

f. Use of 20% capacity (otherwise not utilized) of another machine bought for another project for £15,000.

g. Dividends paid to shareholders funded by the revenue from this project.

h. Sale of the old machine you are replacing with this new project.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning