Record payroll for period.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter10: Liabilities: Current, Installment Notes, And Contingencies

Section: Chapter Questions

Problem 10.4BE

Related questions

Question

Transcribed Image Text:gnment

Saved

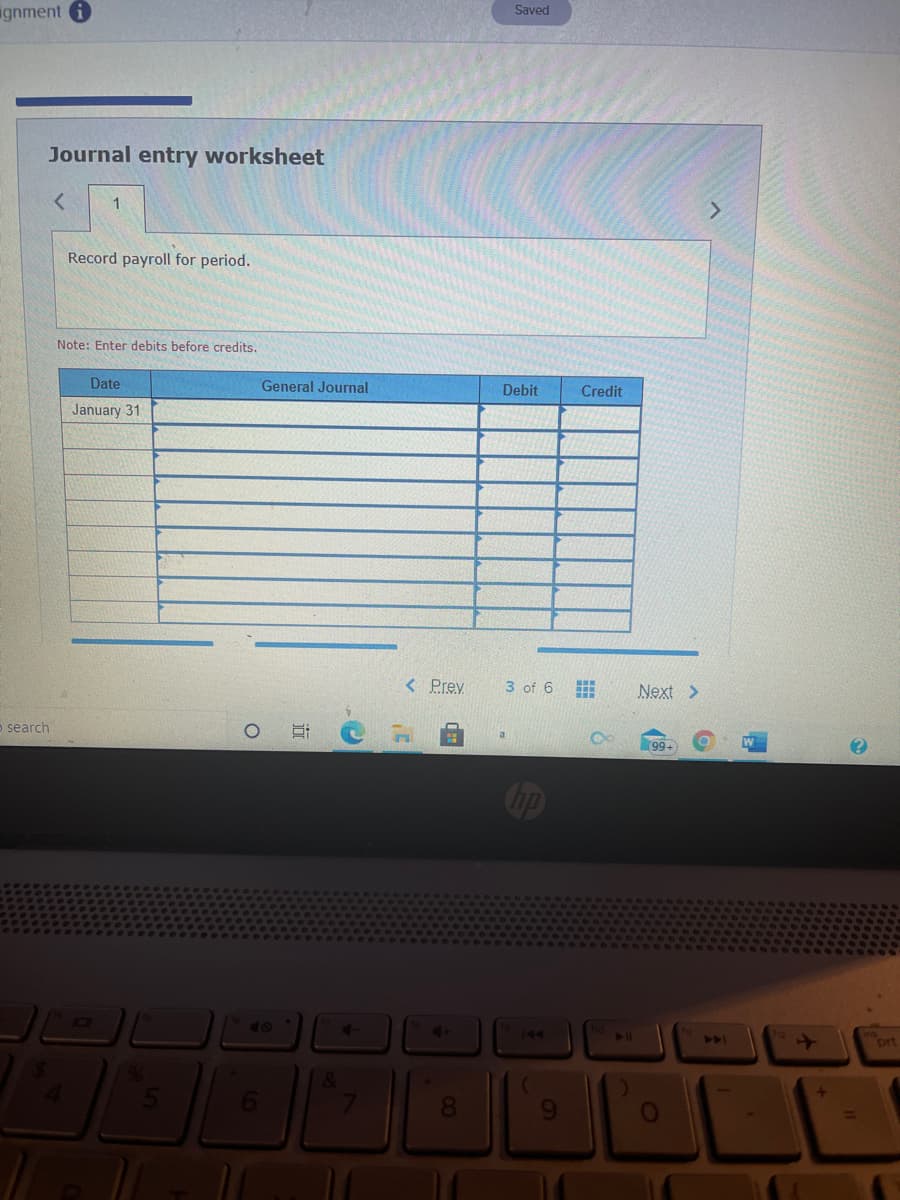

Journal entry worksheet

1

Record payroll for period.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 31

< Prev

3 of 6

Next >

o search

99

Cop

4-

144

4AI

prt

%1

近

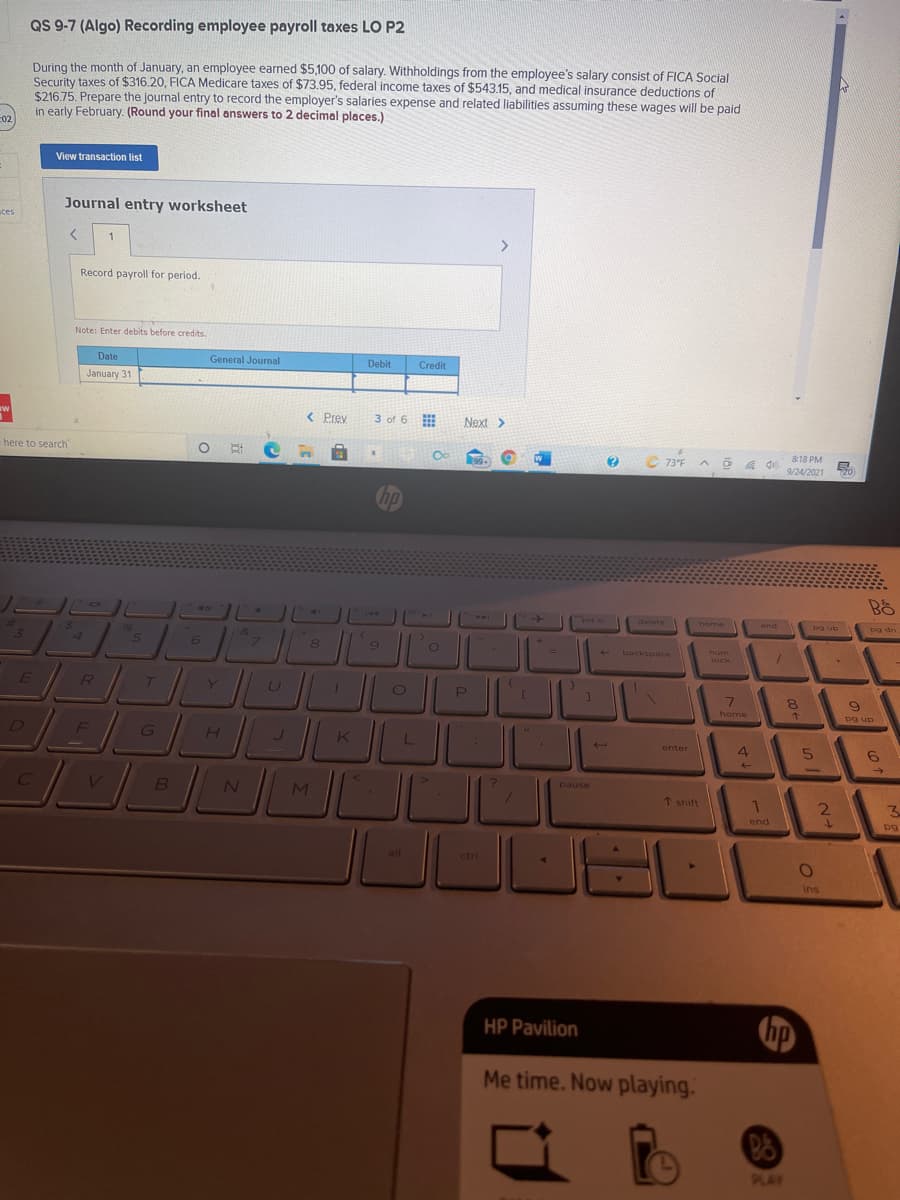

Transcribed Image Text:QS 9-7 (Algo) Recording employee payroll taxes LO P2

During the month of January, an employee earned $5,100 of salary. Withholdings from the employee's salary consist of FICA Social

Security taxes of $316.20, FICA Medicare taxes of $73.95, federal income taxes of $543.15, and medical insurance deductions of

$216.75. Prepare the journal entry to record the employer's salaries expense and related liabilities assuming these wages will be paid

in early February. (Round your final answers to 2 decimal places.)

C02

View transaction list

Journal entry worksheet

ces

1

<>

Record payroll for period.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

January 31

< Prev

3 of 6

Next >

here to search

99

C 73°F

818 PM

9/24/2021

20

hp

144

ort sc

delete

home

end

pg up

Dg dn

4

+ backspace

num

lock

Y.

7.

8.

home

Dg up

D

GO

enter

MI

pause

1 shift

1.

2

3-

end

to

alt

ctri

ins

HP Pavilion

Me time. Now playing.

PLAY

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning