Road Kings 2014 Year Year Year Year Year Year Year Year Year Year Year Year Year Year 1 4 Z 10 11 12 13 OPERATING SUMMARY Price per bus 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 Units sold 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 Revenues 1,747.625,000 1,747.625.000 1,747.625.000 1.747.625.000 1,747.625.000 1,747.625,000 1,747.625.000 1,747.625,000 1,747.625.000 1,747,625.000 1.747.625.000 1,747.625,000 Labor per unit Parts per unit engine Detroit Sales/Administration per year Bus Warranty per unit Engine Warranty per unit Depreciation 52,000 52,000 52,000 52,000 52,000 52,000 52.000 52,000 52,000 52,000 52,000 52,000 52,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94.000 94,000 20,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 250,000,000 250.000.000 250,000,000 250,000,000 250,000,000 250,000.000 250,000,000 250,000,000 250,000,000 250,000,000 250,000,000 250,000,000 250,000,000 0 0 0 0 4.776 1,100 1,100 1,100 1,100 1,100 0 0 0 6.512 1,000 1,000 1,000 1000 1,000 1.000 1.000 1,000 1,000 1.000 1,000 1,000 300,000,000 480.000,000 600.000,000 60,000,000 60.000,000 120,000,000 180,000,000 240,000,000 360,000,000 420,000,000 540,000,000 660,000,000 720,000,000 ЕBIT (5000) 1,282,476,900 1,222,476,900 1,162,476,900 1,102,476,900 1,042,476,900 769,486,140 512.990.760 60,000,000 982.478,000 589,486,800 862,478,000 517,486,800 344,991,200 480,000,000 742,478,000 682,478,000 622,478,000 373,486,800 922,478,000 802,478,000 Taxes 40 % 60% 733.486,140 697,486,140 661.486,140 625,486,140 553,486.800 481,486,800 445.486,800 409.486,800 NOPAT (S000) 296,991,200 272,991,200 660,000,000 488,990,760 464,990,760 440,990,760 1,042,476.900 240.000,000 392,991,200 368,991,200 320,991,200 248,991,200 Add back depreciation Operating Cash Flow ($000) 120,000,000 608,990,760 360,000,000 540.000,000 180,000,000 300,000,000 420,000,000 600,000,000 720,000,000 644,990,760 572.990.760 680,990,760 1,342.476,900 752,991,200 788,991,200 824,991,200 860,991,200 896,991,200 932,991,200 968,991,200 INVESTMENT SUUMMARY Property Plant and Equipment Working Capital 8% of Sales 5,000,000 400,000,000 320,000,000 SALVAGE SUMMARY Property Less: Clean up costs 5,000,000 300,000 Plant & Equipment Gross Salvage Value 720.000.000 15,000,000 Less: Taxes 40% 600,000 Net Salvage Value ($000) Incremental Cash Flow T-note market premiumbeta Bus Warranty 5 yrs Marcus Warranty 5 Detroit Warranty 1,100 1,500 4,776 CAPM 5.40% 3.00% 5.0% 1.20 18,000 24,513 24,342 1,000 20,000 debt 4.90 % r debt 1 minus tax equity r equity ighted Average Cost of Capital 40.00% 28.00% 72%2 5.40% Net Present Value Internal Rate of Return

Road Kings 2014 Year Year Year Year Year Year Year Year Year Year Year Year Year Year 1 4 Z 10 11 12 13 OPERATING SUMMARY Price per bus 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 225,500 Units sold 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 7,750 Revenues 1,747.625,000 1,747.625.000 1,747.625.000 1.747.625.000 1,747.625.000 1,747.625,000 1,747.625.000 1,747.625,000 1,747.625.000 1,747,625.000 1.747.625.000 1,747.625,000 Labor per unit Parts per unit engine Detroit Sales/Administration per year Bus Warranty per unit Engine Warranty per unit Depreciation 52,000 52,000 52,000 52,000 52,000 52,000 52.000 52,000 52,000 52,000 52,000 52,000 52,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94,000 94.000 94,000 20,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 155,000,000 250,000,000 250.000.000 250,000,000 250,000,000 250,000,000 250,000.000 250,000,000 250,000,000 250,000,000 250,000,000 250,000,000 250,000,000 250,000,000 0 0 0 0 4.776 1,100 1,100 1,100 1,100 1,100 0 0 0 6.512 1,000 1,000 1,000 1000 1,000 1.000 1.000 1,000 1,000 1.000 1,000 1,000 300,000,000 480.000,000 600.000,000 60,000,000 60.000,000 120,000,000 180,000,000 240,000,000 360,000,000 420,000,000 540,000,000 660,000,000 720,000,000 ЕBIT (5000) 1,282,476,900 1,222,476,900 1,162,476,900 1,102,476,900 1,042,476,900 769,486,140 512.990.760 60,000,000 982.478,000 589,486,800 862,478,000 517,486,800 344,991,200 480,000,000 742,478,000 682,478,000 622,478,000 373,486,800 922,478,000 802,478,000 Taxes 40 % 60% 733.486,140 697,486,140 661.486,140 625,486,140 553,486.800 481,486,800 445.486,800 409.486,800 NOPAT (S000) 296,991,200 272,991,200 660,000,000 488,990,760 464,990,760 440,990,760 1,042,476.900 240.000,000 392,991,200 368,991,200 320,991,200 248,991,200 Add back depreciation Operating Cash Flow ($000) 120,000,000 608,990,760 360,000,000 540.000,000 180,000,000 300,000,000 420,000,000 600,000,000 720,000,000 644,990,760 572.990.760 680,990,760 1,342.476,900 752,991,200 788,991,200 824,991,200 860,991,200 896,991,200 932,991,200 968,991,200 INVESTMENT SUUMMARY Property Plant and Equipment Working Capital 8% of Sales 5,000,000 400,000,000 320,000,000 SALVAGE SUMMARY Property Less: Clean up costs 5,000,000 300,000 Plant & Equipment Gross Salvage Value 720.000.000 15,000,000 Less: Taxes 40% 600,000 Net Salvage Value ($000) Incremental Cash Flow T-note market premiumbeta Bus Warranty 5 yrs Marcus Warranty 5 Detroit Warranty 1,100 1,500 4,776 CAPM 5.40% 3.00% 5.0% 1.20 18,000 24,513 24,342 1,000 20,000 debt 4.90 % r debt 1 minus tax equity r equity ighted Average Cost of Capital 40.00% 28.00% 72%2 5.40% Net Present Value Internal Rate of Return

Chapter5: Operating Activities: Purchases And Cash Payments

Section: Chapter Questions

Problem 4.6C

Related questions

Question

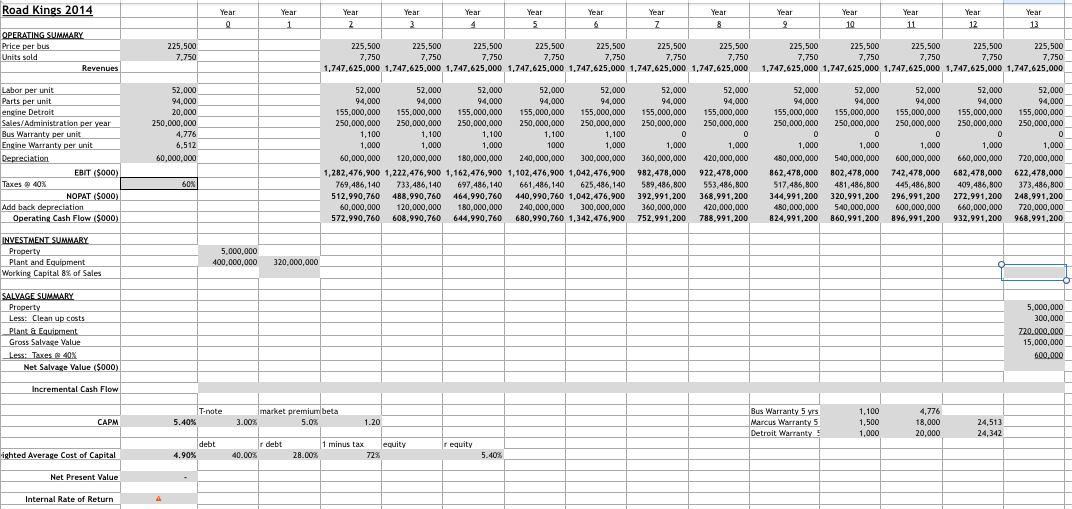

The company will have to allocate funds to net working capital (NWC) for parts inventories equivalent to 8% of annual sales, spent in year 1 and sold off in last year at the end of the project.

Determine the amount of NWC that will be allocated

Transcribed Image Text:Road Kings 2014

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

Year

1

4

Z

10

11

12

13

OPERATING SUMMARY

Price per bus

225,500

225,500

225,500

225,500

225,500

225,500

225,500

225,500

225,500

225,500

225,500

225,500

225,500

Units sold

7,750

7,750

7,750

7,750

7,750

7,750

7,750

7,750

7,750

7,750

7,750

7,750

7,750

Revenues

1,747.625,000 1,747.625.000 1,747.625.000 1.747.625.000 1,747.625.000 1,747.625,000 1,747.625.000

1,747.625,000 1,747.625.000 1,747,625.000 1.747.625.000 1,747.625,000

Labor per unit

Parts per unit

engine Detroit

Sales/Administration per year

Bus Warranty per unit

Engine Warranty per unit

Depreciation

52,000

52,000

52,000

52,000

52,000

52,000

52.000

52,000

52,000

52,000

52,000

52,000

52,000

94,000

94,000

94,000

94,000

94,000

94,000

94,000

94,000

94,000

94,000

94,000

94.000

94,000

20,000

155,000,000

155,000,000

155,000,000

155,000,000

155,000,000

155,000,000

155,000,000

155,000,000

155,000,000

155,000,000

155,000,000

155,000,000

250,000,000

250.000.000

250,000,000

250,000,000

250,000,000

250,000.000

250,000,000

250,000,000

250,000,000

250,000,000

250,000,000

250,000,000

250,000,000

0

0

0

0

4.776

1,100

1,100

1,100

1,100

1,100

0

0

0

6.512

1,000

1,000

1,000

1000

1,000

1.000

1.000

1,000

1,000

1.000

1,000

1,000

300,000,000

480.000,000

600.000,000

60,000,000

60.000,000

120,000,000

180,000,000

240,000,000

360,000,000

420,000,000

540,000,000

660,000,000

720,000,000

ЕBIT (5000)

1,282,476,900 1,222,476,900 1,162,476,900 1,102,476,900 1,042,476,900

769,486,140

512.990.760

60,000,000

982.478,000

589,486,800

862,478,000

517,486,800

344,991,200

480,000,000

742,478,000

682,478,000

622,478,000

373,486,800

922,478,000

802,478,000

Taxes 40 %

60%

733.486,140

697,486,140

661.486,140

625,486,140

553,486.800

481,486,800

445.486,800

409.486,800

NOPAT (S000)

296,991,200

272,991,200

660,000,000

488,990,760

464,990,760

440,990,760 1,042,476.900

240.000,000

392,991,200

368,991,200

320,991,200

248,991,200

Add back depreciation

Operating Cash Flow ($000)

120,000,000

608,990,760

360,000,000

540.000,000

180,000,000

300,000,000

420,000,000

600,000,000

720,000,000

644,990,760

572.990.760

680,990,760 1,342.476,900

752,991,200

788,991,200

824,991,200 860,991,200

896,991,200

932,991,200

968,991,200

INVESTMENT SUUMMARY

Property

Plant and Equipment

Working Capital 8% of Sales

5,000,000

400,000,000

320,000,000

SALVAGE SUMMARY

Property

Less: Clean up costs

5,000,000

300,000

Plant & Equipment

Gross Salvage Value

720.000.000

15,000,000

Less: Taxes 40%

600,000

Net Salvage Value ($000)

Incremental Cash Flow

T-note

market premiumbeta

Bus Warranty 5 yrs

Marcus Warranty 5

Detroit Warranty

1,100

1,500

4,776

CAPM

5.40%

3.00%

5.0%

1.20

18,000

24,513

24,342

1,000

20,000

debt

4.90 %

r debt

1 minus tax

equity

r equity

ighted Average Cost of Capital

40.00%

28.00%

72%2

5.40%

Net Present Value

Internal Rate of Return

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,