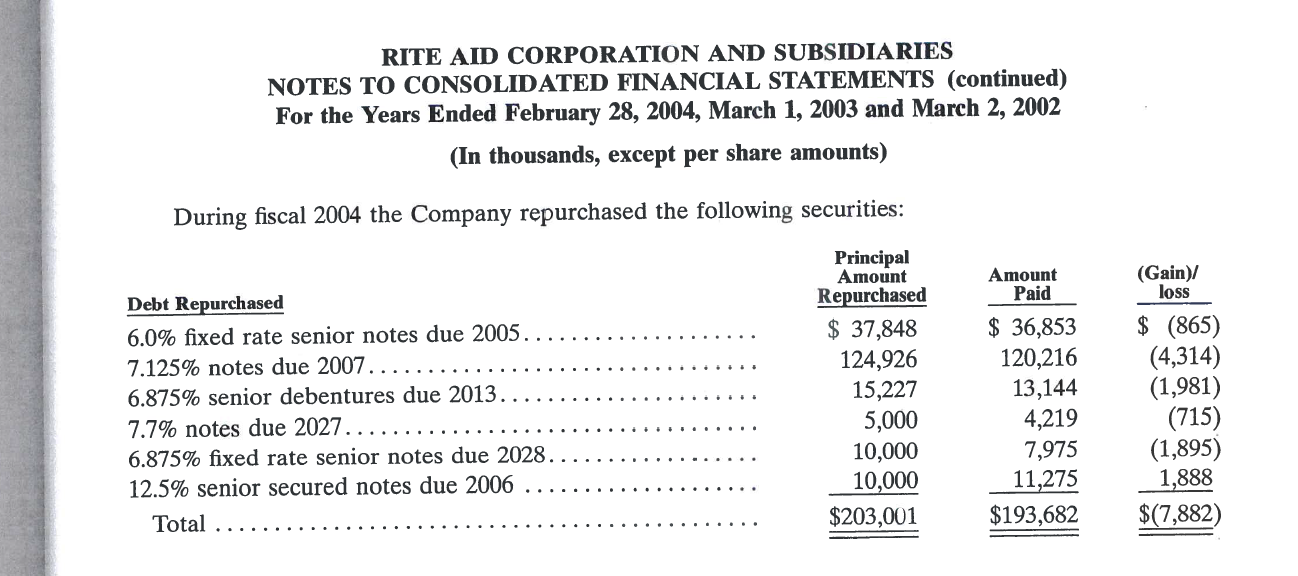

RITE AID CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) For the Years Ended February 28, 2004, March 1, 2003 and March 2, 2002 (In thousands, except per share amounts) During fiscal 2004 the Company repurchased the following securities: Principal Amount (Gain)/ loss Amount Paid Repurchased Debt Repurchased (865) (4,314) (1,981) (715) (1,895) 1,888 $(7,882) $ 36,853 120,216 13,144 4,219 7,975 11,275 37,848 124,926 15,227 6.0% fixed rate senior notes due 2005 7.125% notes due 2007... 6.875% senior debentures due 2013.. 5,000 10,000 10,000 7.7% notes due 2027..... 6.875% fixed rate senior notes due 2028 12.5% senior secured notes due 2006 $193,682 $203,001 Total

RITE AID CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued) For the Years Ended February 28, 2004, March 1, 2003 and March 2, 2002 (In thousands, except per share amounts) During fiscal 2004 the Company repurchased the following securities: Principal Amount (Gain)/ loss Amount Paid Repurchased Debt Repurchased (865) (4,314) (1,981) (715) (1,895) 1,888 $(7,882) $ 36,853 120,216 13,144 4,219 7,975 11,275 37,848 124,926 15,227 6.0% fixed rate senior notes due 2005 7.125% notes due 2007... 6.875% senior debentures due 2013.. 5,000 10,000 10,000 7.7% notes due 2027..... 6.875% fixed rate senior notes due 2028 12.5% senior secured notes due 2006 $193,682 $203,001 Total

Chapter20: Corporations: Distributions In Complete Liquidation And An Overview Of Reorganizations

Section: Chapter Questions

Problem 1BCRQ

Related questions

Question

| Note 10 reports that Rite Aid engaged in some open-market debt transactions during year ended February 28, 2004. |

| Prepare the |

Transcribed Image Text:RITE AID CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

For the Years Ended February 28, 2004, March 1, 2003 and March 2, 2002

(In thousands, except per share amounts)

During fiscal 2004 the Company repurchased the following securities:

Principal

Amount

(Gain)/

loss

Amount

Paid

Repurchased

Debt Repurchased

(865)

(4,314)

(1,981)

(715)

(1,895)

1,888

$(7,882)

$ 36,853

120,216

13,144

4,219

7,975

11,275

37,848

124,926

15,227

6.0% fixed rate senior notes due 2005

7.125% notes due 2007...

6.875% senior debentures due 2013..

5,000

10,000

10,000

7.7% notes due 2027.....

6.875% fixed rate senior notes due 2028

12.5% senior secured notes due 2006

$193,682

$203,001

Total

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you