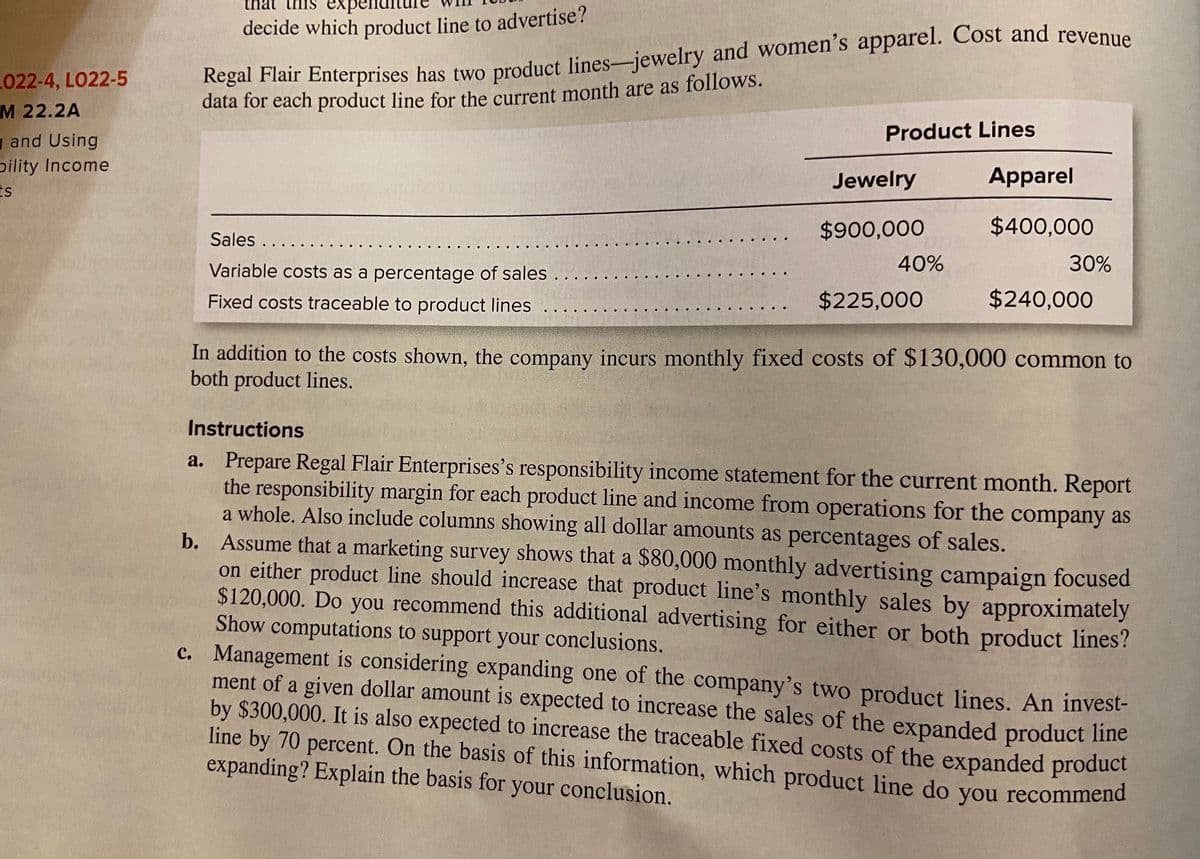

Regal Flair Enterprises has two product lines-jewelry and women's apparel. Cost and revenue data for each product line for the current month are as follows. decide which product line to adve Product Lines Jewelry Apparel $900,000 $400,000 Sales 40% 30% Variable costs as a percentage of sales $225,000 $240,000 Fixed costs traceable to product lines In addition to the costs shown, the company incurs monthly fixed costs of $130,000 common to both product lines. Instructions a. Prepare Regal Flair Enterprises's responsibility income statement for the current month. Report the responsibility margin for each product line and income from operations for the company as a whole. Also include columns showing all dollar amounts as percentages of sales. b. Assume that a marketing survey shows that a $80,000 monthly advertising campaign focused on either product line should increase that product line's monthly sales by approximately $120,000. Do you recommend this additional advertising for either or both product lines? Show computations to support your conclusions. c. Management is considering expanding one of the company's two product lines. An invest- ment of a given dollar amount is expected to increase the sales of the expanded product line by $300,000. It is also expected to increase the traceable fixed costs of the expanded product line by 70 percent. On the basis of this information, which product line do you recommend expanding? Explain the basis for your conclusion.

Regal Flair Enterprises has two product lines-jewelry and women's apparel. Cost and revenue data for each product line for the current month are as follows. decide which product line to adve Product Lines Jewelry Apparel $900,000 $400,000 Sales 40% 30% Variable costs as a percentage of sales $225,000 $240,000 Fixed costs traceable to product lines In addition to the costs shown, the company incurs monthly fixed costs of $130,000 common to both product lines. Instructions a. Prepare Regal Flair Enterprises's responsibility income statement for the current month. Report the responsibility margin for each product line and income from operations for the company as a whole. Also include columns showing all dollar amounts as percentages of sales. b. Assume that a marketing survey shows that a $80,000 monthly advertising campaign focused on either product line should increase that product line's monthly sales by approximately $120,000. Do you recommend this additional advertising for either or both product lines? Show computations to support your conclusions. c. Management is considering expanding one of the company's two product lines. An invest- ment of a given dollar amount is expected to increase the sales of the expanded product line by $300,000. It is also expected to increase the traceable fixed costs of the expanded product line by 70 percent. On the basis of this information, which product line do you recommend expanding? Explain the basis for your conclusion.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter7: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 46E: Lotts Company produces and sells one product. The selling price is 10, and the unit variable cost is...

Related questions

Question

22.2A

Transcribed Image Text:decide which product line to advertise?

L022-4, LO22-5

M 22.2A

data for each product line for the current month are as follows.

Product Lines

g and Using

pility Income

Is

Jewelry

Apparel

$900,000

$400,000

Sales ...

Variable costs as a percentage of sales .

40%

30%

Fixed costs traceable to product lines

$225,000

$240,000

In addition to the costs shown, the company incurs monthly fixed costs of $130,000 common to

both product lines.

Instructions

a. Prepare Regal Flair Enterprises's responsibility income statement for the current month. Report

the responsibility margin for each product line and income from operations for the company as

a whole. Also include columns showing all dollar amounts as percentages of sales.

b. Assume that a marketing survey shows that a $80,000 monthly advertising campaign focused

on either product line should increase that product line's monthly sales by approximately

$120,000. Do you recommend this additional advertising for either or both product lines?

Show computations to support your conclusions.

c. Management is considering expanding one of the company's two product lines. An invest-

ment of a given dollar amount is expected to increase the sales of the expanded product line

by $300,000. It is also expected to increase the traceable fixed costs of the expanded product

line by 70 percent. On the basis of this information, which product line do you recommend

expanding? Explain the basis for your conclusion.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning