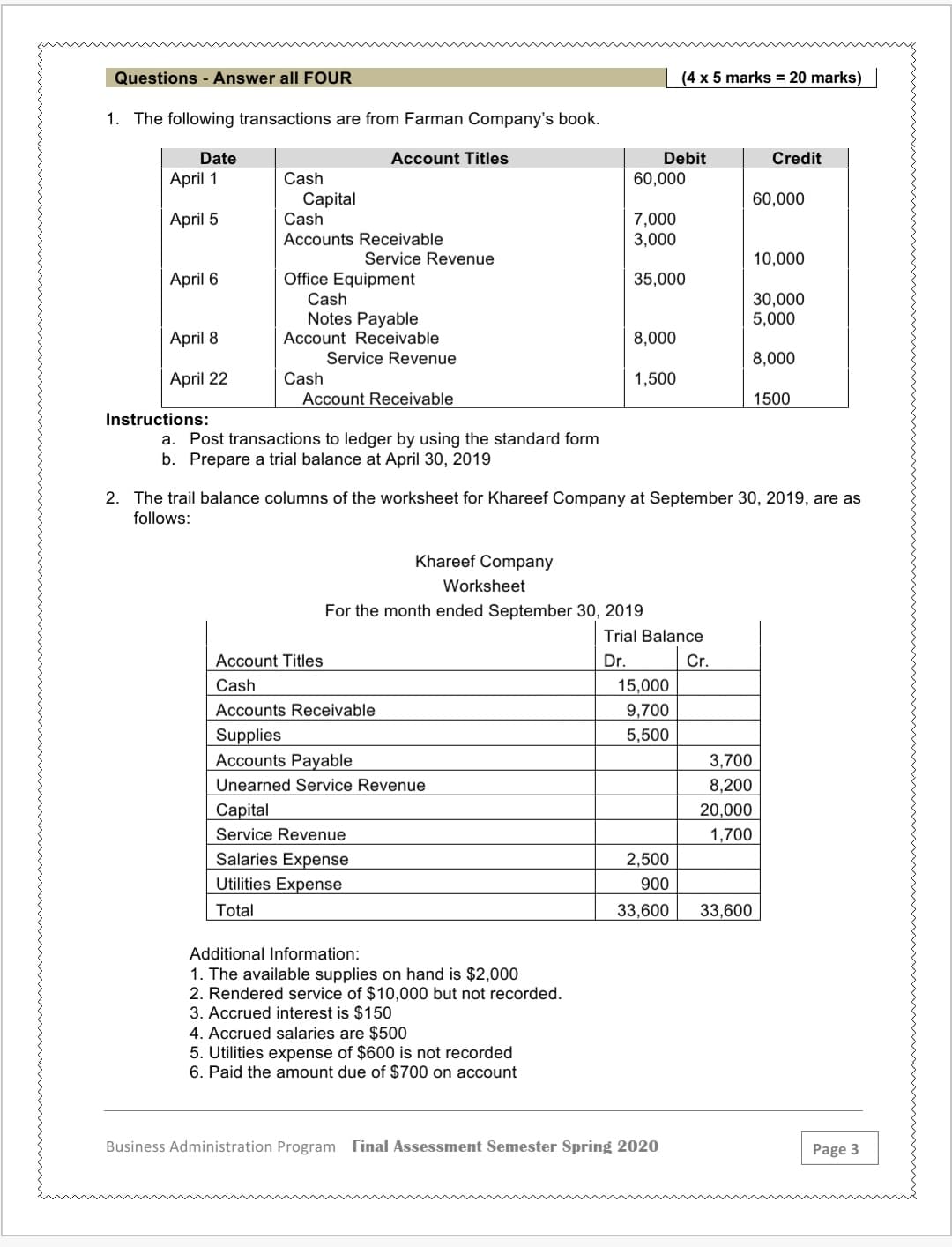

Questions - Answer all FOUR (4 x 5 marks = 20 marks) 1. The following transactions are from Farman Company's book. Date Account Titles Debit Credit April 1 Cash 60,000 Capital Cash 60,000 April 5 7,000 3,000 Accounts Receivable Service Revenue 10,000 Office Equipment Cash Notes Payable April 6 35,000 30,000 5,000 April 8 Account Receivable 8,000 Service Revenue 8,000 April 22 Cash 1,500 Account Receivable 1500 Instructions: a. Post transactions to ledger by using the standard form b. Prepare a trial balance at April 30, 2019 2. The trail balance columns of the worksheet for Khareef Company at September 30, 2019, are as follows: Khareef Company Worksheet For the month ended September 30, 2019 Trial Balance Account Titles Dr. Cr. Cash 15,000 Accounts Receivable 9,700 Supplies Accounts Payable 5,500 3,700 Unearned Service Revenue 8,200 Сapital 20,000 Service Revenue 1,700 Salaries Expense 2,500 Utilities Expense 900 Total 33,600 33,600 Additional Information: 1. The available supplies on hand is $2,000 2. Rendered service of $10,000 but not recorded. 3. Accrued interest is $150 4. Accrued salaries are $500 5. Utilities expense of $600 is not recorded 6. Paid the amount due of $700 on account Business Administration Program Final Assessment Semester Spring 2020 Page 3

Questions - Answer all FOUR (4 x 5 marks = 20 marks) 1. The following transactions are from Farman Company's book. Date Account Titles Debit Credit April 1 Cash 60,000 Capital Cash 60,000 April 5 7,000 3,000 Accounts Receivable Service Revenue 10,000 Office Equipment Cash Notes Payable April 6 35,000 30,000 5,000 April 8 Account Receivable 8,000 Service Revenue 8,000 April 22 Cash 1,500 Account Receivable 1500 Instructions: a. Post transactions to ledger by using the standard form b. Prepare a trial balance at April 30, 2019 2. The trail balance columns of the worksheet for Khareef Company at September 30, 2019, are as follows: Khareef Company Worksheet For the month ended September 30, 2019 Trial Balance Account Titles Dr. Cr. Cash 15,000 Accounts Receivable 9,700 Supplies Accounts Payable 5,500 3,700 Unearned Service Revenue 8,200 Сapital 20,000 Service Revenue 1,700 Salaries Expense 2,500 Utilities Expense 900 Total 33,600 33,600 Additional Information: 1. The available supplies on hand is $2,000 2. Rendered service of $10,000 but not recorded. 3. Accrued interest is $150 4. Accrued salaries are $500 5. Utilities expense of $600 is not recorded 6. Paid the amount due of $700 on account Business Administration Program Final Assessment Semester Spring 2020 Page 3

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Questions - Answer all FOUR

(4 x 5 marks = 20 marks)

1. The following transactions are from Farman Company's book.

Date

Account Titles

Debit

Credit

April 1

Cash

60,000

Capital

Cash

60,000

April 5

7,000

3,000

Accounts Receivable

Service Revenue

10,000

Office Equipment

Cash

Notes Payable

April 6

35,000

30,000

5,000

April 8

Account Receivable

8,000

Service Revenue

8,000

April 22

Cash

1,500

Account Receivable

1500

Instructions:

a. Post transactions to ledger by using the standard form

b. Prepare a trial balance at April 30, 2019

2. The trail balance columns of the worksheet for Khareef Company at September 30, 2019, are as

follows:

Khareef Company

Worksheet

For the month ended September 30, 2019

Trial Balance

Account Titles

Dr.

Cr.

Cash

15,000

Accounts Receivable

9,700

Supplies

Accounts Payable

5,500

3,700

Unearned Service Revenue

8,200

Сapital

20,000

Service Revenue

1,700

Salaries Expense

2,500

Utilities Expense

900

Total

33,600

33,600

Additional Information:

1. The available supplies on hand is $2,000

2. Rendered service of $10,000 but not recorded.

3. Accrued interest is $150

4. Accrued salaries are $500

5. Utilities expense of $600 is not recorded

6. Paid the amount due of $700 on account

Business Administration Program Final Assessment Semester Spring 2020

Page 3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education