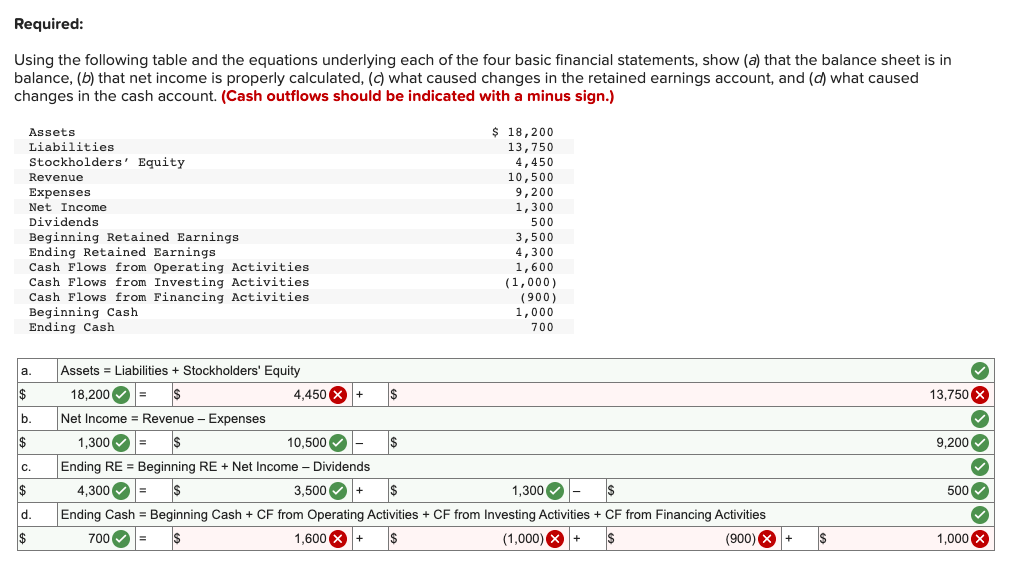

Required: Using the following table and the equations underlying each of the four basic financial statements, show (a) that the balance sheet is in balance, (b) that net income is properly calculated, (c) what caused changes in the retained earnings account, and (d) what caused changes in the cash account. (Cash outflows should be indicated with a minus sign.) Assets $ 18,200 Liabilities Stockholders' Equity 13,750 4,450 10,500 9,200 1,300 Revenue Expenses Net Income Dividends 500 Beginning Retained Earnings Ending Retained Earnings Cash Flows from Operating Activities Cash Flows from Investing Activities Cash Flows from Financing Activities Beginning Cash Ending Cash 3,500 4,300 1,600 (1,000) (900) 1,000 700 a. Assets = Liabilities + Stockholders' Equity $ 18,200 4,450 $ 13,750 X + b. Net Income = Revenue – Expenses 2$ 1,300 10,500 9,200 3D Ending RE = Beginning RE + Net Income – Dividends C. 4,300 1,300 O- 500 $ Ending Cash = Beginning Cash + CF from Operating Activities + CF from Investing Activities + CF from Financing Activities %3D 3.500 d. $ 700 1,600 X+ (1,000) X+ (900) 1,000 X 3D

Required: Using the following table and the equations underlying each of the four basic financial statements, show (a) that the balance sheet is in balance, (b) that net income is properly calculated, (c) what caused changes in the retained earnings account, and (d) what caused changes in the cash account. (Cash outflows should be indicated with a minus sign.) Assets $ 18,200 Liabilities Stockholders' Equity 13,750 4,450 10,500 9,200 1,300 Revenue Expenses Net Income Dividends 500 Beginning Retained Earnings Ending Retained Earnings Cash Flows from Operating Activities Cash Flows from Investing Activities Cash Flows from Financing Activities Beginning Cash Ending Cash 3,500 4,300 1,600 (1,000) (900) 1,000 700 a. Assets = Liabilities + Stockholders' Equity $ 18,200 4,450 $ 13,750 X + b. Net Income = Revenue – Expenses 2$ 1,300 10,500 9,200 3D Ending RE = Beginning RE + Net Income – Dividends C. 4,300 1,300 O- 500 $ Ending Cash = Beginning Cash + CF from Operating Activities + CF from Investing Activities + CF from Financing Activities %3D 3.500 d. $ 700 1,600 X+ (1,000) X+ (900) 1,000 X 3D

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter1: Accounting And The Financial Statements

Section: Chapter Questions

Problem 12MCQ: Which of the following sentences regarding the statement of cash flows is false? The statement of...

Related questions

Question

Please answer the incorrect questions. Thanks!

Transcribed Image Text:Required:

Using the following table and the equations underlying each of the four basic financial statements, show (a) that the balance sheet is in

balance, (b) that net income is properly calculated, (c) what caused changes in the retained earnings account, and (d) what caused

changes in the cash account. (Cash outflows should be indicated with a minus sign.)

Assets

$ 18,200

Liabilities

Stockholders' Equity

13,750

4,450

Revenue

10,500

9,200

1,300

Expenses

Net Income

Dividends

500

Beginning Retained Earnings

Ending Retained Earnings

Cash Flows from Operating Activities

Cash Flows from Investing Activities

Cash Flows from Financing Activities

Beginning Cash

Ending Cash

3,500

4,300

1,600

(1,000)

(900)

1,000

700

a.

Assets = Liabilities + Stockholders' Equity

$

18,200

V

4,450 X+

13,750 X

b.

Net Income = Revenue - Expenses

2$

1,300 =

10,500

2$

9,200

c.

Ending RE = Beginning RE + Net Income – Dividends

2$

4,300 O =

3,500 O+

2$

1.300 O-

I24

500

O

d.

Ending Cash = Beginning Cash + CF from Operating Activities + CF from Investing Activities + CF from Financing Activities

$

700 O=

1,600 X+

2$

(1,000) X +

I24

(900) X+

I$

1,000 x

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning