Sales (in pounds) Production (in pounds) Selling Price per pound Potato Chips Byproduct 34,960 $26 46,000 8,200 5,000 There were no beginning inventories on September 1, 2017. Required 1. What is the gross margin for Crispy, Inc., under the production method and the sales method of byproduct accounting? 2. What are the inventory costs reported in the balance sheet on September 30, 2017, for the main product and byproduct under the two methods of byproduct accounting in requirement 1? 3. Prepare the journal entries to record the byproduct activities under (a) the production method and (b) the sales method. Briefly discuss the effects on the financial statements.

Sales (in pounds) Production (in pounds) Selling Price per pound Potato Chips Byproduct 34,960 $26 46,000 8,200 5,000 There were no beginning inventories on September 1, 2017. Required 1. What is the gross margin for Crispy, Inc., under the production method and the sales method of byproduct accounting? 2. What are the inventory costs reported in the balance sheet on September 30, 2017, for the main product and byproduct under the two methods of byproduct accounting in requirement 1? 3. Prepare the journal entries to record the byproduct activities under (a) the production method and (b) the sales method. Briefly discuss the effects on the financial statements.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter5: The Income Statement And The Statement Of Cash Flows

Section: Chapter Questions

Problem 2MC: The following information is available for Cooke Company for the current year: The gross margin is...

Related questions

Question

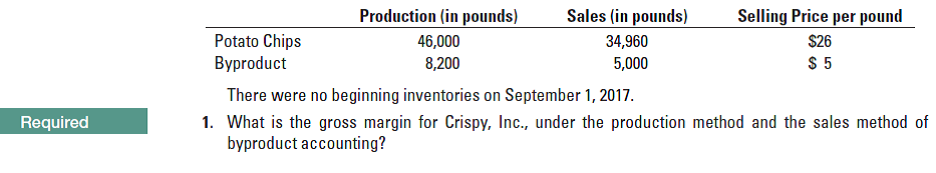

Accounting for a main product and a byproduct (Cheatham and green, adapted)Crispy,Inc., is a producer of potato chips. A single production process at crispy, Inc., yields potato chips as the main product, as well as byproduct that can be sold as a snack. Both products are fully processed by the splitoff point, and there are no separable costs.

For September 2017, the cost of operations is $520,000. Production and sales data are as follows:

Transcribed Image Text:Sales (in pounds)

Production (in pounds)

Selling Price per pound

Potato Chips

Byproduct

34,960

$26

46,000

8,200

5,000

There were no beginning inventories on September 1, 2017.

Required

1. What is the gross margin for Crispy, Inc., under the production method and the sales method of

byproduct accounting?

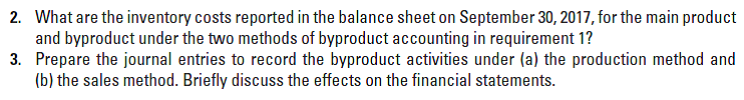

Transcribed Image Text:2. What are the inventory costs reported in the balance sheet on September 30, 2017, for the main product

and byproduct under the two methods of byproduct accounting in requirement 1?

3. Prepare the journal entries to record the byproduct activities under (a) the production method and

(b) the sales method. Briefly discuss the effects on the financial statements.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 7 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning