Salem Company has outstanding $100 million of 7% bonds, due in 7 years, and callable at 104. The bonds were issued at par and are selling today at a market price of 94.

Salem Company has outstanding $100 million of 7% bonds, due in 7 years, and callable at 104. The bonds were issued at par and are selling today at a market price of 94.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

ChapterD: Investments

Section: Chapter Questions

Problem D.1EX

Related questions

Question

100%

Transcribed Image Text:Question 1 - Ch 10 QUIZ - Connect

tion.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewcon... A 13 * @

1

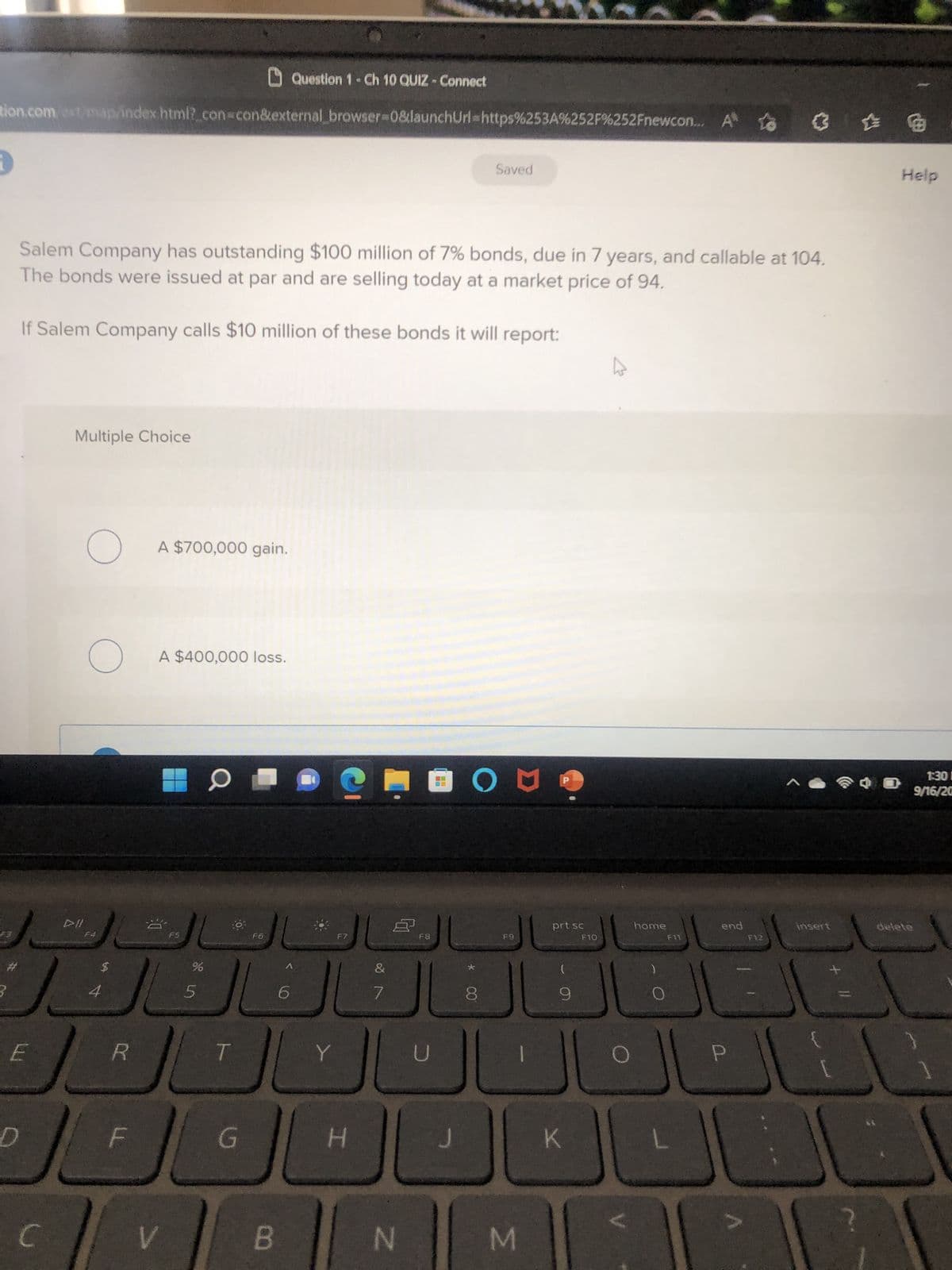

Salem Company has outstanding $100 million of 7% bonds, due in 7 years, and callable at 104.

The bonds were issued at par and are selling today at a market price of 94.

If Salem Company calls $10 million of these bonds it will report:

E

D

Multiple Choice

C

Dll

O

O

F4

A $700,000 gain.

F

A $400,000 loss.

***

%

V

5

O

O

R

JBOL

F6

G

6

B

Y

CHOON

F7

H

&

7

N

F8

Saved

U

8

F9

M

prt sc

9

K

F10

home

0

F11

L

end

P

F32

insert

L

B

Help

1:30

9/16/20

Transcribed Image Text:n.com/ext/map/index.html?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewcon...

(>))

F3

3

E

D

O

C

O

O

DII

F4

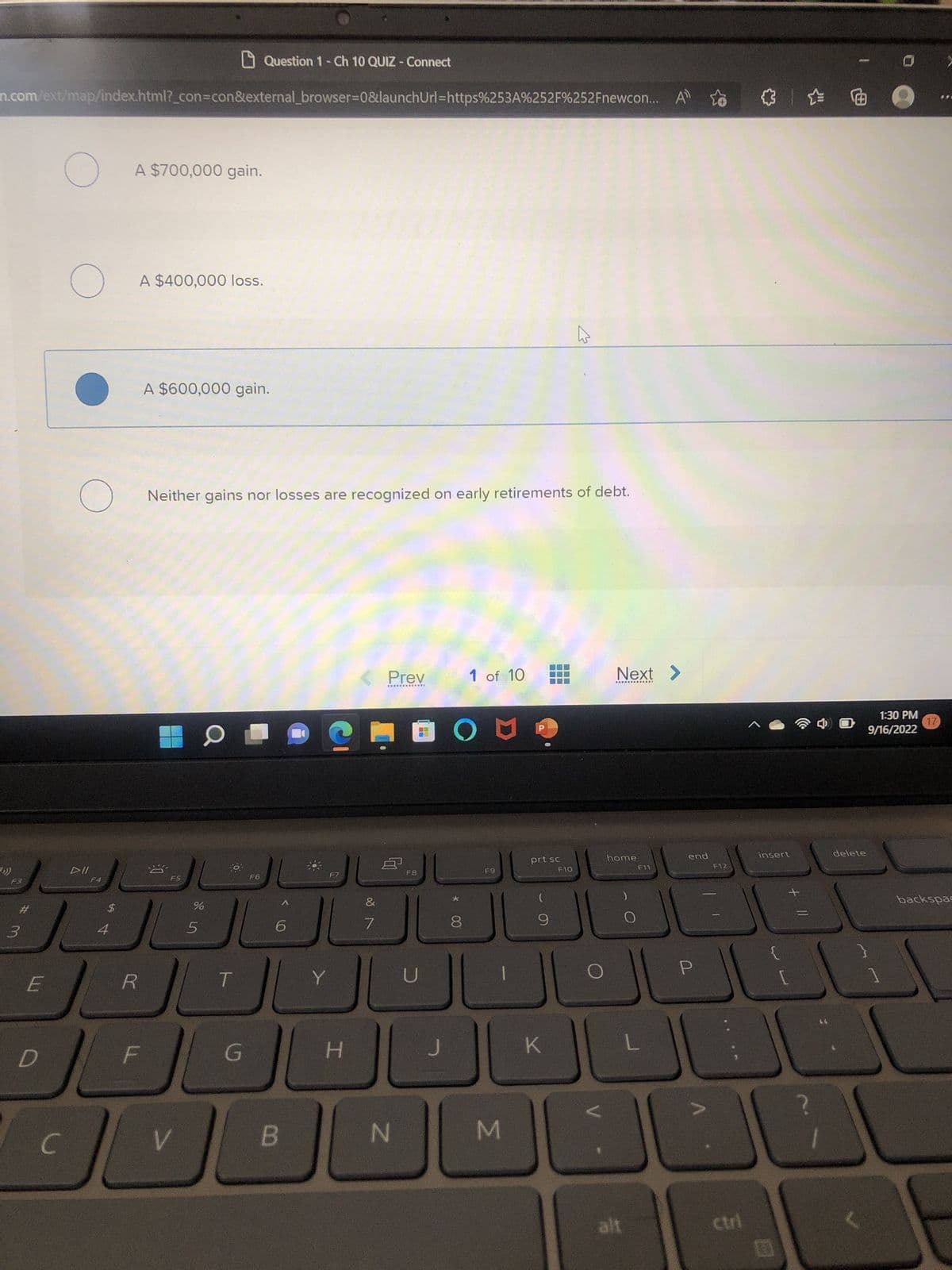

A $700,000 gain.

$

A $400,000 loss.

R

A $600,000 gain.

F

Neither gains nor losses are recognized on early retirements of debt.

F5

%

JAGGE

5

JU

O

V

Question 1 - Ch 10 QUIZ - Connect

OF

F6

G

6

B

F7

CHOON

H

Prev

7

N

F8

U

*

00

1 of 10

8

F9

M

prt sc

9

K

F10

Next >

home

alt

F11

L

end

P

F12

右面

ctri

insert

[

JU

+ 11

delete

1:30 PM

9/16/2022

17

>

backspac

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning