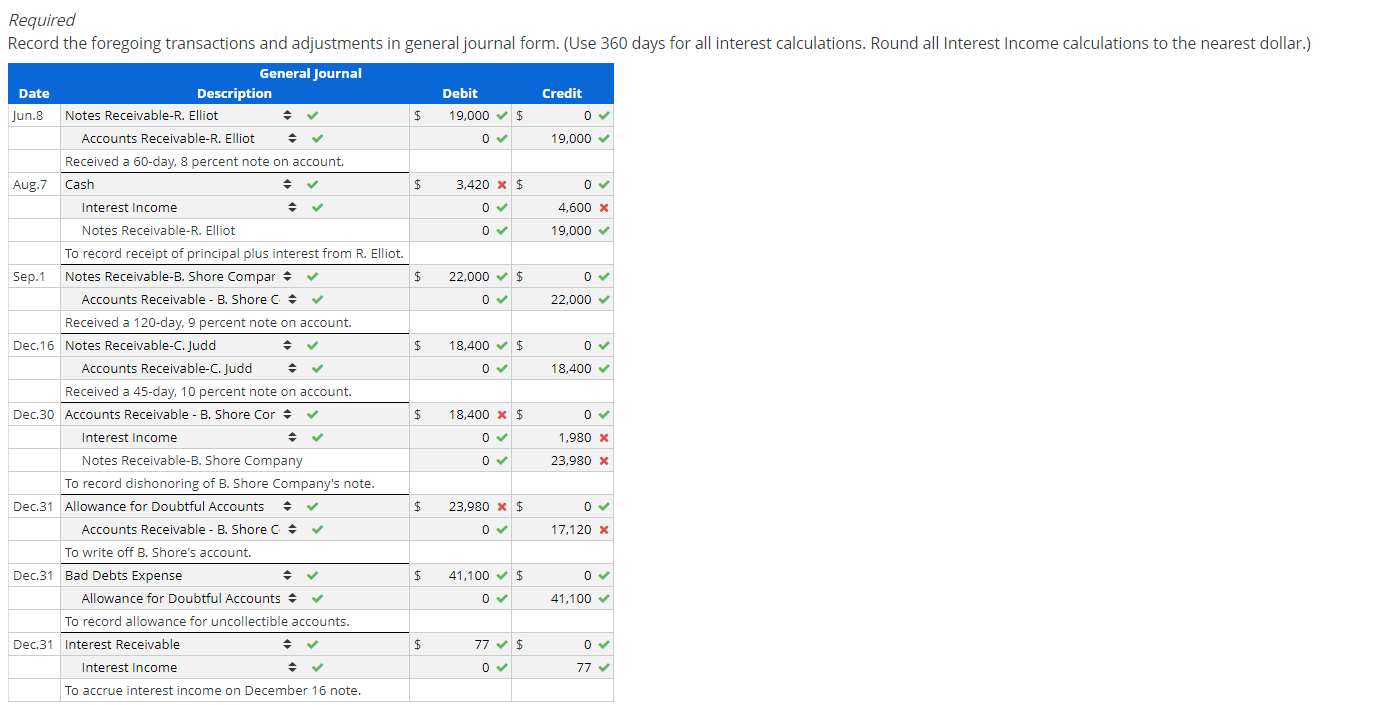

Required Record the foregoing transactions and adjustments in general journal form. (Use 360 days for all interest calculations. Round all Interest Income calculations to the nearest dollar.) General Journal Debit Description Credit Date Notes Receivable-R. Elliot 24 Jun.8 19,000 v $ Accounts Receivable-R. Elliot 19,000 Received a 60-day, 8 percent note on account. 3,420 x $ Aug.7 Cash Interest Income 4,600 x Notes Receivable-R. Elliot 19,000 v To record receipt of principal plus interest from R. Elliot. Notes Receivable-B. Shore Compar + 22.000 v $ Sep.1 Accounts Receivable - B. Shore C + 22,000 v Received a 120-day, 9 percent note on account. Dec.16 Notes Receivable-C. Judd 18,400 v $ Accounts Receivable-C. Judd 18,400 v Received a 45-day, 10 percent note on account. Dec.30 Accounts Receivable - B. Shore Cor + 18,400 x $ Interest Income 1,980 x Notes Receivable-B. Shore Company 23,980 x To record dishonoring of B. Shore Company's note. v v Dec.31 Allowance for Doubtful Accounts + 23,980 x $ Accounts Receivable - B. Shore C + 17,120 x To write off B. Shore's account. Dec.31 Bad Debts Expense 2$ 41,100 v $ Allowance for Doubtful Accounts + 41,100 v To record allowance for uncollectible accounts. Dec.31 Interest Receivable 24 77 v $ Interest Income 77 v To accrue interest income on December 16 note. Journal Entries for Accounts and Notes Receivable Lancaster, Inc., began business on January 1. Certain transactions for the year follow: Received a $19,000, 60 day, eight percent note on account from R. Elliot. Jun.8 Received payment from R. Elliot on her note (principal plus interest). Aug.7 Received a $22,000, 120 day, nine percent note from B. Shore Company on account. Sep.1 Dec.16 Received a $18,400, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $22,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $18,500. Dec.31 Made the appropriate adjusting entries for interest.

Required Record the foregoing transactions and adjustments in general journal form. (Use 360 days for all interest calculations. Round all Interest Income calculations to the nearest dollar.) General Journal Debit Description Credit Date Notes Receivable-R. Elliot 24 Jun.8 19,000 v $ Accounts Receivable-R. Elliot 19,000 Received a 60-day, 8 percent note on account. 3,420 x $ Aug.7 Cash Interest Income 4,600 x Notes Receivable-R. Elliot 19,000 v To record receipt of principal plus interest from R. Elliot. Notes Receivable-B. Shore Compar + 22.000 v $ Sep.1 Accounts Receivable - B. Shore C + 22,000 v Received a 120-day, 9 percent note on account. Dec.16 Notes Receivable-C. Judd 18,400 v $ Accounts Receivable-C. Judd 18,400 v Received a 45-day, 10 percent note on account. Dec.30 Accounts Receivable - B. Shore Cor + 18,400 x $ Interest Income 1,980 x Notes Receivable-B. Shore Company 23,980 x To record dishonoring of B. Shore Company's note. v v Dec.31 Allowance for Doubtful Accounts + 23,980 x $ Accounts Receivable - B. Shore C + 17,120 x To write off B. Shore's account. Dec.31 Bad Debts Expense 2$ 41,100 v $ Allowance for Doubtful Accounts + 41,100 v To record allowance for uncollectible accounts. Dec.31 Interest Receivable 24 77 v $ Interest Income 77 v To accrue interest income on December 16 note. Journal Entries for Accounts and Notes Receivable Lancaster, Inc., began business on January 1. Certain transactions for the year follow: Received a $19,000, 60 day, eight percent note on account from R. Elliot. Jun.8 Received payment from R. Elliot on her note (principal plus interest). Aug.7 Received a $22,000, 120 day, nine percent note from B. Shore Company on account. Sep.1 Dec.16 Received a $18,400, 45 day, ten percent note from C. Judd on account. Dec.30 B. Shore Company failed to pay its note. Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $22,600. An analysis of aged receivables indicates that the desired balance of the allowance account should be $18,500. Dec.31 Made the appropriate adjusting entries for interest.

Chapter9: Accounting For Receivables

Section: Chapter Questions

Problem 22MC: A company collects an honored note with a maturity date of 24 months from establishment, a 10%...

Related questions

Question

I am struggling with these calculations: I uploaded both data need to answer question and answer table

Transcribed Image Text:Required

Record the foregoing transactions and adjustments in general journal form. (Use 360 days for all interest calculations. Round all Interest Income calculations to the nearest dollar.)

General Journal

Debit

Description

Credit

Date

Notes Receivable-R. Elliot

24

Jun.8

19,000 v $

Accounts Receivable-R. Elliot

19,000

Received a 60-day, 8 percent note on account.

3,420 x $

Aug.7 Cash

Interest Income

4,600 x

Notes Receivable-R. Elliot

19,000 v

To record receipt of principal plus interest from R. Elliot.

Notes Receivable-B. Shore Compar +

22.000 v $

Sep.1

Accounts Receivable - B. Shore C +

22,000

v

Received a 120-day, 9 percent note on account.

Dec.16 Notes Receivable-C. Judd

18,400 v $

Accounts Receivable-C. Judd

18,400 v

Received a 45-day, 10 percent note on account.

Dec.30 Accounts Receivable - B. Shore Cor +

18,400 x $

Interest Income

1,980 x

Notes Receivable-B. Shore Company

23,980 x

To record dishonoring of B. Shore Company's note.

v

v

Dec.31 Allowance for Doubtful Accounts

+

23,980 x $

Accounts Receivable - B. Shore C +

17,120 x

To write off B. Shore's account.

Dec.31 Bad Debts Expense

2$

41,100 v $

Allowance for Doubtful Accounts +

41,100 v

To record allowance for uncollectible accounts.

Dec.31 Interest Receivable

24

77 v $

Interest Income

77 v

To accrue interest income on December 16 note.

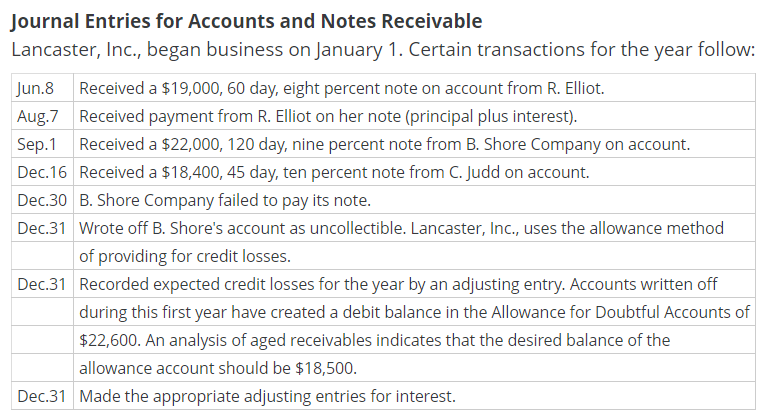

Transcribed Image Text:Journal Entries for Accounts and Notes Receivable

Lancaster, Inc., began business on January 1. Certain transactions for the year follow:

Received a $19,000, 60 day, eight percent note on account from R. Elliot.

Jun.8

Received payment from R. Elliot on her note (principal plus interest).

Aug.7

Received a $22,000, 120 day, nine percent note from B. Shore Company on account.

Sep.1

Dec.16 Received a $18,400, 45 day, ten percent note from C. Judd on account.

Dec.30 B. Shore Company failed to pay its note.

Dec.31 Wrote off B. Shore's account as uncollectible. Lancaster, Inc., uses the allowance method

of providing for credit losses.

Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off

during this first year have created a debit balance in the Allowance for Doubtful Accounts of

$22,600. An analysis of aged receivables indicates that the desired balance of the

allowance account should be $18,500.

Dec.31 Made the appropriate adjusting entries for interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage