! Required information [The following information applies to the questions displayed below.] Rocky owns and operates Balboa's Gym located in Philadelphia. The following transactions occur for the month of October 2 Receive membership dues for the month of October totaling $8,500 5 Issue common stock in exchange for cash, $12,000. 9 Purchase additional boxing equipment for $9,600, paying one-half of the amount in cash and issuing a note payable to the seller for the other one-half due by the end of the year 1. October 2. October 3. October 4. October 12 Pay $1,500 for advertising regarding a special membership rate available during the month of October 5. October 19 Pay dividends to stockholders, $4,400. 6. October 22 Pay liability insurance to cover accidents to members for the next six months, starting November 1, $6,900. 7. October 25 Receive cash in advance for November memberships, $5,600 8. October 30 Receive, but do not pay, utilities bill for the month, $5,200. 9. October 31 Pay employees' salaries for the month, $7,300. 4. Prepare a statement of cash flows for the month of October, properly classifying each of the cash transactions into operating, investing, and financing activities. Assume that the balance of cash at the beginning of October is $16,600. (List cash outflows and decrease in cash as negative amounts. Total entries from the same source together when entering in the statement of cash flows.) BALBOA'S GYM Statement of Cash Flows For the month ended October 31 Cash Flows from Operating Activities Cash inflows: Cash outflows: $ Net cash flows from operating activities 0 Cash Flows from Investing Activities Net cash flows from investing activities Cash Flows from Financing Activities Net cash flows from financing activities 0 Cash at the beginning of the month Cash at the end of the month

! Required information [The following information applies to the questions displayed below.] Rocky owns and operates Balboa's Gym located in Philadelphia. The following transactions occur for the month of October 2 Receive membership dues for the month of October totaling $8,500 5 Issue common stock in exchange for cash, $12,000. 9 Purchase additional boxing equipment for $9,600, paying one-half of the amount in cash and issuing a note payable to the seller for the other one-half due by the end of the year 1. October 2. October 3. October 4. October 12 Pay $1,500 for advertising regarding a special membership rate available during the month of October 5. October 19 Pay dividends to stockholders, $4,400. 6. October 22 Pay liability insurance to cover accidents to members for the next six months, starting November 1, $6,900. 7. October 25 Receive cash in advance for November memberships, $5,600 8. October 30 Receive, but do not pay, utilities bill for the month, $5,200. 9. October 31 Pay employees' salaries for the month, $7,300. 4. Prepare a statement of cash flows for the month of October, properly classifying each of the cash transactions into operating, investing, and financing activities. Assume that the balance of cash at the beginning of October is $16,600. (List cash outflows and decrease in cash as negative amounts. Total entries from the same source together when entering in the statement of cash flows.) BALBOA'S GYM Statement of Cash Flows For the month ended October 31 Cash Flows from Operating Activities Cash inflows: Cash outflows: $ Net cash flows from operating activities 0 Cash Flows from Investing Activities Net cash flows from investing activities Cash Flows from Financing Activities Net cash flows from financing activities 0 Cash at the beginning of the month Cash at the end of the month

Financial Accounting

15th Edition

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter2: Analyzing Transactions

Section: Chapter Questions

Problem 3PB: On October 1, 2019, Jay Pryor established an interior decorating business, Pioneer Designs. During...

Related questions

Question

Need help on this

![!

Required information

[The following information applies to the questions displayed below.]

Rocky owns and operates Balboa's Gym located in Philadelphia. The following transactions occur for the month of

October

2 Receive membership dues for the month of October totaling $8,500

5 Issue common stock in exchange for cash, $12,000.

9 Purchase additional boxing equipment for $9,600, paying one-half of the amount in cash and

issuing a note payable to the seller for the other one-half due by the end of the year

1. October

2. October

3. October

4. October 12 Pay $1,500 for advertising regarding a special membership rate available during the month of

October

5. October 19 Pay dividends to stockholders, $4,400.

6. October 22 Pay liability insurance to cover accidents to members for the next six months, starting

November 1, $6,900.

7. October 25 Receive cash in advance for November memberships, $5,600

8. October 30 Receive, but do not pay, utilities bill for the month, $5,200.

9. October 31 Pay employees' salaries for the month, $7,300.

4. Prepare a statement of cash flows for the month of October, properly classifying each of the cash transactions into operating,

investing, and financing activities. Assume that the balance of cash at the beginning of October is $16,600. (List cash outflows and

decrease in cash as negative amounts. Total entries from the same source together when entering in the statement of cash flows.)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F8aeb4c9c-8d33-4b47-954d-a4d3ce02aa40%2F92dc8a83-d9d1-46b6-84f9-d70051965960%2F86btaks.png&w=3840&q=75)

Transcribed Image Text:!

Required information

[The following information applies to the questions displayed below.]

Rocky owns and operates Balboa's Gym located in Philadelphia. The following transactions occur for the month of

October

2 Receive membership dues for the month of October totaling $8,500

5 Issue common stock in exchange for cash, $12,000.

9 Purchase additional boxing equipment for $9,600, paying one-half of the amount in cash and

issuing a note payable to the seller for the other one-half due by the end of the year

1. October

2. October

3. October

4. October 12 Pay $1,500 for advertising regarding a special membership rate available during the month of

October

5. October 19 Pay dividends to stockholders, $4,400.

6. October 22 Pay liability insurance to cover accidents to members for the next six months, starting

November 1, $6,900.

7. October 25 Receive cash in advance for November memberships, $5,600

8. October 30 Receive, but do not pay, utilities bill for the month, $5,200.

9. October 31 Pay employees' salaries for the month, $7,300.

4. Prepare a statement of cash flows for the month of October, properly classifying each of the cash transactions into operating,

investing, and financing activities. Assume that the balance of cash at the beginning of October is $16,600. (List cash outflows and

decrease in cash as negative amounts. Total entries from the same source together when entering in the statement of cash flows.)

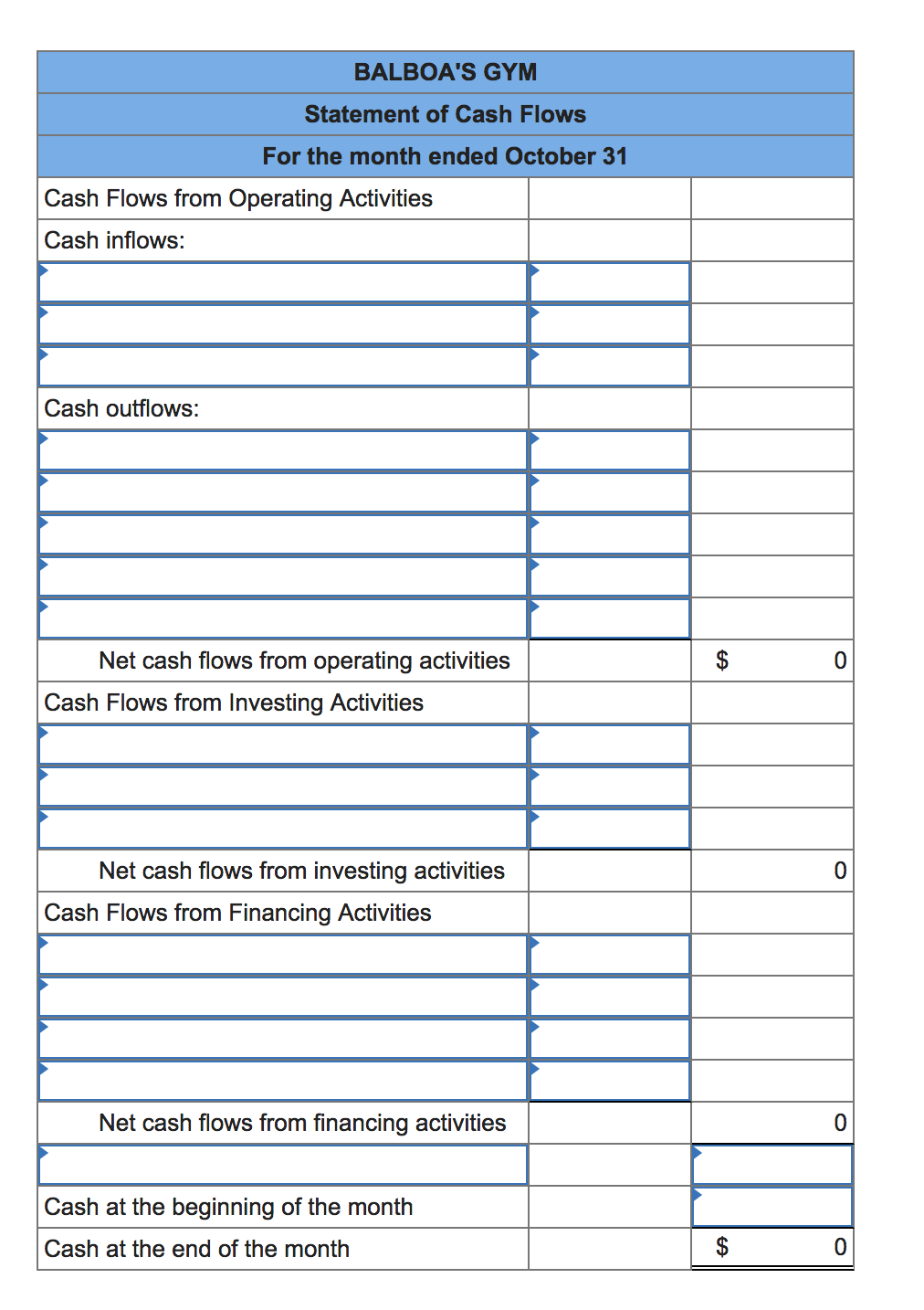

Transcribed Image Text:BALBOA'S GYM

Statement of Cash Flows

For the month ended October 31

Cash Flows from Operating Activities

Cash inflows:

Cash outflows:

$

Net cash flows from operating activities

0

Cash Flows from Investing Activities

Net cash flows from investing activities

Cash Flows from Financing Activities

Net cash flows from financing activities

0

Cash at the beginning of the month

Cash at the end of the month

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning