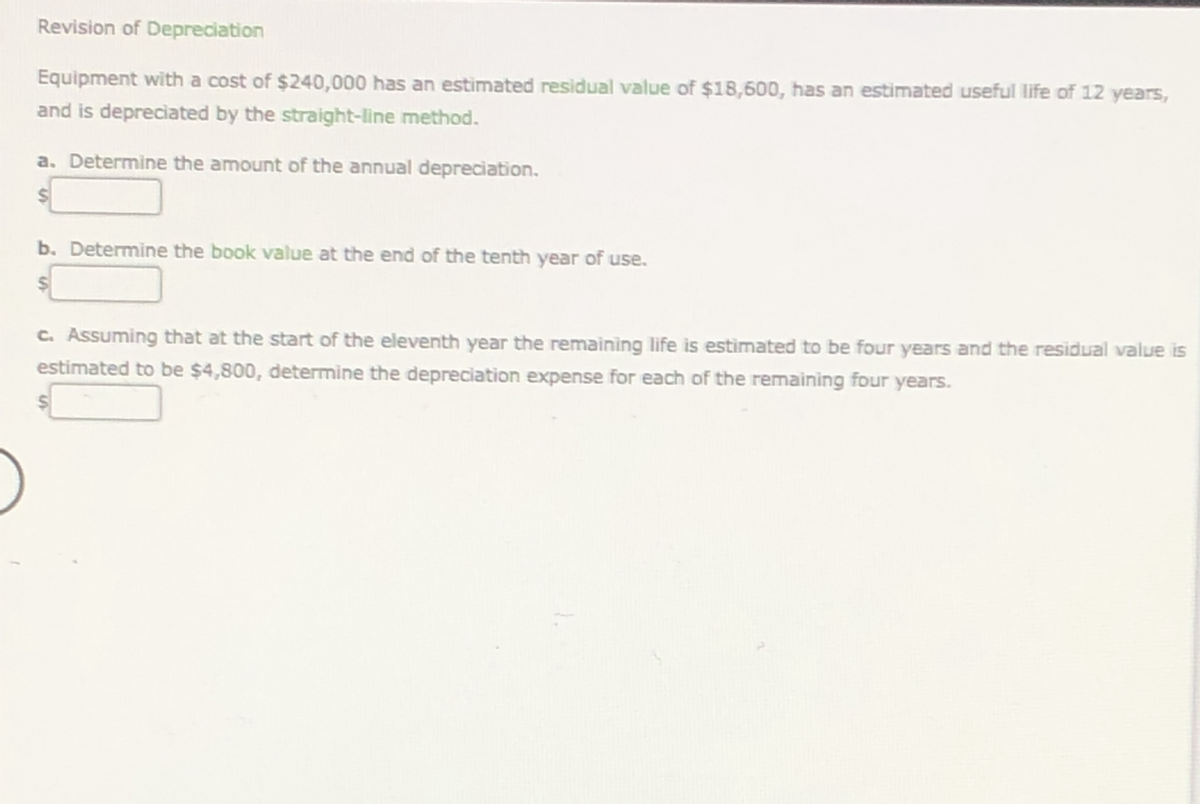

Revision of Depreciation Equipment with a cost of $240,000 has an estimated residual value of $18,600, has an estimated useful life of 12 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. b. Determine the book value at the end of the tenth year of use. C. Assuming that at the start of the eleventh year the remaining life is estimated to be four years and the residual value is estimated to be $4,800, determine the depreciation expense for each of the remaining four years.

Revision of Depreciation Equipment with a cost of $240,000 has an estimated residual value of $18,600, has an estimated useful life of 12 years, and is depreciated by the straight-line method. a. Determine the amount of the annual depreciation. b. Determine the book value at the end of the tenth year of use. C. Assuming that at the start of the eleventh year the remaining life is estimated to be four years and the residual value is estimated to be $4,800, determine the depreciation expense for each of the remaining four years.

College Accounting, Chapters 1-27

23rd Edition

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:HEINTZ, James A.

Chapter18: Accounting For Long-term Assets

Section: Chapter Questions

Problem 3CE: A machine costing 350,000 has a salvage value of 15,000 and an estimated life of three years....

Related questions

Question

100%

Transcribed Image Text:Revision of Depreciation

Equipment with a cost of $240,000 has an estimated residual value of $18,600, has an estimated useful life of 12 years,

and is depreciated by the straight-line method.

a. Determine the amount of the annual depreciation.

b. Determine the book value at the end of the tenth year of use.

C. Assuming that at the start of the eleventh year the remaining life is estimated to be four years and the residual value is

estimated to be $4,800, determine the depreciation expense for each of the remaining four years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub