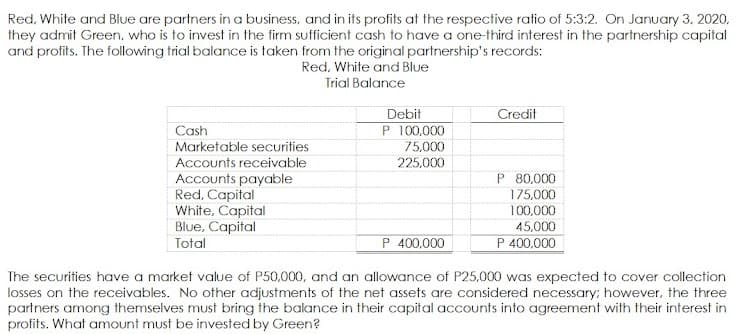

Red, White and Blue are partners in a business, and in its profits at the respective ratio of 5:3:2. On January 3, 2020, they admit Green, who is to invest in the firm sufficient cash to have a orne-third interest in the partnership capital and profits. The following trial balance is taken from the original partnership's records: Red, White and Blue Trial Balance Debit P 100,000 75,000 225,000 Credit Cash Marketable securities Accounts receivable Accounts payable Red, Capital White, Capital Blue, Capital P 80,000 175,000 100,000 45,000 Total P 400,000 P 400,000 The securities have a market value of P50,000, and an allowance of P25,000 was expected to cover collection losses on the receivables. No other adjustments of the net assets are considered necessary: however, the three partners among themselves must bring the balance in their capital accounts into agreement with their interest in profits. What amount must be invested by Green?

Red, White and Blue are partners in a business, and in its profits at the respective ratio of 5:3:2. On January 3, 2020, they admit Green, who is to invest in the firm sufficient cash to have a orne-third interest in the partnership capital and profits. The following trial balance is taken from the original partnership's records: Red, White and Blue Trial Balance Debit P 100,000 75,000 225,000 Credit Cash Marketable securities Accounts receivable Accounts payable Red, Capital White, Capital Blue, Capital P 80,000 175,000 100,000 45,000 Total P 400,000 P 400,000 The securities have a market value of P50,000, and an allowance of P25,000 was expected to cover collection losses on the receivables. No other adjustments of the net assets are considered necessary: however, the three partners among themselves must bring the balance in their capital accounts into agreement with their interest in profits. What amount must be invested by Green?

SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN:9780357391266

Author:Nellen

Publisher:Nellen

Chapter14: Partnerships And Limited Liability Entities

Section: Chapter Questions

Problem 2BD

Related questions

Question

100%

Transcribed Image Text:Red, White and Blue are partners ina business, and in its profits at the respective ratio of 5:3:2. On January 3, 2020,

they admit Green, who is to invest in the firm sufficient cash to have a one-third interest in the partnership capital

and profits. The following trial balance is taken from the original partnership's records:

Red, White and Blue

Trial Balance

Debit

Credit

P 100,000

Cash

Marketable securities

Accounts receivable

75,000

225,000

P 80,000

Accounts payable

Red, Capital

White, Capital

Blue, Capital

175,000

100,000

45,000

Total

P 400,000

P 400,000

The securities have a market value of P50,000, and an allowance of P25,000 was expected to cover collection

losses on the receivables. No other adjustments of the net assets are considered necessary: however, the three

partners among themselves must bring the balance in their capital accounts into agreement with their interest in

profits. What amount must be invested by Green?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,