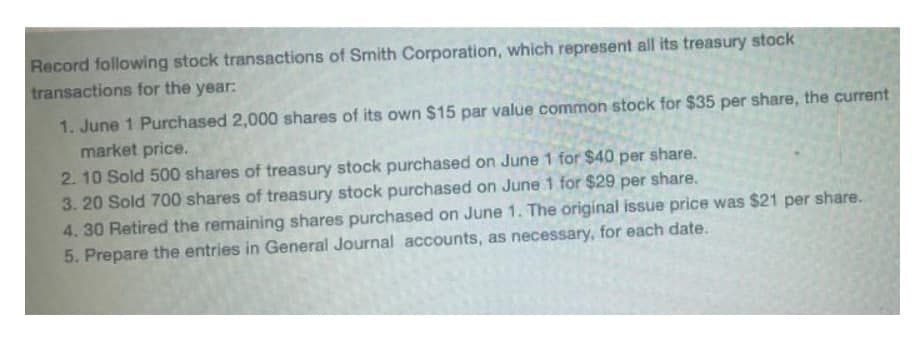

Record following stock transactions of Smith Corporation, which represent all its treasury stock transactions for the year: 1. June 1 Purchased 2,000 shares of its own $15 par value common stock for $35 per share, the current market price. 2.10 Sold 500 shares of treasury stock purchased on June 1 for $40 per share. 3. 20 Sold 700 shares of treasury stock purchased on June 1 for $29 per 4.30 Retired the remaining shares purchased on June 1. The original issue price was $21 per share. 5. Prepare the entries in General Journal accounts, as necessary, for each date. share.

Q: On October 10, the stockholders' equity section of Sherman Systems appears as follows. Common…

A: Working Notes: 1. Treasury stock A/c = shares purchase * per share rate = (5000 shares *$25) =…

Q: On October 10, the stockholders' equity section of Sherman Systems appears as follows. Common…

A: Treasury shares are those shares which are repurchased or reacquired by the business from its own…

Q: On October 10, the stockholders' equity section of Sherman Systems appears as follows. Common…

A: Journal entry is a process of recording and classifying business transactions initially into books…

Q: Carl Corporation has the following beginning balances in its stockholders' equity accounts on…

A: Since you have asked multiple questions, we will solve the first question for you. If you want any…

Q: On January 1, 2021. Hum Enterprises Inc. had 80.000 common shares, recorded at $560,000. The company…

A: Share refers to the unit that is issued by the company into a market to raise funds by making an…

Q: At the beginning of the current year, Hardin Company had 20,000 shares of $10 par common stock…

A: Weighted average shares outstanding is a number of shares of the company after incorporating…

Q: Universal Cable Corporation has 1,000,000 shares of $1 par value capital stock outstanding on…

A: 1. Prepare journal entries to record the above transactions.

Q: On January 1, Tesla had 40,000 shares of $10 par value common stock issued and outstanding. All…

A: A treasury stock means a reacquired stock which is repurchased by the organization or company,…

Q: On January 1, Riverbed Corp had 62,300 shares of no-par common stock issued and outstanding. The…

A: Journal is a place where accounting transactions are listed in the book keeping system before ledger…

Q: Sheffield Corp.'s balance sheet reported the following: Capital stock outstanding, 4,000 shares,…

A: Treasury stock is the amount or value of stock that is being reacquired or repurchased from the…

Q: York's outstanding stock consists of 75,000 shares of noncumulative 6.0% preferred stock with a $5…

A: The question is based on the concept of Financial Accounting. When the dividend is declared and paid…

Q: A company has two classes of stock authorized: 8%, $10 par preferred, and $1 par value common. The…

A: Stockholder's Equity - Stockholder's Equity includes the amount contributed by shareholders issued…

Q: Entries to issue stock Devers Company had the following…

A: Introduction: A journal entry is used to describe a transaction that is recorded in the company's…

Q: On January 1, Sheffield Corp. had 56,600 shares of no-par common stock issued and outstanding. The…

A: Dividend is payable on No. of outstanding shares.

Q: On January 1, Larkspur, Inc. had 93,000 shares of no-par common stock issued and outstanding. The…

A: Journal entry: This is the first step to record accounts. It is written in the same order in which…

Q: Leprechan Inc. had the following stock and convertible securities outstanding on January 1: ●…

A:

Q: A company began the current year with the following balances in its stockholders’ equity accounts…

A: Treasury Stock refers to the company’s own outstanding stock bought back from stockholders. These…

Q: Nylah Corporation's balance sheet reported the following: Capital stock outstanding, 5,000 shares,…

A: Treasury stock: These are the own shares purchased by the issuing company from the open market.…

Q: Dawls Corporation reported stockholders' equity on December 31 of the prior year as follows:…

A: As per relevant accounting principles, when treasury stock is purchased, the treasury stock account…

Q: On January 1, 2021, Pharoah Corp. had 491,000 shares of common stock outstanding. During 2021, it…

A: Earnings per share is a financial ratio that represents the value income earned for one share. The…

Q: Kohler Corporation reports the following components of stockholders’ equity at December 31 of the…

A: Solution 1: Kohler Corporation - Journal Entries Date Particulars Debit Credit 2-Jan…

Q: 2 On January 1, Graves Corporation had 60,000 shares of no-par common stock issued and outstanding.…

A: The journal entries are prepared to keep the record of day to day transactions of the business on…

Q: On January 1, Pharoah Company had 64,500 shares of no-par common stock issued and outstanding. The…

A: Introduction: Journals: Recording of a business transactions in a chronological order. First step in…

Q: Leprechan Inc. had the following stock and convertible securities outstanding on January 1: •…

A: Earnings per share (EPS) is calculated by dividing a company's profit by the number of shares of…

Q: Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 66,000…

A: Dividends are distributions of earnings by a corporation to its stockholders. Usually the…

Q: Recording the Sale of Common and Preferred Stock At the end of its first year of operations,…

A: The organization can raise funds for the operation song integrity by issuing common stock, preferred…

Q: Explain how to calculate the after stock dividend to enter on the balance sheet for the below. At…

A: Determine the effect of stock dividend.

Q: Required: Calculate basic earnings per share: ___________ Calculate fully diluted earnings per…

A: The weighted average common share outstanding should be used to determine the basic earnings per…

Q: Dwight Corporation in its first year of operations had the following stock transactions.…

A: Journal Entry :— It is an act of recording transaction when it is occured in books of accounts for…

Q: On January 1, Guillen Corporation had 95,000 shares of no-par common stock issued and outstanding.…

A: Dividend can be defined as the profit distribution done by a corporation to its shareholders, who…

Q: A company has two classes of stock authorized: 9%, $10 par preferred, and $1 par value common. The…

A: Stockholder's equity section of balance sheet is as under:

Q: Kohler Corporation reports the following components of stockholders' equity at December 31 of the…

A: Shareholders Equity refers to sum of Common shares Capital, Retained Earnings and Preferred stock.

Q: On January 1, Guillen Corporation had 95,000 shares of no-par common stock issued and outstanding.…

A: Journal entry: A journal entry is used to record day-to-day transactions of the business by debiting…

Q: Weaver Corporation had the following stock issued and outstanding at January 1, Year 1: 66,000…

A: Definition: Dividends: This is the amount of cash distributed to stockholders by a company out its…

Q: Please help

A: Journal entry: Journal entry is a set of economic events which can be measured in monetary terms.…

Q: Explain how to calculate the after stock dividend to enter on the Balance Sheet. At the beginning of…

A: A Stock Dividend is the payment of dividends in the forms of shares of the company. In cash crunch…

Q: On January 1,2022, the stockholders equity section of concord corporation shows common stock ($5…

A: Sale value of treasury stock=Number of shares×Value per share=11,000×$11=$121,000

Q: On January 1, Vermont Corporation had 46,400 shares of $9 par value common stock issued and…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Ivanhoe Company had these transactions during the current period. June 12 Issued 82,500 shares…

A: Amount credited to common stock = $82,500*$1 Amount credited to common stock = $82,500 Paid in…

Q: Selected stock transactionsThe following selected accounts appear in the ledger of ParksConstruction…

A: The journal entries are prepared to keep the record of day to day transactions of the business.

Q: Mt. Everst Company has $1,000,000 shares of 10%, $20 Par Value Preferred Stock outstanding. On…

A: 4% Stock Dividend is recorded using the market price of the stock as of the date of stock dividends…

Q: Milo Co. had 795,000 shares of common stock outstanding as of January 1. On May 1, they issued…

A: Firstly, we shall calculate the Shares that were outstanding during the year and the Months for…

Q: A company has two classes of stock authorized: 9%, $10 par preferred, and $1 par value common. The…

A:

Q: On January 1, Vermont Corporation had 40,000 shares of $10 par value common stock issued and…

A: Treasury stock: Shares which are bought back by the company from the open market but not retired…

Q: In Draco Corporation's first year of business, the following transactions affected its equity…

A: Retained earnings = net income - dividend = 82000-31000 = $51,000

Q: How many shares of common stock were outstanding at the end of the period? How many shares of…

A: 1. When common stock is issued for cash, cash, and common stock increase. Cash XXXX…

Q: On January 1, 2021, Pharoah Corp. had 491,000 shares of common stock outstanding. During 2021, it…

A: Note: Assume that the accounting period of Pharoah Corp. starts in January and ends in December of…

Q: The stockholders' equity section of Martino Inc. at the beginning of the current year appears below.…

A: Stockholder’s equity represents the amount of resources which are available to stockholders or…

Q: Orson Company reports the following transactions relating to its stock accounts in the current year.…

A: Orson Company have purchased and sold common stock , preferred stock, ,treasury stock and there is…

Step by step

Solved in 2 steps with 1 images

- Selected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 2016, were as follows: a. Issued 15,000 shares of 20 par common stock at 30, receiving cash. b. Issued 4, 000 shares of 80 par preferred 5% stock at 100, receiving cash. c. Issued 500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. d. Declared a quarterly dividend of 0.50 per share on common stock and 1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. e. Paid the cash dividends declared in (d). f. Purchased 7,500 shares of Solstice Corp. at 40 per share, plus a 150 brokerage commission. The investment is classified as an available-for-sale investment. g. Purchased 8,000 shares of treasury common stock at 33 per share. h. Purchased 40,000 shares of Pinkberry Co. stock directly from the founders for 24 per share. Pinkberry has 125,000 shares issued and outstanding. Equinox Products Inc. treated the investment as an equity method investment. i. Declared a 1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. j. Paid the cash dividends to the preferred stockholders. k. Received 27,500 dividend from Pinkberry Co. investment in (h). l. Purchased 90,000 of Dream Inc. 10-year, 5% bonds, directly from the issuing company, at their face amount plus accrued interest of 37 5. The bonds are classified as a held-to-maturity long -term investment. m. Sold, at 38 per share, 2,600 shares of treasury common stock purchased in (g). n. Received a dividend of 0 .60 per share from the Solstice Corp. investment in (f). o. Sold 1,000 shares of Solstice Corp. at 45, including commission. p. Recorded the payment of semiannual interest on the bonds issue d in (c) and the amortization of the premium for six months. The amortization is determined using the straight-line method . q. Accrued interest for three months on the Dream Inc. bonds purchased in (I). r. Pinkberry Co. recorded total earnings of 240 ,000. Equinox Products recorded equity earnings for its share of Pinkberry Co. net income. s. The fair value for Solstice Corp. stock was 39. 02 per share on December 31, 2016. The investment is adjusted to fair value , using a valuation allowance account. Assume Valuation Allowance for Available-for-Sale Investments h ad a beginning balance of zero. Instructions 1. Journalize the selected transactions. 2. After all of the transaction s for the year ended December 31, 201 6, had been poste d [including the transactions recorded in part (1) and all adjusting entries), the data that follows were taken from the records of Equinox Products Inc. a. Prepare a multiple-step in come statement for the year ended December 31, 201 6, concluding with earnings per share . In computing earnings per share, assume that the average number of common shares outstanding was 100,000 and preferred dividends were 100,000. ( Round earnings per share to the nearest cent.) b. Prepare a retained earnings statement for the year ended December 31, 20 6. c. Prepare a balance sheet in report form as of December 31, 2016.Selected stock transactions The following selected accounts appear in the ledger of Parks Construction Inc. at the beginning of the current year: During the year, the corporation completed a number of transactions affecting the stockholders equity. They are summarized as follows: a. Issued 200,000 shares of common stock at 12, receiving cash. b. Issued 8,000 shares of preferred 2% stock at 115. c. Purchased 175,000 shares of treasury common for 10 per share. d. Sold 110,000 shares of treasury common for 14 per share. e. Sold 30,000 shares of treasury common for 8 per share. f. Declared cash dividends of 1.25 per share on preferred stock and 0.08 per share on common stock. g. Paid the cash dividends. Instructions Journalize the entries to record the transactions. Identify each entry by letter.Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. (a)Received 20,000 for the balance due on subscriptions for preferred stock with a par value of 40,000 and issued the stock. (b)Purchased 10,000 shares of common treasury stock for 18 per share. (c)Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d)Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e)Sold 5,000 shares of common treasury stock for Si00,000. (f)Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g)Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.

- Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. Open the file STOCKEQ from the website for this book at cengagebrain.com. Enter the formulas in the appropriate cells on the worksheet. Then fill in the columns to show the effect of each of the selected transactions and events listed earlier. Enter your name in cell A1. Save the completed worksheet as STOCKEQ2. Print the worksheet. Also print your formulas. Check figure: Total stockholders equity balance at 12/31/12 (cell G21). 398,800.Chen Corporation began 2012 with the following stockholders equity balances: The following selected transactions and events occurred during the year: a. Issued 10,000 shares of common stock for 60,000. b. Purchased 1,200 shares of treasury stock for 4,800. c. Sold 2,000 shares of treasury stock for 11,000. d. Generated net income of 94,000. e. Declared and paid the full years dividend on preferred stock and a dividend of 1.00 per share on common stock outstanding at the end of the year. Chen Corporation maintains several paid-in capital accounts (Paid-in Capital in Excess of Par, Paid-in Capital from Treasury Stock, etc.) in its ledger, but combines them all as Additional paid-in capital when preparing financial statements. In the space provided below, prepare the stockholders equity section of Chen Corporations balance sheet as of December 31, 2012. Use proper headings and provide full disclosure of all appropriate information. Chens corporate charter authorizes the issuance of 1,000 shares of preferred stock and 100,000 shares of common stock.

- Treasury Stock Transactions Garrett Inc. had no treasury stock at the beginning of the year. During February, Garrett purchased 12,600 shares of treasury stock at $23 per share. In May, Garrett sold 4,500 of the treasury shares for $25 per share. In November, Garrett sold the remaining treasury shares for $18 per share. Required: Prepare journal entries for the February, May, and November treasury stock transactions.Stockholders equity accounts and other related accounts of Gonzales Company as of January 1, 20--, the beginning of its fiscal year, are shown below. Preferred stock subscriptions receivable 50,000 Preferred stock, 10 par, 9% (200,000 shares authorized; 20,000 shares issued)200,000 Preferred stock subscribed (10,000 shares)100,000 Paid-in capital in excess of parpreferred stock40,000 Common stock, 10 par (100,000 shares authorized; 60,000 shares issued)600,000 Paid-in capital in excess of parcommon stock250,000 Retained earnings750,000 During 20--, Gonzales Company completed the following transactions affecting stockholders equity: (a) Received 20,000 for the balance due on subscriptions for 4,000 shares of preferred stock with a par value of 40,000 and issued the stock. (b) Purchased 10,000 shares of common treasury stock for 18 per share. (c) Received subscriptions for 10,000 shares of common stock at 19 per share, collecting down payments of 45,000. (d) Issued 15,000 shares of common stock in exchange for land with a fair market value of 290,000. (e) Sold 5,000 shares of common treasury stock for 100,000. (f) Issued 10,000 shares of preferred stock at 11.50 per share, receiving cash. (g) Sold 3,000 shares of common treasury stock for 17 per share. REQUIRED 1. Prepare general journal entries for the transactions, identifying each transaction by letter. 2. Post the journal entries to appropriate T accounts. The cash account has a beginning balance of 300,000. 3. Prepare the stockholders equity section of the balance sheet as of December 31, 20--. Net income for the year was 825,000 and dividends of 400,000 were paid.The following selected transactions and events occurred during 2013: a. Issued 200 shares of preferred stock for 20,000. b. Sold 800 shares of treasury stock for 2,800. c. Declared and issued a 4% common stock dividend. The market value on the date of declaration was 5 per share. d. Generated a net loss for the year of 16,000. e. Declared and paid the full years dividend on all the preferred stock and a dividend of 15 per share on common stock outstanding at the end of the year. Enter beginning balances for 2013 on STOCKEQ2. Then erase all 2012 entries and enter the transactions for 2013. Save the results as STOCKEQ4. Print the results.

- Nutritious Pet Food Companys board of directors declares a large stock dividend (50%) on June 30 when the stocks market value per share is $30. At that time, there are 10,000 shares of $1 par value common stock outstanding (none held in treasury). What is the journal entry to record the stock dividend distribution on July 31?CASH DIVIDENDS, STOCK DIVIDEND, AND STOCK SPLIT During the year ended December 31, 20--, Baggio Company completed the following transactions: Apr. 15 Declared a semiannual dividend of 0.65 per share on preferred stock and 0.45 per share on common stock to shareholders of record on May 5, payable on May 10. Currently, 6,000 shares of 50 par preferred stock and 70,000 shares of 1 par common stock are outstanding. May 10 Paid the cash dividends. Oct. 15 Declared semiannual dividend of 0.65 per share on preferred stock and 0.45 per share on common stock to shareholders of record on November 5, payable on November 20. Nov. 20 Paid the cash dividends. 22 Declared a 10% stock dividend to shareholders of record on December 8, distributable on December 16. Market value of the common stock was estimated at 15 per share. Dec. 16 Issued certificates for common stock dividend. 20 Board of directors declared a two-for-one common stock split. REQUIRED Prepare journal entries for the transactions.Outstanding Stock Lars Corporation shows the following information in the stockholders equity section of its balance sheet: The par value of common stock is S5, and the total balance in the Common Stock account is $225,000. There are 13,000 shares of treasury stock. Required: What is the number of shares outstanding? Use the following information for Exercises 10-58 and 10-59: Stahl Company was incorporated as a new business on January 1, 2019. The company is authorized to issue 600,000 shares of $2 par value common stock and 80,000 shares of 6%, S20 par value, cumulative preferred stock. On January 1, 2019, the company issued 75,000 shares of common stock for $15 per share and 5,000 shares of preferred stock for $25 per share. Net income for the year ended December 31, 2019, was $500,000.