Requirements 1. Determine the amounts that Woody's should report for cost of goods sold and ending inventory two ways: (Woody's uses a perpetual inventory system.) a. FIFO b. LIFO 2. Woody's uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses totaled $330, and the income tax rate was 35%. Print - X Done Data table Date Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Print Quantity 11 7 6 4 Unit Cost $ Done 46 68 Sale Price $ 91 91

Requirements 1. Determine the amounts that Woody's should report for cost of goods sold and ending inventory two ways: (Woody's uses a perpetual inventory system.) a. FIFO b. LIFO 2. Woody's uses the FIFO method. Prepare the company's income statement for the month ended March 31, 2021, reporting gross profit. Operating expenses totaled $330, and the income tax rate was 35%. Print - X Done Data table Date Mar 1 Mar 2 Mar 7 Mar 13 Item Balance Purchase Sale Sale Print Quantity 11 7 6 4 Unit Cost $ Done 46 68 Sale Price $ 91 91

Century 21 Accounting General Journal

11th Edition

ISBN:9781337680059

Author:Gilbertson

Publisher:Gilbertson

Chapter20: Accounting For Inventory

Section: Chapter Questions

Problem 3AP

Related questions

Question

Question attacheed in screenshot

thank sfor the help

greatly appreicated

oeipt234p2o3i5po2i35po23i5p2o3i52po

5i3po2ip3o5i2p3oi2p

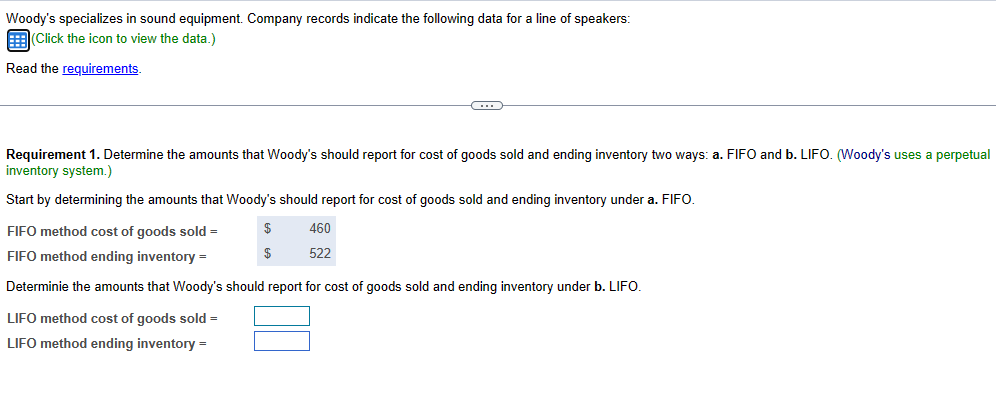

Transcribed Image Text:Woody's specializes in sound equipment. Company records indicate the following data for a line of speakers:

(Click the icon to view the data.)

Read the requirements.

Requirement 1. Determine the amounts that Woody's should report for cost of goods sold and ending inventory two ways: a. FIFO and b. LIFO. (Woody's uses a perpetual

inventory system.)

Start by determining the amounts that Woody's should report for cost of goods sold and ending inventory under a. FIFO.

$

$

460

522

FIFO method cost of goods sold =

FIFO method ending inventory =

Determinie the amounts that Woody's should report for cost of goods sold and ending inventory under b. LIFO.

LIFO method cost of goods sold =

LIFO method ending inventory =

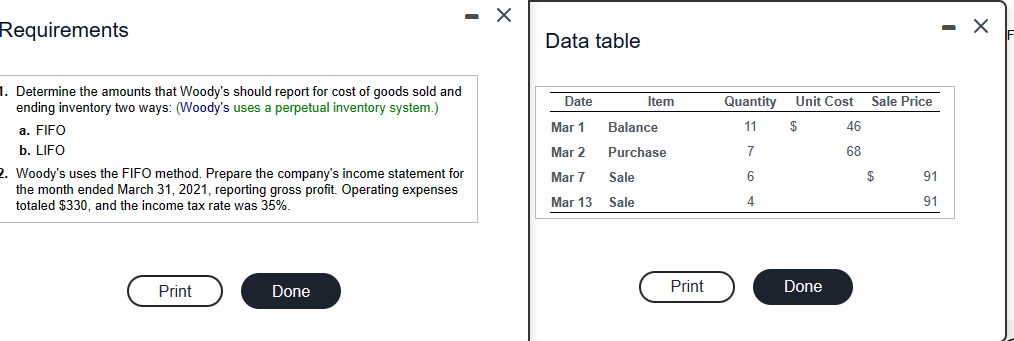

Transcribed Image Text:Requirements

1. Determine the amounts that Woody's should report for cost of goods sold and

ending inventory two ways: (Woody's uses a perpetual inventory system.)

a. FIFO

b. LIFO

2. Woody's uses the FIFO method. Prepare the company's income statement for

the month ended March 31, 2021, reporting gross profit. Operating expenses

totaled $330, and the income tax rate was 35%.

Print

- X

Done

Data table

Date

Mar 1

Mar 2

Mar 7

Mar 13

Item

Balance

Purchase

Sale

Sale

Print

Quantity

11

7

6

4

Unit Cost

$

Done

46

68

Sale Price

$

91

91

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning