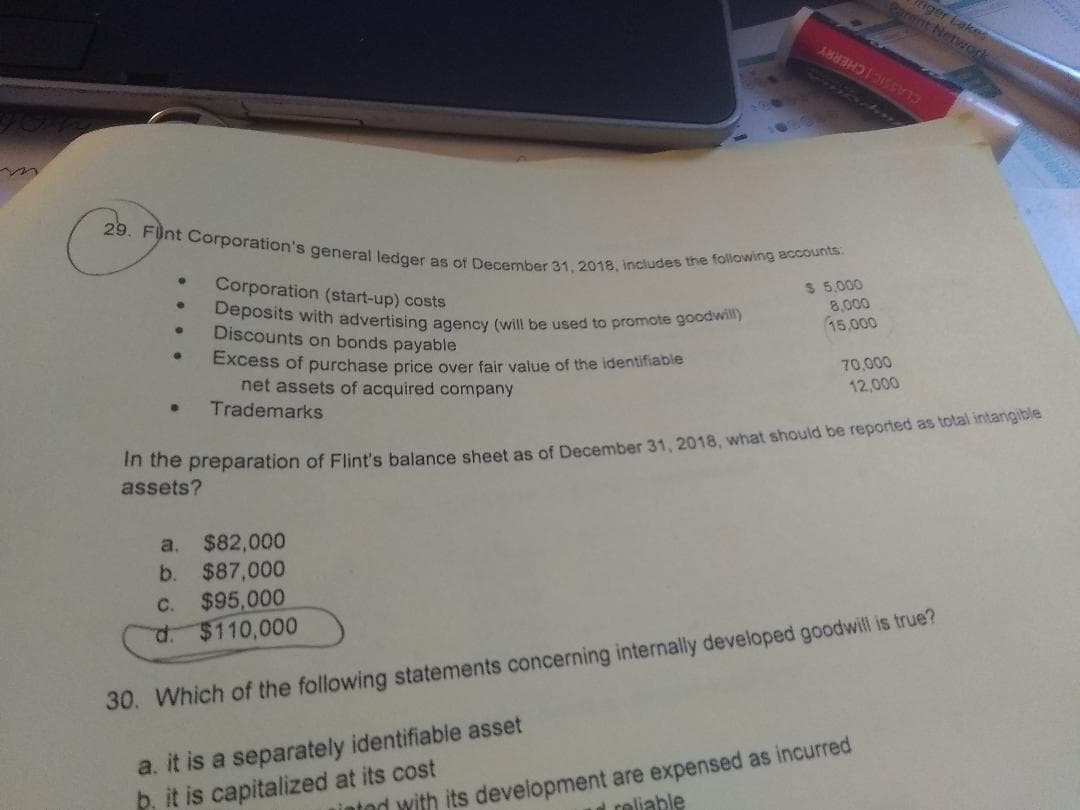

riger Lakes Parent Network CLASSIC ICHERRY 29. Fünt Corporation's general ledger as of December 31, 2018, includes the following accounts Corporation (start-up) costs $ 5,000 8,000 15,000 Deposits with advertising agency (will be used to promote goodwill) Discounts on bonds payable Excess of purchase price over fair value of the identifiable net assets of acquired company Trademarks 70,000 12,000 In the preparation of Flint's balance sheet as of December 31, 2018, what should be reported as total intangible assets? $82,000 b. a. $87,000 $95,000 d. $110,000 C. 30. Which of the following statements concerning internally developed goodwill is true? a. it is a separately identifiable asset b. it is capitalized at its cost intod with its development are expensed as incurred reliable

riger Lakes Parent Network CLASSIC ICHERRY 29. Fünt Corporation's general ledger as of December 31, 2018, includes the following accounts Corporation (start-up) costs $ 5,000 8,000 15,000 Deposits with advertising agency (will be used to promote goodwill) Discounts on bonds payable Excess of purchase price over fair value of the identifiable net assets of acquired company Trademarks 70,000 12,000 In the preparation of Flint's balance sheet as of December 31, 2018, what should be reported as total intangible assets? $82,000 b. a. $87,000 $95,000 d. $110,000 C. 30. Which of the following statements concerning internally developed goodwill is true? a. it is a separately identifiable asset b. it is capitalized at its cost intod with its development are expensed as incurred reliable

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter12: Intangibles

Section: Chapter Questions

Problem 7P: Hamilton Companys balance sheet on January 1, 2019, was as follows: Korbel Company is considering...

Related questions

Question

100%

please answer question 29

Transcribed Image Text:riger Lakes

Parent Network

CLASSIC ICHERRY

29. Fünt Corporation's general ledger as of December 31, 2018, includes the following accounts

Corporation (start-up) costs

$ 5,000

8,000

15,000

Deposits with advertising agency (will be used to promote goodwill)

Discounts on bonds payable

Excess of purchase price over fair value of the identifiable

net assets of acquired company

Trademarks

70,000

12,000

In the preparation of Flint's balance sheet as of December 31, 2018, what should be reported as total intangible

assets?

$82,000

b.

a.

$87,000

$95,000

d. $110,000

C.

30. Which of the following statements concerning internally developed goodwill is true?

a. it is a separately identifiable asset

b. it is capitalized at its cost

intod with its development are expensed as incurred

reliable

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning