Required 1. Compute the break-even point in dollar sales for next year assuming the machine is installed. 2. Prepare a contribution margin income statement for next year that shows the expected results with the machine installed. Assume sales are $750,000. 3. Compute the sales level required in both dollars and units to earn $87,000 of target income for next year with the machine installed. Check (2) Income, $57,000

Required 1. Compute the break-even point in dollar sales for next year assuming the machine is installed. 2. Prepare a contribution margin income statement for next year that shows the expected results with the machine installed. Assume sales are $750,000. 3. Compute the sales level required in both dollars and units to earn $87,000 of target income for next year with the machine installed. Check (2) Income, $57,000

Chapter3: Cost-volume-profit Analysis

Section: Chapter Questions

Problem 5EB: Cadre, Inc., sells a single product with a selling price of $120 and variable costs per unit of $90....

Related questions

Question

100%

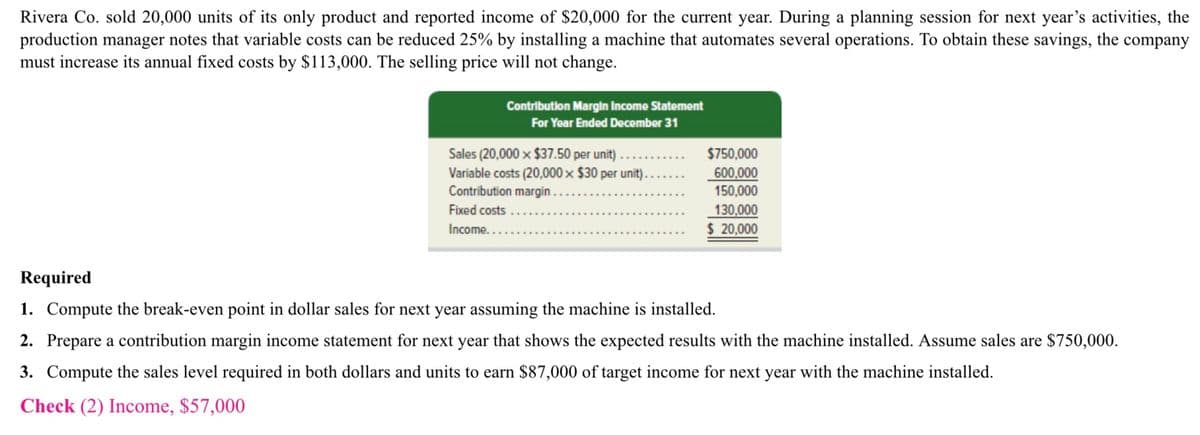

Transcribed Image Text:Rivera Co. sold 20,000 units of its only product and reported income of $20,000 for the current year. During a planning session for next year's activities, the

production manager notes that variable costs can be reduced 25% by installing a machine that automates several operations. To obtain these savings, the company

must increase its annual fixed costs by $113,000. The selling price will not change.

Contribution Margin Income Statement

For Year Ended December 31

Sales (20,000 × $37.50 per unit)..

Variable costs (20,000 × $30 per unit).

Contribution margin..

Fixed costs

Income....

$750,000

600,000

150,000

130,000

$ 20,000

Required

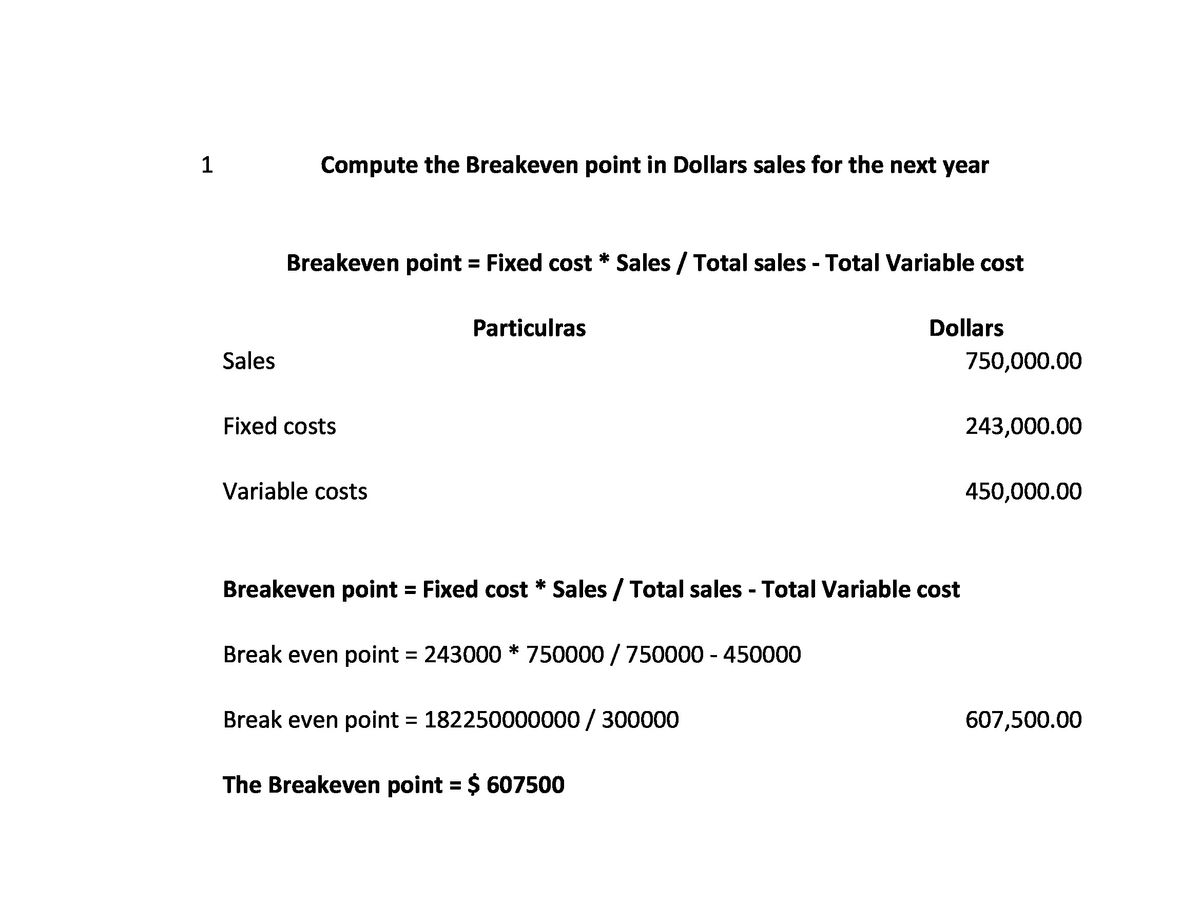

1. Compute the break-even point in dollar sales for next year assuming the machine is installed.

2. Prepare a contribution margin income statement for next year that shows the expected results with the machine installed. Assume sales are $750,000.

3. Compute the sales level required in both dollars and units to earn $87,000 of target income for next year with the machine installed.

Check (2) Income, $57,000

Expert Solution

Step 1

Solution

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning