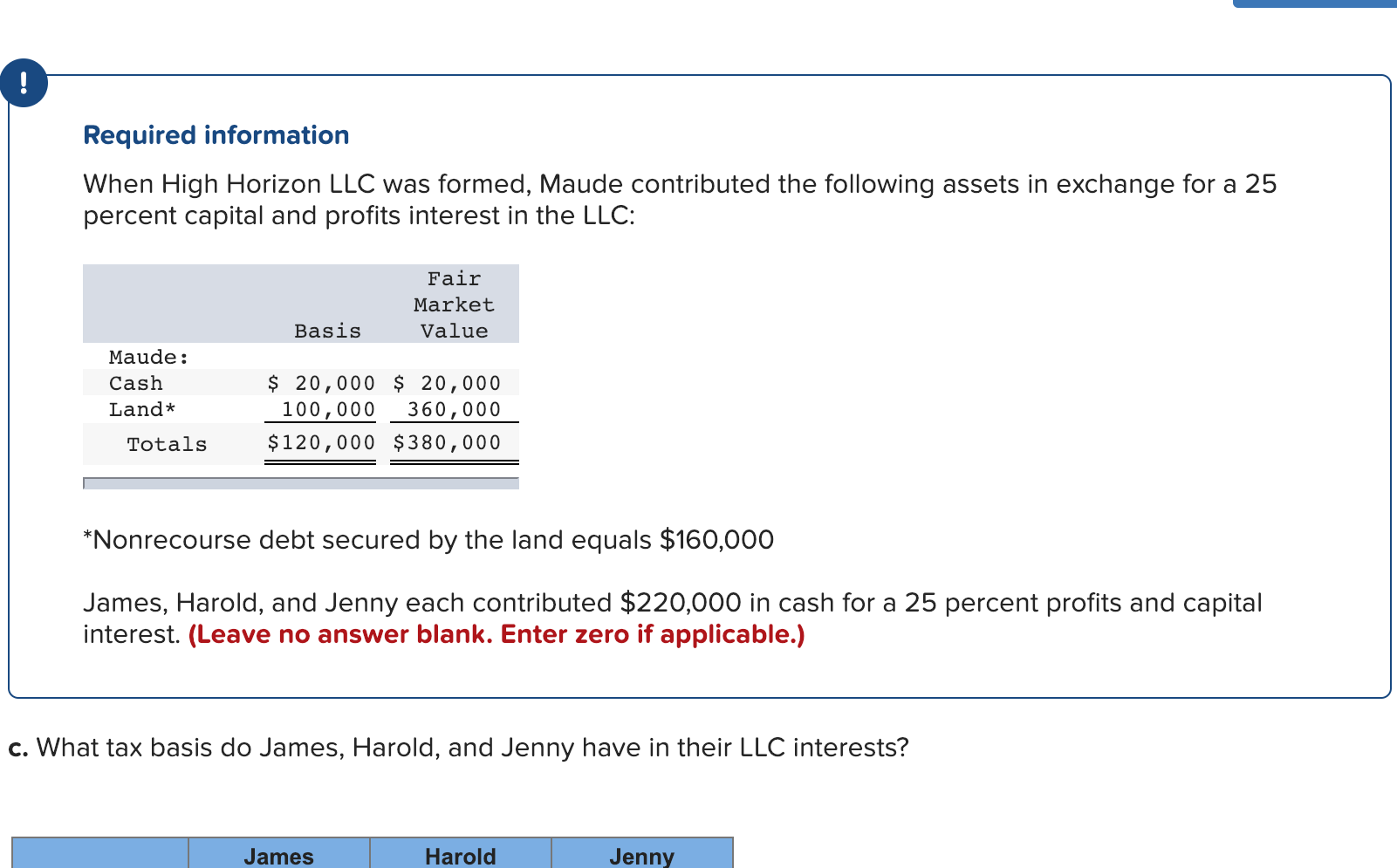

Required information When High Horizon LLC was formed, Maude contributed the following assets in exchange for a 25 percent capital and profits interest in the LLC: Fair Market Value Basis Maude: Cash Land* $ 20,000 20,000 100,000 360,000 $120,000 $380,000 Totals Nonrecourse debt secured by the land equals $160,000 James, Harold, and Jenny each contributed $220,000 in cash for a 25 percent profits and capital interest. (Leave no answer blank. Enter zero if applicable.) c. What tax basis do James, Harold, and Jenny have in their LLC interests? James Harold Jenny

Required information When High Horizon LLC was formed, Maude contributed the following assets in exchange for a 25 percent capital and profits interest in the LLC: Fair Market Value Basis Maude: Cash Land* $ 20,000 20,000 100,000 360,000 $120,000 $380,000 Totals Nonrecourse debt secured by the land equals $160,000 James, Harold, and Jenny each contributed $220,000 in cash for a 25 percent profits and capital interest. (Leave no answer blank. Enter zero if applicable.) c. What tax basis do James, Harold, and Jenny have in their LLC interests? James Harold Jenny

Chapter20: Corporations And Partnerships

Section: Chapter Questions

Problem 5CPA

Related questions

Question

Transcribed Image Text:Required information

When High Horizon LLC was formed, Maude contributed the following assets in exchange for a 25

percent capital and profits interest in the LLC:

Fair

Market

Value

Basis

Maude:

Cash

Land*

$ 20,000 20,000

100,000 360,000

$120,000 $380,000

Totals

Nonrecourse debt secured by the land equals $160,000

James, Harold, and Jenny each contributed $220,000 in cash for a 25 percent profits and capital

interest. (Leave no answer blank. Enter zero if applicable.)

c. What tax basis do James, Harold, and Jenny have in their LLC interests?

James

Harold

Jenny

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning