Record the gain or loss for Midwest Chicken on the exchange of the equipment.

Chapter11: Long-term Assets

Section: Chapter Questions

Problem 12PB: Farm Fresh Agriculture Company purchased Sunny Side Egg Distribution for $400,000 cash when Sunny...

Related questions

Question

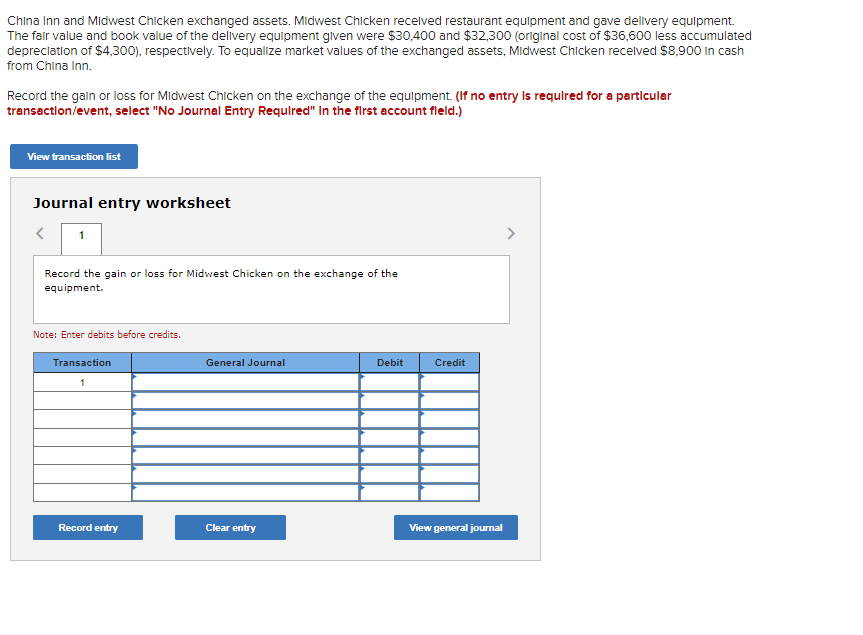

Transcribed Image Text:China Inn and Midwest Chicken exchanged assets. Midwest Chicken received restaurant equipment and gave delivery equipment.

The fair value and book value of the delivery equipment given were $30,400 and $32,300 (original cost of $36,600 less accumulated

depreciation of $4,300), respectively. To equalize market values of the exchanged assets, Midwest Chicken received $8,900 in cash

from China Inn.

Record the gain or loss for Midwest Chicken on the exchange of the equipment. (If no entry is required for a particular

transaction/event, select "No Journal Entry Required" In the first account fleld.)

View transaction list

Journal entry worksheet

1

Record the gain or loss for Midwest Chicken on the exchange of the

equipment.

Note: Enter debits before credits.

Transaction

1

Record entry

General Journal

Clear entry

Debit

Credit

View general journal

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College