Raw material purchases $ 175,000 Direct labor 254,000 Indirect labor 109,000 Selling and administrative salaries 133,000 Building depreciation* 80,000 Other selling and administrative expenses 195,000 Other factory costs . 344,000 Sales revenue ($130 per unit) 1,495,000 *Seventy-five percent of the company's building was devoted to production activities; the remaining 25 percent was used for selling and administrative functions. Inventory data: January 1 December 31 Raw material.. $ 15,800 $18,200 Work in process. 35,700 62,100 Finished goods* 111,100 97,900 *The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively.

Raw material purchases $ 175,000 Direct labor 254,000 Indirect labor 109,000 Selling and administrative salaries 133,000 Building depreciation* 80,000 Other selling and administrative expenses 195,000 Other factory costs . 344,000 Sales revenue ($130 per unit) 1,495,000 *Seventy-five percent of the company's building was devoted to production activities; the remaining 25 percent was used for selling and administrative functions. Inventory data: January 1 December 31 Raw material.. $ 15,800 $18,200 Work in process. 35,700 62,100 Finished goods* 111,100 97,900 *The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively.

Chapter5: Process Costing

Section: Chapter Questions

Problem 10MC: Direct material costs $3 per unit, direct labor costs $5 per unit, and overhead is applied at the...

Related questions

Question

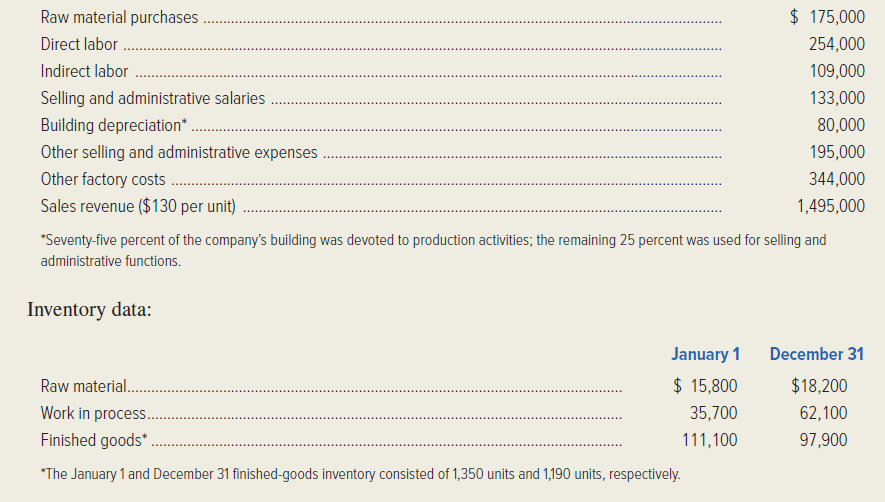

The following selected information was extracted from the 20x1 accounting records of Lone Oak Products:

Required:

1. Calculate Lone Oak’s manufacturing

2. Calculate Lone Oak’s cost of goods manufactured.

3. Compute the company’s cost of goods sold.

4. Determine net income for 20x1, assuming a 30% income tax rate.

5. Determine the number of completed units manufactured during the year.

6. Build a spreadsheet: Construct an Excel spreadsheet to solve all of the preceding requirements. Show how the solution will change if the following data change: indirect labor is $115,000 and other

Transcribed Image Text:Raw material purchases

$ 175,000

Direct labor

254,000

Indirect labor

109,000

Selling and administrative salaries

133,000

Building depreciation*

80,000

Other selling and administrative expenses

195,000

Other factory costs .

344,000

Sales revenue ($130 per unit)

1,495,000

*Seventy-five percent of the company's building was devoted to production activities; the remaining 25 percent was used for selling and

administrative functions.

Inventory data:

January 1

December 31

Raw material..

$ 15,800

$18,200

Work in process.

35,700

62,100

Finished goods*

111,100

97,900

*The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub