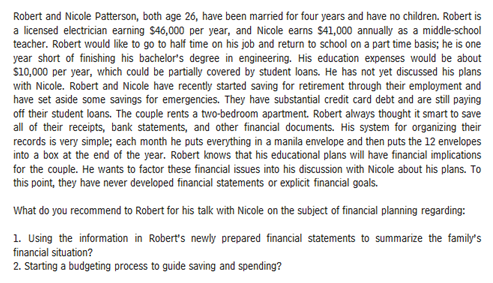

Robert and Nicole Patterson, both age 26, have been married for four years and have no children. Robert is a licensed electrician earning $46,000 per year, and Nicole earns $41,000 annually as a middle-school teacher. Robert would like to go to half time on his job and return to school on a part time basis; he is one year short of finishing his bachelor's degree in engineering. His education expenses would be about $10,000 per year, which could be partially covered by student loans. He has not yet discussed his plans with Nicole. Robert and Nicole have recently started saving for retirement through their employment and have set aside some savings for emergencies. They have substantial credit card debt and are still paying off their student loans. The couple rents a two-bedroom apartment. Robert always thought it smart to save all of their receipts, bank statements, and other financial documents. His system for organizing their records is very simple; each month he puts everything in a manila envelope and then puts the 12 envelopes into a box at the end of the year. Robert knows that his educational plans will have financial implications for the couple. He wants to factor these financial issues into his discussion with Nicole about his plans. To this point, they have never developed financial statements or explicit financial goals. What do you recommend to Robert for his talk with Nicole on the subject of financial planning regarding: 1. Using the information in Robert's newly prepared financial statements to summarize the family's financial situation? 2. Starting a budgeting process to guide saving and spending?

Robert and Nicole Patterson, both age 26, have been married for four years and have no children. Robert is a licensed electrician earning $46,000 per year, and Nicole earns $41,000 annually as a middle-school teacher. Robert would like to go to half time on his job and return to school on a part time basis; he is one year short of finishing his bachelor's degree in engineering. His education expenses would be about $10,000 per year, which could be partially covered by student loans. He has not yet discussed his plans with Nicole. Robert and Nicole have recently started saving for retirement through their employment and have set aside some savings for emergencies. They have substantial credit card debt and are still paying off their student loans. The couple rents a two-bedroom apartment. Robert always thought it smart to save all of their receipts, bank statements, and other financial documents. His system for organizing their records is very simple; each month he puts everything in a manila envelope and then puts the 12 envelopes into a box at the end of the year. Robert knows that his educational plans will have financial implications for the couple. He wants to factor these financial issues into his discussion with Nicole about his plans. To this point, they have never developed financial statements or explicit financial goals. What do you recommend to Robert for his talk with Nicole on the subject of financial planning regarding: 1. Using the information in Robert's newly prepared financial statements to summarize the family's financial situation? 2. Starting a budgeting process to guide saving and spending?

Chapter8: Taxation Of Individuals

Section: Chapter Questions

Problem 79TPC

Related questions

Question

Transcribed Image Text:Robert and Nicole Patterson, both age 26, have been married for four years and have no children. Robert is

a licensed electrician earning $46,000 per year, and Nicole earns $41,000 annually as a middle-school

teacher. Robert would like to go to half time on his job and return to school on a part time basis; he is one

year short of finishing his bachelor's degree in engineering. His education expenses would be about

s10,000 per year, which could be partially covered by student loans. He has not yet discussed his plans

with Nicole. Robert and Nicole have recently started saving for retirement through their employment and

have set aside some savings for emergencies. They have substantial credit card debt and are still paying

off their student loans. The couple rents a two-bedroom apartment. Robert always thought it smart to save

all of their receipts, bank statements, and other financial documents. His system for organizing their

records is very simple; each month he puts everything in a manila envelope and then puts the 12 envelopes

into a box at the end of the year. Robert knows that his educational plans will have financial implications

for the couple. He wants to factor these financial issues into his discussion with Nicole about his plans. To

this point, they have never developed financial statements or explicit financial goals.

What do you recommend to Robert for his talk with Nicole on the subject of financial planning regarding:

1. Using the information in Robert's newly prepared financial statements to summarize the family's

financial situation?

2. Starting a budgeting process to guide saving and spending?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT