Return on Investment and Investment Decisions Leslie Blandings, division manager of Audiotech Inc., was debating the merits a new product-a weather radio that would put out a warning if the county in which the listener lived were under a severe thunderstorm or tornado alert. The budgeted income of the division was $825,000 with operating assets of S4,525,000. The proposed investment would add income of $640,000 and would require an additional investment in equipment of $4,000,000. The minimum required return on investment for the company is 12%. Required: 2. Compute the residual income of the following: a. The division if the radio project is not undertaken. $4 b. The radio project alone. C. The division if the radio project is undertaken. 3. This depends on whether Leslie's division is evaluated on the basis of ROI or on the basis of residual income. Overall division ROI wills decrease ; so if ROI is the basis for evaluation, she will decline the investment. On the other hand, residual income for the project is positive and will raise overall residual income. If the division is evaluated on the basis of residual income, the project will be accepted

Return on Investment and Investment Decisions Leslie Blandings, division manager of Audiotech Inc., was debating the merits a new product-a weather radio that would put out a warning if the county in which the listener lived were under a severe thunderstorm or tornado alert. The budgeted income of the division was $825,000 with operating assets of S4,525,000. The proposed investment would add income of $640,000 and would require an additional investment in equipment of $4,000,000. The minimum required return on investment for the company is 12%. Required: 2. Compute the residual income of the following: a. The division if the radio project is not undertaken. $4 b. The radio project alone. C. The division if the radio project is undertaken. 3. This depends on whether Leslie's division is evaluated on the basis of ROI or on the basis of residual income. Overall division ROI wills decrease ; so if ROI is the basis for evaluation, she will decline the investment. On the other hand, residual income for the project is positive and will raise overall residual income. If the division is evaluated on the basis of residual income, the project will be accepted

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 3PB

Related questions

Question

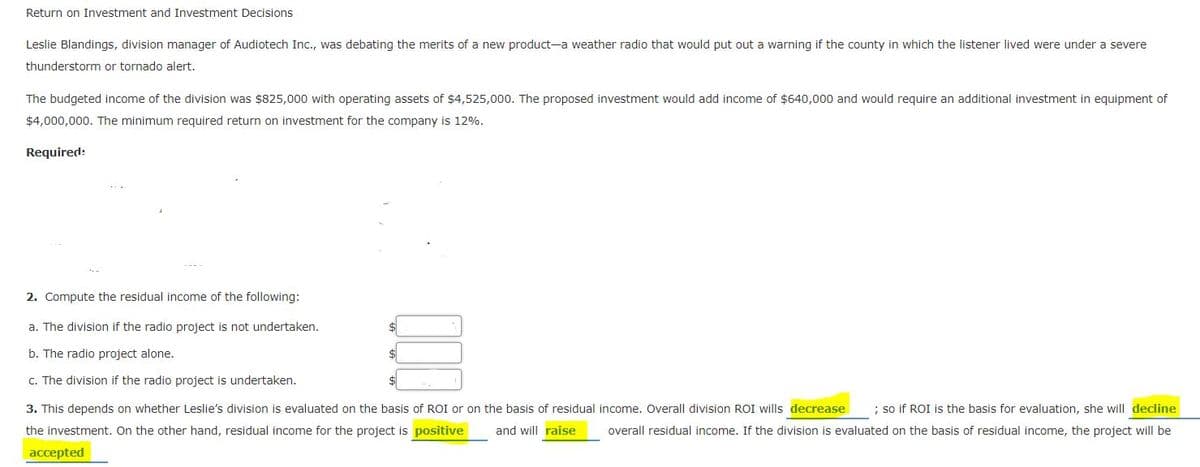

Transcribed Image Text:Return on Investment and Investment Decisions

Leslie Blandings, division manager of Audiotech Inc., was debating the merits of a new product-a weather radio that would put out a warning if the county in which the listener lived were under a severe

thunderstorm or tornado alert.

The budgeted income of the division was $825,000 with operating assets of $4,525,000. The proposed investment would add income of $640,000 and would require an additional investment in equipment of

$4,000,000. The minimum required return on investment for the company is 12%.

Required:

2. Compute the residual income of the following:

a. The division if the radio project is not undertaken.

$

b. The radio project alone.

$

c. The division if the radio project is undertaken.

3. This depends on whether Leslie's division is evaluated on the basis of ROI or on the basis of residual income. Overall division ROI wills decrease

; so if ROI is the basis for evaluation, she will decline

the investment. On the other hand, residual income for the project is positive

and will raise

overall residual income. If the division is evaluated on the basis of residual income, the project will be

accepted

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning