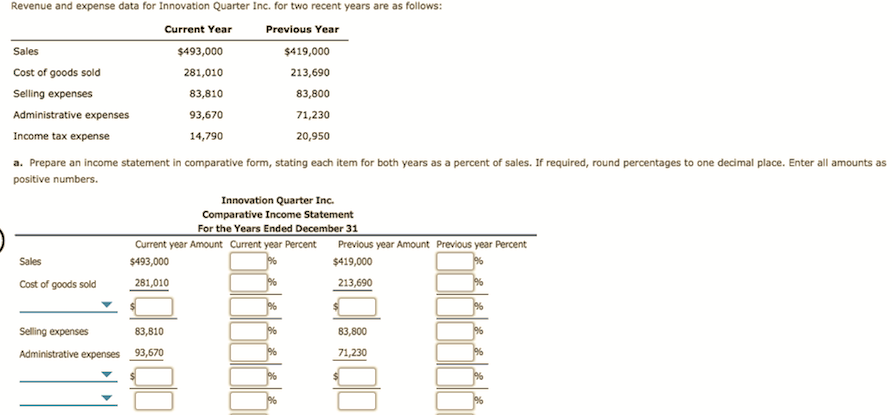

Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous Year Sales $493,000 $419,000 Cost of goods sold 281,010 213,690 83,810 Selling expenses 83,800 Administrative expenses 93,670 71,230 Income tax expense 14,790 20,950 a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amour nounts as positive numbers. Innovation Quarter Inc Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent Previous year Amount Previous year Percent Sales $493,000 $419,000 281,010 213,690 Cost of goods sold Selling expenses 83,810 83,800 96 96 93,670 71,230 Administrative expenses Innovation Quarter Inc. Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent Previous year Amount Previous year Percent $493,000 Sales $419,000 281,010 213,690 Cost of goods sold 9% % Selling expenses 83,810 83,800 % 71,230 Administrative expenses 93,670 % % Income tax expense 14,790 20,950 b. The vertical analysis indicates that the cost of goods sold as a percent of sales by 6 percentage points, while selling expenses by 3 by 2 percentage points. Thus, net income as a percent of sales by 3 percentage points. percentage points, and administrative expenses

Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous Year Sales $493,000 $419,000 Cost of goods sold 281,010 213,690 83,810 Selling expenses 83,800 Administrative expenses 93,670 71,230 Income tax expense 14,790 20,950 a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amour nounts as positive numbers. Innovation Quarter Inc Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent Previous year Amount Previous year Percent Sales $493,000 $419,000 281,010 213,690 Cost of goods sold Selling expenses 83,810 83,800 96 96 93,670 71,230 Administrative expenses Innovation Quarter Inc. Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent Previous year Amount Previous year Percent $493,000 Sales $419,000 281,010 213,690 Cost of goods sold 9% % Selling expenses 83,810 83,800 % 71,230 Administrative expenses 93,670 % % Income tax expense 14,790 20,950 b. The vertical analysis indicates that the cost of goods sold as a percent of sales by 6 percentage points, while selling expenses by 3 by 2 percentage points. Thus, net income as a percent of sales by 3 percentage points. percentage points, and administrative expenses

Financial Accounting

14th Edition

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Carl Warren, Jim Reeve, Jonathan Duchac

Chapter17: Financial Statement Analysis

Section: Chapter Questions

Problem 1E: Revenue and expense data for Gresham Inc. for two recent years are as follows: a. Prepare an income...

Related questions

Question

100%

Transcribed Image Text:Revenue and expense data for Innovation Quarter Inc. for two recent years are as follows:

Current Year

Previous Year

Sales

$493,000

$419,000

Cost of goods sold

281,010

213,690

83,810

Selling expenses

83,800

Administrative expenses

93,670

71,230

Income tax expense

14,790

20,950

a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amour

nounts as

positive numbers.

Innovation Quarter Inc

Comparative Income Statement

For the Years Ended December 31

Current year Amount Current year Percent

Previous year Amount Previous year Percent

Sales

$493,000

$419,000

281,010

213,690

Cost of goods sold

Selling expenses

83,810

83,800

96

96

93,670

71,230

Administrative expenses

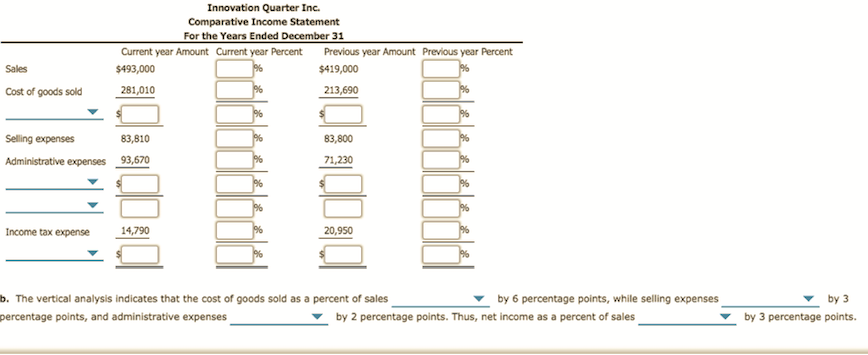

Transcribed Image Text:Innovation Quarter Inc.

Comparative Income Statement

For the Years Ended December 31

Current year Amount Current year Percent

Previous year Amount Previous year Percent

$493,000

Sales

$419,000

281,010

213,690

Cost of goods sold

9%

%

Selling expenses

83,810

83,800

%

71,230

Administrative expenses 93,670

%

%

Income tax expense

14,790

20,950

b. The vertical analysis indicates that the cost of goods sold as a percent of sales

by 6 percentage points, while selling expenses

by 3

by 2 percentage points. Thus, net income as a percent of sales

by 3 percentage points.

percentage points, and administrative expenses

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning