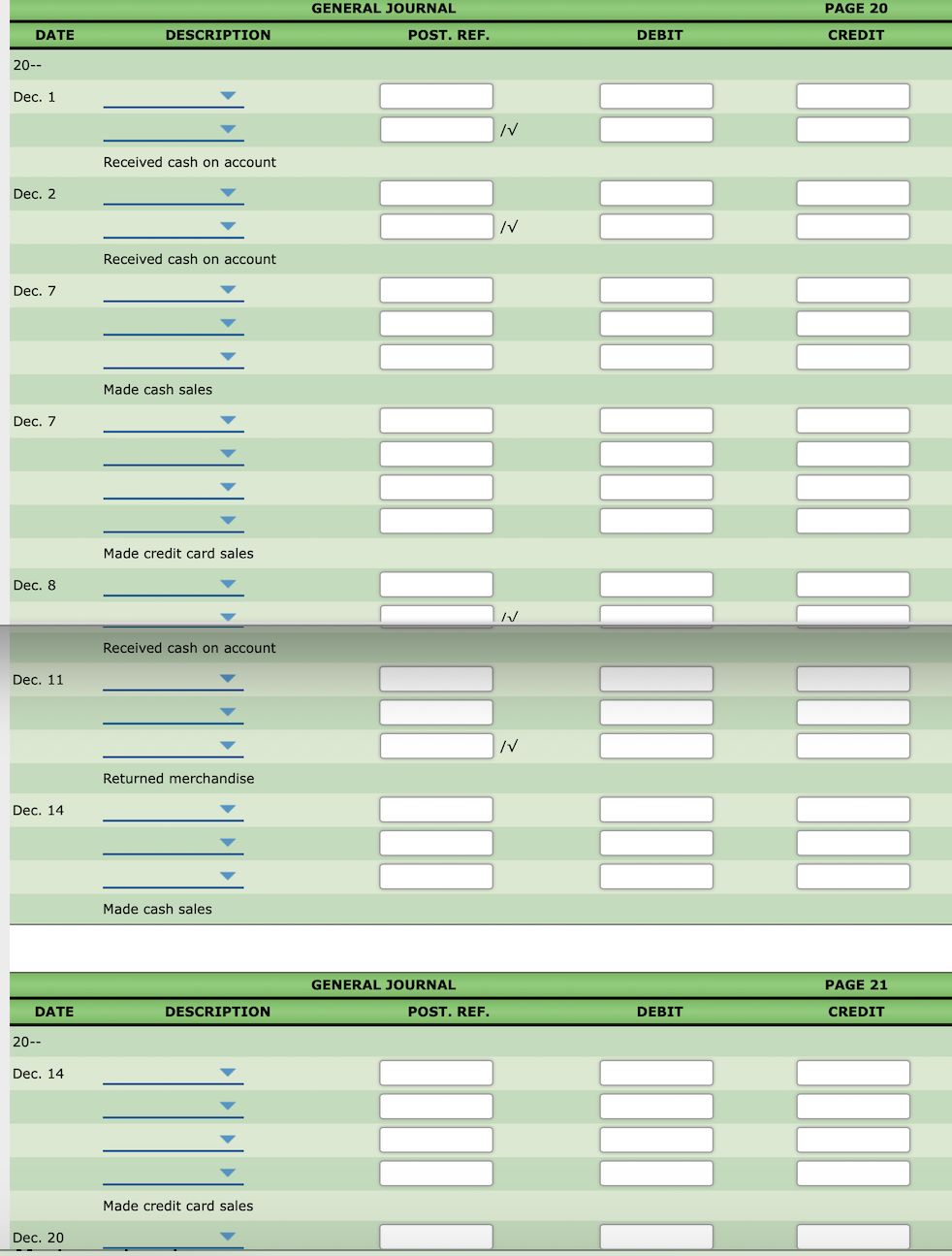

Record the transactions starting on page 20 of a general journal. Enter the posting references when you complete part 2. (image 1/ 1.10.53 PM.png)

Record the transactions starting on page 20 of a general journal. Enter the posting references when you complete part 2. (image 1/ 1.10.53 PM.png)

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter10: Accounting For Sales And Cash Receipts

Section: Chapter Questions

Problem 4AP

Related questions

Question

100%

Cash Receipts Transactions

Zebra Imaginarium, a retail business, had the following cash receipts during December 20--. The sales tax is 6%.

| Dec. 1 | Received payment on account from Michael Anderson, $1,350. | |

| 2 | Received payment on account from Ansel Manufacturing, $350. | |

| 7 | Cash sales for the week were $3,180 plus tax. Bank credit card sales for the week were $3,000 plus tax. Bank credit card fee is 3%. | |

| 8 | Received payment on account from J. Gorbea, $870. | |

| 11 | Michael Anderson returned merchandise for a credit, $60 plus tax. | |

| 14 | Cash sales for the week were $2,760 plus tax. Bank credit card sales for the week were $760 plus tax. Bank credit card fee is 3%. | |

| 20 | Received payment on account from Tom Wilson, $1,120. | |

| 21 | Ansel Manufacturing returned merchandise for a credit, $18 plus tax. | |

| 21 | Cash sales for the week were $3,300 plus tax. | |

| 24 | Received payment on account from Rachel Carson, $2,070. |

Required:

1. Record the transactions starting on page 20 of a general journal. Enter the posting references when you complete part 2. (image 1/ 1.10.53 PM.png)

1. Record the transactions starting on page 20 of a general journal. Enter the posting references when you complete part 2. (image 2)

Transcribed Image Text:GENERAL LEDGER

ACCOUNT

Cash

ACCOUNT NO.

101

BALANCE

DATE

ITEM

POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

20--

Dec. 1

Balance

9,860.00

dropdown

ACCOUNT

Accounts Receivable

ACCOUNT NO.

122

BALANCE

DATE

ITEM

POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

вес. 1

Balance

9,350.00

ACCOUNT

Sales Tax Payable

ACCOUNT NO.

231

BALANCE

DATE

ITEM

POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

0--

ACCOUNT

Sales

ACCOUNT No.

401

BALANCE

DATE

ITEM

POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

--

ACCOUNT

Sales Returns and Allowances

ACCOUNT No.

401.1

BALANCE

DATE

ITEM

POST. REF.

DEBIT

CREDIT

DEBIT

CREDIT

--

Transcribed Image Text:GENERAL JOURNAL

PAGE 20

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

20--

Dec. 1

Received cash on account

Dec. 2

/V

Received cash on account

Dec. 7

Made cash sales

Dec. 7

Made credit card sales

Dec. 8

Received cash on account

Dec. 11

/V

Returned merchandise

Dec. 14

Made cash sales

GENERAL JOURNAL

PAGE 21

DATE

DESCRIPTION

POST. REF.

DEBIT

CREDIT

20--

Dec. 14

Made credit card sales

Dec. 20

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning