Refer to Note 20, Financial Instruments. h. i What is the fair-value of Rite Aid's fixed-rate debt at February 28, 2004? Why does it differ from the carrying amount? What is the fair-value of the variable-rate debt at February 28, 2004? Why does it not differ from its carrying amount? ii iii Why would financial statement users want to know the fair-value of Rite Aid's debt? 20. Financial Instruments The carrying amounts and fair values of financial instruments at February 28, 2004 and March 1, 2003 are listed as follows: 2003 2004 Fair Value Carrying Amount Fair Value Carrying Amount $1,150,000 $1,150,000 $1,372,500 $1,372,500 $2,558,497 $2,640,995 $2,313,942 $2,027,603 Variable rate indebtedness Fixed rate indebtedness . Cash, trade receivables and trade payables are carried at market value, which approximates their fair values due to the short-term maturity of these instruments The following methods and assumptions were used in estimating fair value disclosures for financial instruments: LIBOR-based borrowings under credit facilities: The carrying amounts for LIBOR-based borrowings under the credit facilities, term loans and term notes approximate their fair values due to the short-term nature of the obligations and the variable interest rates Long-term indebtedness: The fair values of long-term indebtedness is estimated based on the quoted market prices of the financial instruments. If quoted market prices were not available, the Company estimated the fair value based on the quoted market price of a financial instrument with similar characteristics

Refer to Note 20, Financial Instruments. h. i What is the fair-value of Rite Aid's fixed-rate debt at February 28, 2004? Why does it differ from the carrying amount? What is the fair-value of the variable-rate debt at February 28, 2004? Why does it not differ from its carrying amount? ii iii Why would financial statement users want to know the fair-value of Rite Aid's debt? 20. Financial Instruments The carrying amounts and fair values of financial instruments at February 28, 2004 and March 1, 2003 are listed as follows: 2003 2004 Fair Value Carrying Amount Fair Value Carrying Amount $1,150,000 $1,150,000 $1,372,500 $1,372,500 $2,558,497 $2,640,995 $2,313,942 $2,027,603 Variable rate indebtedness Fixed rate indebtedness . Cash, trade receivables and trade payables are carried at market value, which approximates their fair values due to the short-term maturity of these instruments The following methods and assumptions were used in estimating fair value disclosures for financial instruments: LIBOR-based borrowings under credit facilities: The carrying amounts for LIBOR-based borrowings under the credit facilities, term loans and term notes approximate their fair values due to the short-term nature of the obligations and the variable interest rates Long-term indebtedness: The fair values of long-term indebtedness is estimated based on the quoted market prices of the financial instruments. If quoted market prices were not available, the Company estimated the fair value based on the quoted market price of a financial instrument with similar characteristics

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter24: Enterprise Risk Management

Section: Chapter Questions

Problem 4P

Related questions

Question

see attached pictures for questions

Transcribed Image Text:Refer to Note 20, Financial Instruments.

h.

i

What is the fair-value of Rite Aid's fixed-rate debt at February 28, 2004? Why does it differ

from the carrying amount?

What is the fair-value of the variable-rate debt at February 28, 2004? Why does it not differ

from its carrying amount?

ii

iii

Why would financial statement users want to know the fair-value of Rite Aid's debt?

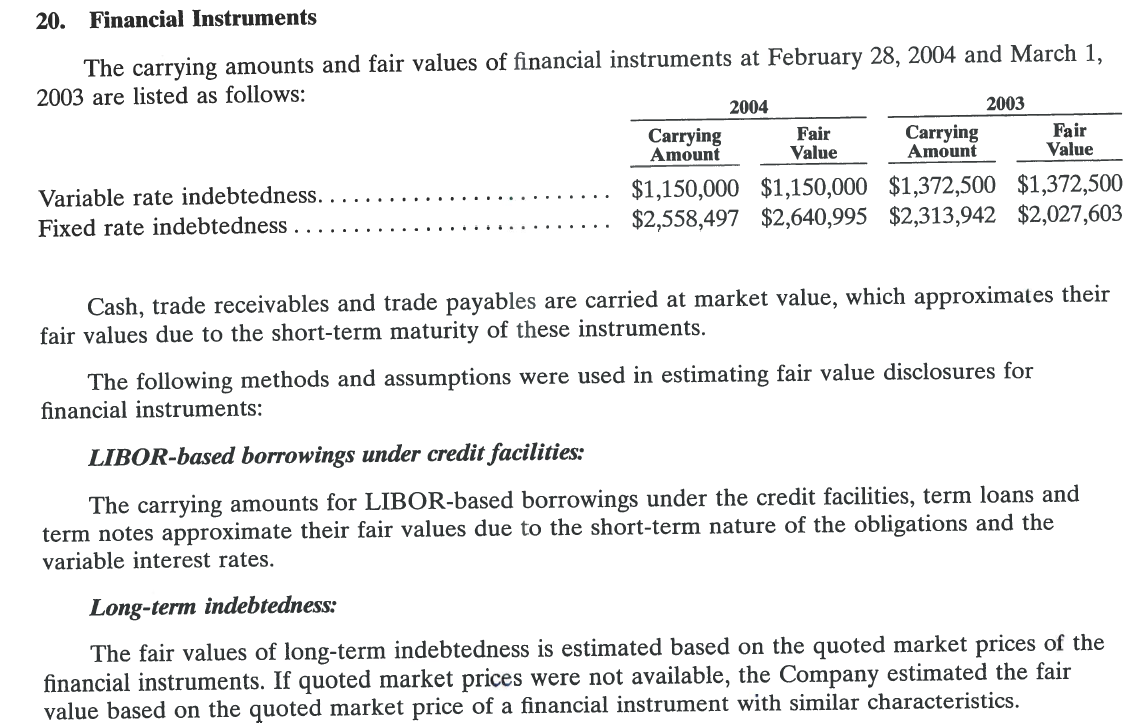

Transcribed Image Text:20. Financial Instruments

The carrying amounts and fair values of financial instruments at February 28, 2004 and March 1,

2003 are listed as follows:

2003

2004

Fair

Value

Carrying

Amount

Fair

Value

Carrying

Amount

$1,150,000 $1,150,000 $1,372,500 $1,372,500

$2,558,497 $2,640,995 $2,313,942 $2,027,603

Variable rate indebtedness

Fixed rate indebtedness .

Cash, trade receivables and trade payables are carried at market value, which approximates their

fair values due to the short-term maturity of these instruments

The following methods and assumptions were used in estimating fair value disclosures for

financial instruments:

LIBOR-based borrowings under credit facilities:

The carrying amounts for LIBOR-based borrowings under the credit facilities, term loans and

term notes approximate their fair values due to the short-term nature of the obligations and the

variable interest rates

Long-term indebtedness:

The fair values of long-term indebtedness is estimated based on the quoted market prices of the

financial instruments. If quoted market prices were not available, the Company estimated the fair

value based on the quoted market price of a financial instrument with similar characteristics

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning