Required: Determine Scholz's pension expense for 2019 and prepare the appropriate journal entries to record the expense as well as the cash contribution to plan assets and payment of benefits to retirees. Determine the new gains and/or losses in 2019 and prepare the appropriate journal entry(s) to record them. Prepare a pension spreadsheet to assist you in determining end of 2019 balances in the PBO, plan assets, prior service cost—AOCI, the net loss—AOCI, and the pension liability. Required: 4. Determine Scholz's pension expense for 2020 and prepare the appropriate journal entries to record the expense, the cash funding of plan assets, and payment of benefits to retirees. 5. Determine the new gains and/or losses in 2020 and prepare the appropriate journal entry(s) to record them. 6. Prepare a pension spreadsheet to assist you in determining end of 2020 balances in the PBO, plan assets, prior service cost—AOCI, the net loss—AOCI, and the pension liability.

Required: Determine Scholz's pension expense for 2019 and prepare the appropriate journal entries to record the expense as well as the cash contribution to plan assets and payment of benefits to retirees. Determine the new gains and/or losses in 2019 and prepare the appropriate journal entry(s) to record them. Prepare a pension spreadsheet to assist you in determining end of 2019 balances in the PBO, plan assets, prior service cost—AOCI, the net loss—AOCI, and the pension liability. Required: 4. Determine Scholz's pension expense for 2020 and prepare the appropriate journal entries to record the expense, the cash funding of plan assets, and payment of benefits to retirees. 5. Determine the new gains and/or losses in 2020 and prepare the appropriate journal entry(s) to record them. 6. Prepare a pension spreadsheet to assist you in determining end of 2020 balances in the PBO, plan assets, prior service cost—AOCI, the net loss—AOCI, and the pension liability.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter19: Accounting For Post Retirement Benefits

Section: Chapter Questions

Problem 4RE

Related questions

Question

Required:

- Determine Scholz's pension expense for 2019 and prepare the appropriate journal entries to record the expense as well as the cash contribution to plan assets and payment of benefits to retirees.

- Determine the new gains and/or losses in 2019 and prepare the appropriate

journal entry (s) to record them. - Prepare a pension spreadsheet to assist you in determining end of 2019 balances in the PBO, plan assets, prior service cost—AOCI, the net loss—AOCI, and the pension liability.

Required:

4. Determine Scholz's pension expense for 2020 and prepare the appropriate journal entries to record the expense, the cash funding of plan assets, and payment of benefits to retirees.

5. Determine the new gains and/or losses in 2020 and prepare the appropriate journal entry(s) to record them.

6. Prepare a pension spreadsheet to assist you in determining end of 2020 balances in the PBO, plan assets, prior service cost—AOCI, the net loss—AOCI, and the pension liability.

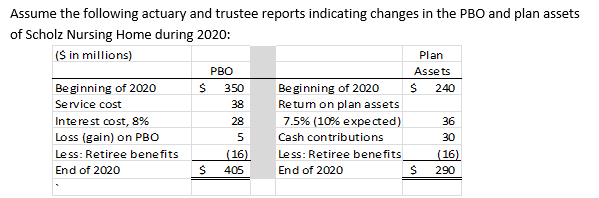

Transcribed Image Text:Assume the following actuary and trustee reports indicating changes in the PBO and plan assets

of Scholz Nursing Home during 2020:

(S in millions)

Plan

PBO

Assets

Be ginning of 2020

Be ginning of 2020

Re tum on plan assets

7.5% (10% expected)

350

240

Service cost

38

Interest cost, 8%

28

36

Loss (gain) on PBO

Cash contributions

30

Less: Retiree benefits

(16)

Less: Retiree benefits

(16)

End of 2020

405

End of 2020

290

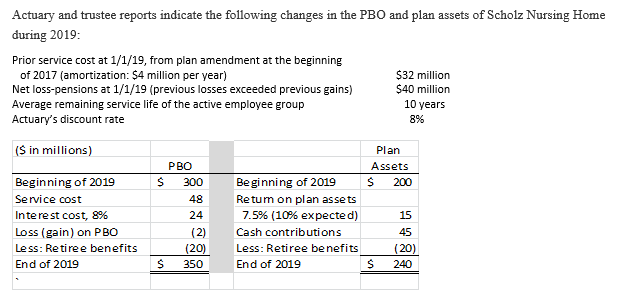

Transcribed Image Text:Actuary and trustee reports indicate the following changes in the PBO and plan assets of Scholz Nursing Home

during 2019:

Prior service cost at 1/1/19, from plan amendment at the beginning

of 2017 (amortization: $4 million per year)

Net loss-pensions at 1/1/19 (previous losses exceeded previous gains)

$32 million

$40 million

10 years

Average remaining service life of the active employee group

Actuary's discount rate

8%

(S in millions)

Plan

PBO

Assets

Be ginning of 2019

Re tum on plan assets

7.5% (10% expected)

Beginning of 2019

300

200

Service cost

48

Interest cost, 8%

24

15

Loss (gain) on PBO

(2)

Cash contributions

45

Less: Retiree benefits

(20)

Less: Retiree benefits

(20)

End of 2019

350

End of 2019

240

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT