Recording Revenue Under a Contract Modification Traders Inc. enters into a three-year office maintenance contract with its customer for $840,000 ($280,000 per year, to be paid at the end of each year). The $280,000 per year is the standalone selling price for a year of maintenance service. At the end of the second year, both parties agree to modify the maintenance contract as follows: (1) the fee for the third year is reduced to $220,000 to be paid at the end of Year 3, and (2) the contract is extended to Year 4 and Year 5 for $400,000 ( $200,000 per year, to be paid at the end of each year). The standalone selling price for one year of service at the time of modification is $240,000. Maintenance fees are billed annually by Traders Inc. Required Answer the following questions, rounding each answer to the nearest whole dollar. Assume any payments due were received in cash. a. Record Traders Inc.S journal entry to recognize revenue for each of the first two years of the contract Dec. 31. Year 1 Cash Service Revenue To record revenue. Dec. 31. Year 2 Cash Service Revenue Account Name Dec. 31, Year 8 Cash Dec. 31. Year 4 Cash Deterred Service Revenue To mennt revenue. Dec. 31. Year 5 Cash Account Name Account Name V b. Record Traders Inc.'s journal entry to recognize revenue for each of the years three through five of the contract, taking into account the contract modification. Assume cash payments. Account Name V Dr. 200,000 0 V 280,000 0 Dr. 720,000 a a Dr. 200,000 0 0 Dr. 200,000 Cr. 0 0 280,000 280,000 C x 200,00 * x Cr. Cr. ✓ X Cx Cx

Recording Revenue Under a Contract Modification Traders Inc. enters into a three-year office maintenance contract with its customer for $840,000 ($280,000 per year, to be paid at the end of each year). The $280,000 per year is the standalone selling price for a year of maintenance service. At the end of the second year, both parties agree to modify the maintenance contract as follows: (1) the fee for the third year is reduced to $220,000 to be paid at the end of Year 3, and (2) the contract is extended to Year 4 and Year 5 for $400,000 ( $200,000 per year, to be paid at the end of each year). The standalone selling price for one year of service at the time of modification is $240,000. Maintenance fees are billed annually by Traders Inc. Required Answer the following questions, rounding each answer to the nearest whole dollar. Assume any payments due were received in cash. a. Record Traders Inc.S journal entry to recognize revenue for each of the first two years of the contract Dec. 31. Year 1 Cash Service Revenue To record revenue. Dec. 31. Year 2 Cash Service Revenue Account Name Dec. 31, Year 8 Cash Dec. 31. Year 4 Cash Deterred Service Revenue To mennt revenue. Dec. 31. Year 5 Cash Account Name Account Name V b. Record Traders Inc.'s journal entry to recognize revenue for each of the years three through five of the contract, taking into account the contract modification. Assume cash payments. Account Name V Dr. 200,000 0 V 280,000 0 Dr. 720,000 a a Dr. 200,000 0 0 Dr. 200,000 Cr. 0 0 280,000 280,000 C x 200,00 * x Cr. Cr. ✓ X Cx Cx

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter17: Advanced Issues In Revenue Recognition

Section: Chapter Questions

Problem 2RE: Yankee Corp. agrees to provide Albany Company 24 months of coaching services. The contract sets the...

Related questions

Question

Please help me

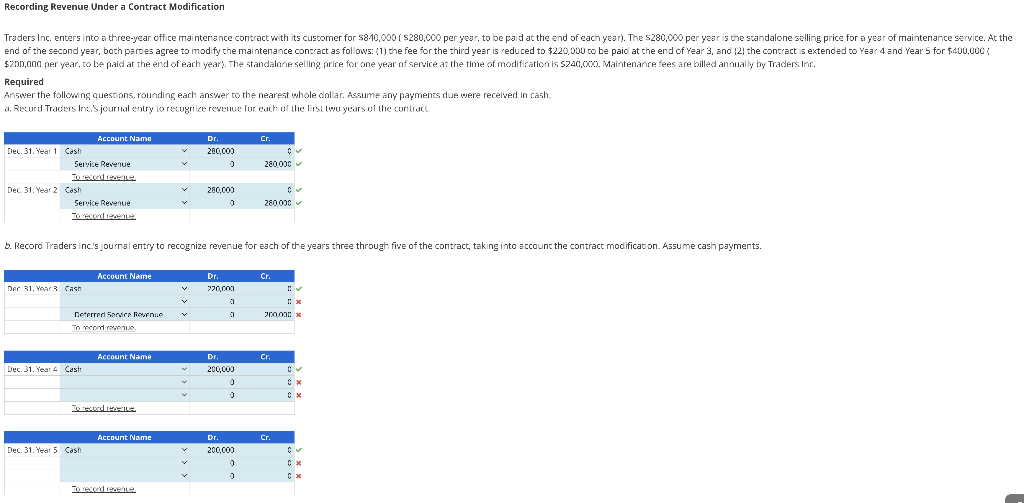

Transcribed Image Text:Recording Revenue Under a Contract Modification

Traders Inc. enters into a three-year office maintenance contract with its customer for $840,000 ($280,000 per year, to be paid at the end of each year). The $280,000 per year is the standalone selling price for a year of maintenance service. At the

end of the second year, both parties agree to modify the maintenance contract as follows: (1) the fee for the third year is reduced to $220,000 to be paid at the end of Year 3, and (2) the contract is extended to Year 4 and Year 5 for $400,000 (

$200,000 per year, to be paid at the end of each year). The standalone selling price for one year of service at the time of modification is $240,000. Maintenance fees are billed annually by Traders Inc.

Required

Answer the following questions, rounding each answer to the nearest whole dollar. Assume any payments due were received in cash.

a. Record Traders Inc.S journal entry to recognize revenue for each of the first two years of the contract

Dec. 31. Year 1 Cash

Service Revenue

To record revenue.

Dec. 31. Year 2 Cash

Service Revenue

To record revenue.

Account Name

Dec. 31, Year 3 Cash

Dec. 31. Year 4 Cash

Deterred Service Revenue

To record revenue.

Account Name

Dec. 31. Year 5 Cash

b. Record Traders Inc.'s journal entry to recognize revenue for each of the years three through five of the contract, taking into account the contract modification. Assume cash payments.

Account Name

To recorders.

Account Name

Dr.

280,000

0

v

280,000

0

Dr.

220,000

a

a

Dr.

200,000

0

0

Cr.

Dr.

200,000

0

0

280,000 ✓

C

280,000

Cr.

700,000 x

Cr.

*

Cr.

✓

Cx

C

Cx

Cx

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College