Required: Determine the partners' share in the profit under each of the following assumptions: 1. Beginning capital balances. 2. Average capital balances. (Investments and withdrawals are assumed to have been made as of the beginning of the month if made before the middle of the month, and assumed to have been made as of the beginning of the following month if made after the middle of the month.) 3. Ending capital balances.

Required: Determine the partners' share in the profit under each of the following assumptions: 1. Beginning capital balances. 2. Average capital balances. (Investments and withdrawals are assumed to have been made as of the beginning of the month if made before the middle of the month, and assumed to have been made as of the beginning of the following month if made after the middle of the month.) 3. Ending capital balances.

Chapter11: Partnerships: Distributions, Transfer Of Interests, And Terminations

Section: Chapter Questions

Problem 41P

Related questions

Question

Hi,

Can you please answer this question? thank you

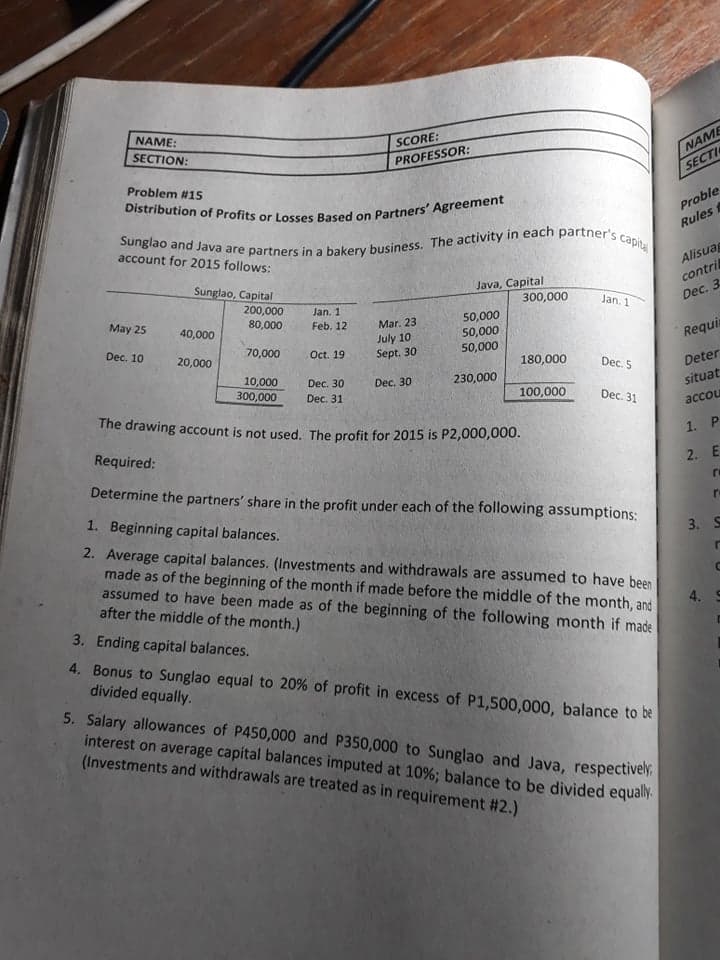

Transcribed Image Text:Sunglao and Java are partners in a bakery business. The activity in each partner's capita

Distribution of Profits or Losses Based on Partners' Agreement

NAME:

SECTION:

SCORE:

PROFESSOR:

NAME

Problem #15

SECTI

Proble

Rules

account for 2015 follows:

Alisua

Sunglao, Capital

Java, Capital

300,000

contri

200,000

Dec. 3

Jan. 1

Jan. 1

May 25

80,000

50,000

50,000

50,000

40,000

Feb. 12

Mar. 23

July 10

Sept. 30

Requi

Dec. 10

70,000

Oct. 19

20,000

180,000

Dec. 5

Deter

10,000

300,000

Dec. 30

Dec. 30

230,000

Dec. 31

situat

100,000

Dec. 31

accou

The drawing account is not used. The profit for 2015 is P2,000,000.

1. P

Required:

2. E

Determine the partners' share in the profit under each of the following assumptions:

1. Beginning capital balances.

3. S

2. Average capital balances. (Investments and withdrawals are assumed to have been

made as of the beginning of the month if made before the middle of the month, and

assumed to have been made as of the beginning of the following month if made

after the middle of the month.)

3. Ending capital balances.

4. Bonus to Sunglao equal to 20% of profit in excess of P1,500,000, balance to be

divided equally.

5. Salary allowances of P450,000 and P350,000 to Sunglao and Java, respectively,

interest on average capital balances imputed at 10%; balance to be divided equally.

(Investments and withdrawals are treated as in requirement # 2.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning