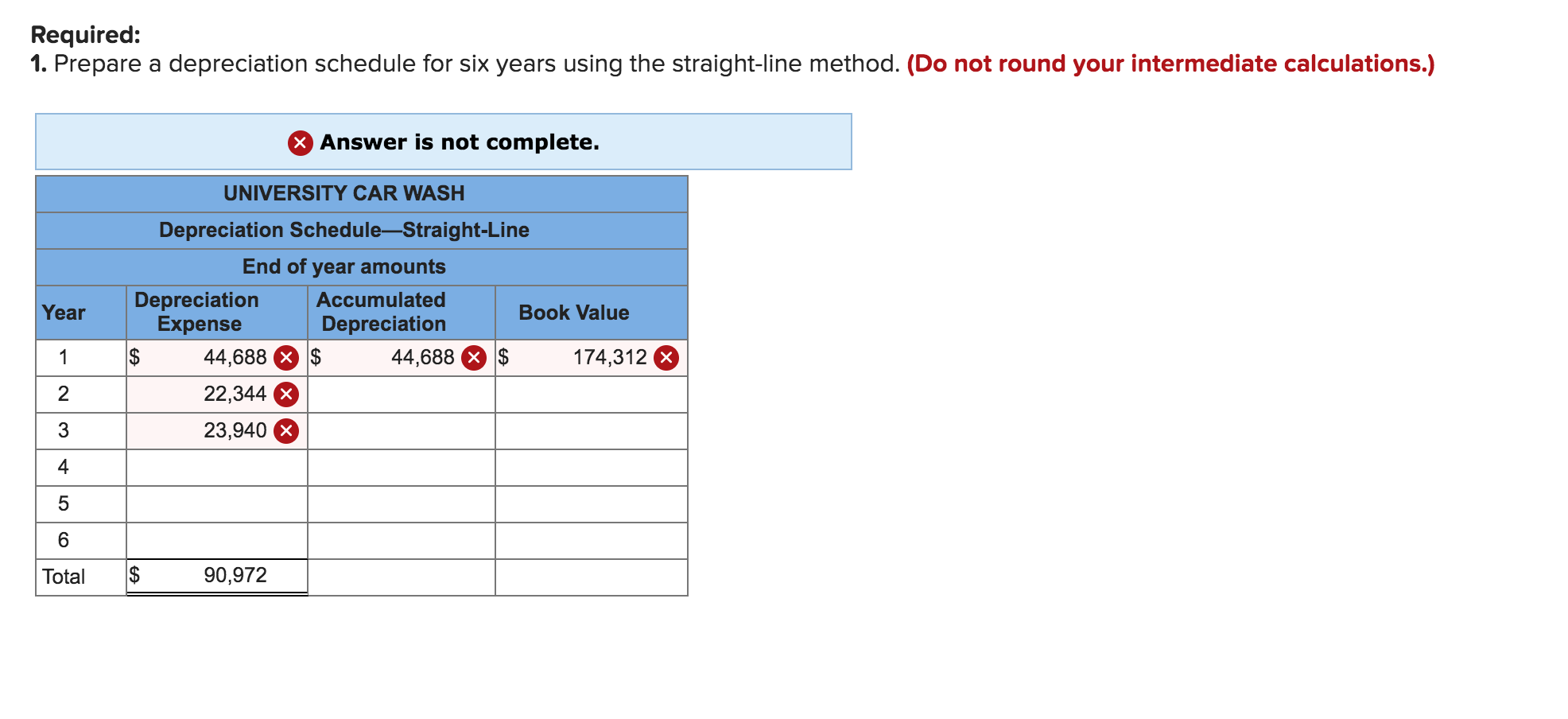

Required information [The following information applies to the questions displayed below.] University Car Wash built a deluxe car wash across the street from campus. The new machines cost $219,000 including installation. The company estimates that the equipment will have a residual value of $19,500. University Car Wash also estimates it will use the machine for six years or about 12,500 total hours. Actual use per year was as follows: Year Hours Used 2,800 1,400 1,500 2,500 2,300 2,000 2 4 Required: 1. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.) X Answer is not complete. UNIVERSITY CAR WASH Depreciation Schedule-Straight-Line End of year amounts Depreciation Expense Accumulated Year Book Value Depreciation 44,688 X $ 44,688 X $ 174,312 2 22,344 X 3 23,940 4 Total 2$ 90,972

Required information [The following information applies to the questions displayed below.] University Car Wash built a deluxe car wash across the street from campus. The new machines cost $219,000 including installation. The company estimates that the equipment will have a residual value of $19,500. University Car Wash also estimates it will use the machine for six years or about 12,500 total hours. Actual use per year was as follows: Year Hours Used 2,800 1,400 1,500 2,500 2,300 2,000 2 4 Required: 1. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.) X Answer is not complete. UNIVERSITY CAR WASH Depreciation Schedule-Straight-Line End of year amounts Depreciation Expense Accumulated Year Book Value Depreciation 44,688 X $ 44,688 X $ 174,312 2 22,344 X 3 23,940 4 Total 2$ 90,972

Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Eugene F. Brigham, Phillip R. Daves

Chapter12: Capital Budgeting: Decision Criteria

Section: Chapter Questions

Problem 18P: Filkins Fabric Company is considering the replacement of its old, fully depreciated knitting...

Related questions

Question

Hello, I am stuck with this problem. Could you help me please?

![Required information

[The following information applies to the questions displayed below.]

University Car Wash built a deluxe car wash across the street from campus. The new machines cost $219,000 including

installation. The company estimates that the equipment will have a residual value of $19,500. University Car Wash also

estimates it will use the machine for six years or about 12,500 total hours. Actual use per year was as follows:

Year

Hours Used

2,800

1,400

1,500

2,500

2,300

2,000

2

4](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F219064fc-be0d-4a8b-a28d-bcaa5ec97039%2F932f8406-c834-4a54-ac16-a63e6aec856c%2Ffijr0i.png&w=3840&q=75)

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.]

University Car Wash built a deluxe car wash across the street from campus. The new machines cost $219,000 including

installation. The company estimates that the equipment will have a residual value of $19,500. University Car Wash also

estimates it will use the machine for six years or about 12,500 total hours. Actual use per year was as follows:

Year

Hours Used

2,800

1,400

1,500

2,500

2,300

2,000

2

4

Transcribed Image Text:Required:

1. Prepare a depreciation schedule for six years using the straight-line method. (Do not round your intermediate calculations.)

X Answer is not complete.

UNIVERSITY CAR WASH

Depreciation Schedule-Straight-Line

End of year amounts

Depreciation

Expense

Accumulated

Year

Book Value

Depreciation

44,688 X $

44,688 X $

174,312

2

22,344 X

3

23,940

4

Total

2$

90,972

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning