Safe Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. On December 31, Safe Home has collected $700 from cash-paying customers. Safe Home’s remaining customers owe the business $1,900. What is the accrual basis?

Safe Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. On December 31, Safe Home has collected $700 from cash-paying customers. Safe Home’s remaining customers owe the business $1,900. What is the accrual basis?

Chapter3: Income Sources

Section: Chapter Questions

Problem 79P

Related questions

Topic Video

Question

Safe Home provides house-sitting for people while they are away on vacation. Some of its customers pay immediately after the job is finished. Some customers ask that the business send them a bill. On December 31, Safe Home has collected $700 from cash-paying customers. Safe Home’s remaining customers owe the business $1,900. What is the accrual basis?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

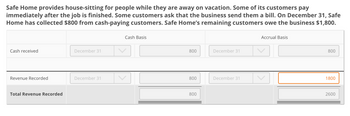

Transcribed Image Text:Safe Home provides house-sitting for people while they are away on vacation. Some of its customers pay

immediately after the job is finished. Some customers ask that the business send them a bill. On December 31, Safe

Home has collected $800 from cash-paying customers. Safe Home's remaining customers owe the business $1,800.

Cash received

Revenue Recorded

Total Revenue Recorded

December 31

December 31

Cash Basis

800

800

800

December 31

December 31

Accrual Basis

800

1800

2600

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning