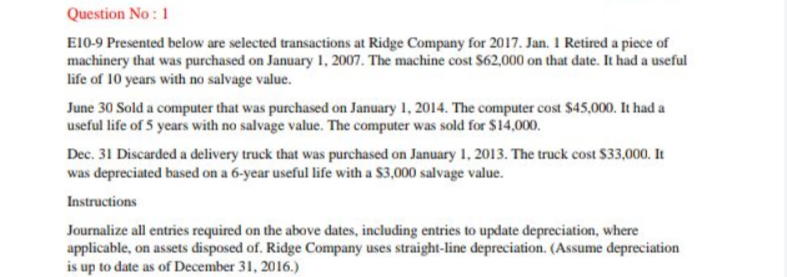

Question No: 1 E10-9 Presented below are selected transactions at Ridge Company for 2017. Jan. I Retired a piece of machinery that was purchased on January 1, 2007. The machine cost $62,000 on that date. It had a useful life of 10 years with no salvage value. June 30 Sold a computer that was purchased on January 1, 2014. The computer cost $45,000. It had a useful life of 5 years with no salvage value. The computer was sold for $14,000. Dec. 31 Discarded a delivery truck that was purchased on January 1, 2013. The truck cost $33,000. It was depreciated based on a 6-year useful life with a $3,000 salvage value. Instructions Journalize all entries required on the above dates, including entries to update depreciation, where applicable, on assets disposed of. Ridge Company uses straight-line depreciation. (Assume depreciation is up to date as of December 31, 2016.)

Question No: 1 E10-9 Presented below are selected transactions at Ridge Company for 2017. Jan. I Retired a piece of machinery that was purchased on January 1, 2007. The machine cost $62,000 on that date. It had a useful life of 10 years with no salvage value. June 30 Sold a computer that was purchased on January 1, 2014. The computer cost $45,000. It had a useful life of 5 years with no salvage value. The computer was sold for $14,000. Dec. 31 Discarded a delivery truck that was purchased on January 1, 2013. The truck cost $33,000. It was depreciated based on a 6-year useful life with a $3,000 salvage value. Instructions Journalize all entries required on the above dates, including entries to update depreciation, where applicable, on assets disposed of. Ridge Company uses straight-line depreciation. (Assume depreciation is up to date as of December 31, 2016.)

Financial Accounting: The Impact on Decision Makers

10th Edition

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Gary A. Porter, Curtis L. Norton

Chapter8: Operating Assets: Property, Plant, And Equipment, And Intangibles

Section: Chapter Questions

Problem 8.5E: Change in Estimate Assume that Bloomer Company purchased a new machine on January 1, 2016, for...

Related questions

Question

Transcribed Image Text:Question No: 1

E10-9 Presented below are selected transactions at Ridge Company for 2017. Jan. I Retired a piece of

machinery that was purchased on January 1, 2007. The machine cost $62,000 on that date. It had a useful

life of 10 years with no salvage value.

June 30 Sold a computer that was purchased on January 1, 2014. The computer cost $45,000. It had a

useful life of 5 years with no salvage value. The computer was sold for $14,000.

Dec. 31 Discarded a delivery truck that was purchased on January 1, 2013. The truck cost $33,000. It

was depreciated based on a 6-year useful life with a $3,000 salvage value.

Instructions

Journalize all entries required on the above dates, including entries to update depreciation, where

applicable, on assets disposed of. Ridge Company uses straight-line depreciation. (Assume depreciation

is up to date as of December 31, 2016.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning