Required: 1. Enter the amount of each transaction on individual items of the accounting equation. Do not determine new account balances after each transaction. (Enter the transactions in the given order. Enter reductions to account balances with a minus sign. Select "NA" if the transaction does not include an expense.) Assets = Liabilities Equity Account Titles Accounts Receivable Accounts %3D Common Stock Office Date Cash Dividends Revenues Expenses for Expenses Equipment Payable May + 1 %3D 1 %3D 3 %3D %3D 8 %3! 12 %3D 15 %3D 20 %3D 22 %3D 25 26 %3! 27 %3D

Required: 1. Enter the amount of each transaction on individual items of the accounting equation. Do not determine new account balances after each transaction. (Enter the transactions in the given order. Enter reductions to account balances with a minus sign. Select "NA" if the transaction does not include an expense.) Assets = Liabilities Equity Account Titles Accounts Receivable Accounts %3D Common Stock Office Date Cash Dividends Revenues Expenses for Expenses Equipment Payable May + 1 %3D 1 %3D 3 %3D %3D 8 %3! 12 %3D 15 %3D 20 %3D 22 %3D 25 26 %3! 27 %3D

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter1: Business Transactions (ptrans)

Section: Chapter Questions

Problem 3R: On June 1 of the current year, Wilson Wood opened Woodys Web Services. This sole proprietorship had...

Related questions

Topic Video

Question

Can you please also complete the 28, 30, 30 and 31 transactions

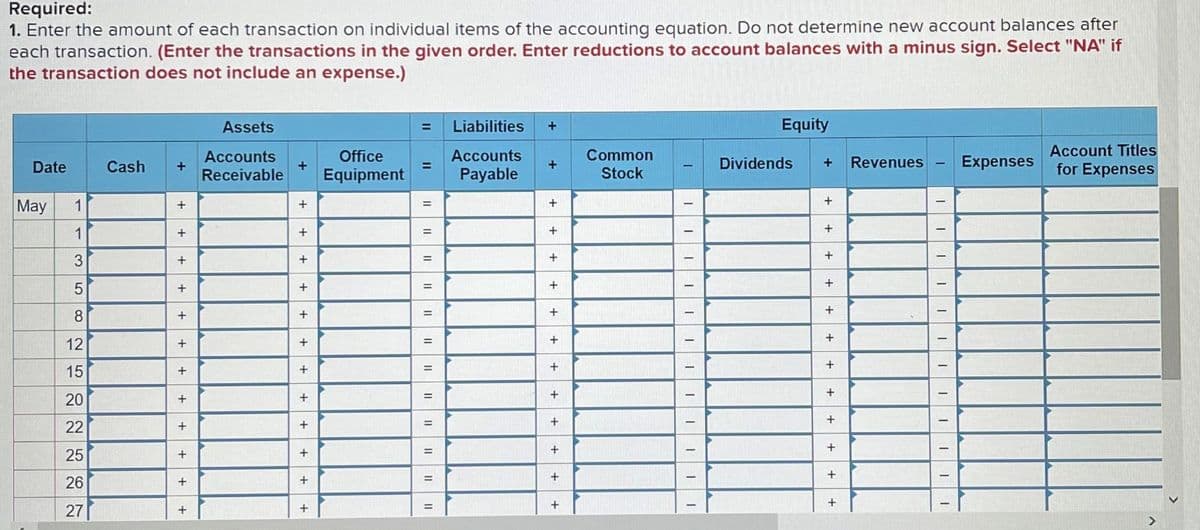

Transcribed Image Text:Required:

1. Enter the amount of each transaction on individual items of the accounting equation. Do not determine new account balances after

each transaction. (Enter the transactions in the given order. Enter reductions to account balances with a minus sign. Select "NA" if

the transaction does not include an expense.)

Assets

Liabilities

+

Equity

Office

Accounts

Common

Account Titles

Accounts

+

Receivable

Date

Cash

+

Equipment

Dividends

Revenues

Expenses

for Expenses

Payable

Stock

May

1

1

+

%3D

3

%3D

+

+

+

8.

%3D

12

15

+

+

20

%3D

+

22

%3D

%3D

+

25

+

%3D

26

+

+

27

III

+ +

![Required information

[The following information applies to the questions displayed below.]

Gabi Gram started The Gram Co., a new business that began operations on May 1. The Gram Co. completed the

following transactions during its first month of operations.

May 1 G. Gram invested $42,000 cash in the company in exchange for its common stock.

1 The company rented a furnished office and paid $2,400 cash for May's rent.

3 The company purchased $1,930 of office equipment on credit.

5 The company paid $770 cash for this month's cleaning services.

8 The company provided consulting services for a client and immediately collected $5,500 cash.

12 The company provided $2,600 of consulting services for a client on credit.

15 The company paid $780 cash for an assistant's salary for the first half of this month.

20 The company received $2,600 cash payment for the services provided on May 12.

22 The company provided $3,100 of consulting services on credit.

25 The company received $3,100 cash payment for the services provided on May 22.

26 The company paid $1,930 cash for the office equipment purchased on May 3.

27 The company purchased $85 of office equipment on credit.

28 The company paid $780 cash for an assistant's salary for the second half of this month.

30 The company paid $400 cash for this month's telephone bill.

30 The company paid $260 cash for this month's utilities.

31 The company paid $1,500 cash in dividends to the owner (sole shareholder).](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F2bcd9420-2e71-4537-86fb-91c5a0e6047d%2F2b9cd409-3c8c-44d1-8ca1-72591bf83fd6%2Fxz742sb_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

Gabi Gram started The Gram Co., a new business that began operations on May 1. The Gram Co. completed the

following transactions during its first month of operations.

May 1 G. Gram invested $42,000 cash in the company in exchange for its common stock.

1 The company rented a furnished office and paid $2,400 cash for May's rent.

3 The company purchased $1,930 of office equipment on credit.

5 The company paid $770 cash for this month's cleaning services.

8 The company provided consulting services for a client and immediately collected $5,500 cash.

12 The company provided $2,600 of consulting services for a client on credit.

15 The company paid $780 cash for an assistant's salary for the first half of this month.

20 The company received $2,600 cash payment for the services provided on May 12.

22 The company provided $3,100 of consulting services on credit.

25 The company received $3,100 cash payment for the services provided on May 22.

26 The company paid $1,930 cash for the office equipment purchased on May 3.

27 The company purchased $85 of office equipment on credit.

28 The company paid $780 cash for an assistant's salary for the second half of this month.

30 The company paid $400 cash for this month's telephone bill.

30 The company paid $260 cash for this month's utilities.

31 The company paid $1,500 cash in dividends to the owner (sole shareholder).

Expert Solution

Introduction

Accounting equation helps management to analyze the balance of total assets to total liabilities & equity and it also ensures that the journal entry prepared in step 1 of accounting cycle is accurate or made as per the double entry book system.

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,