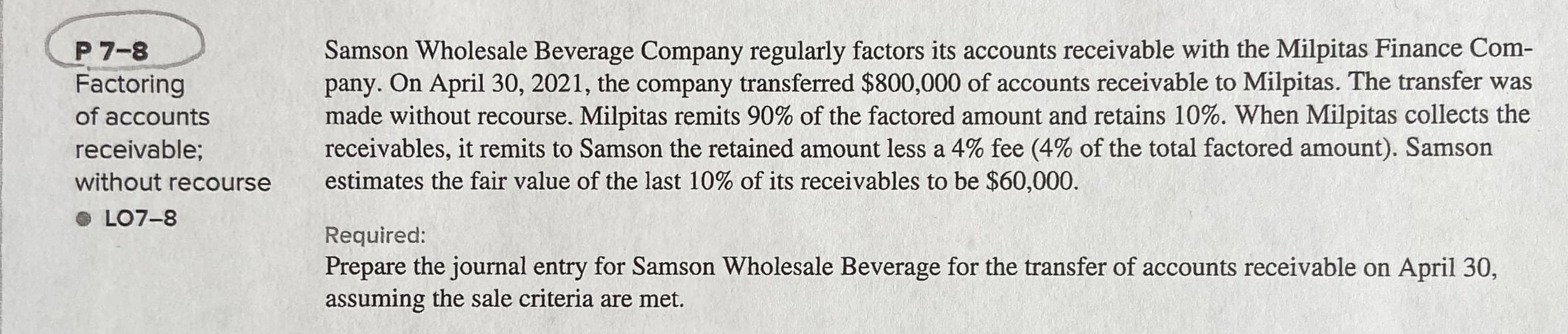

Samson Wholesale Beverage Company regularly factors its accounts receivable with the Milpitas Finance Com- pany. On April 30, 2021, the company transferred $800,000 of accounts receivable to Milpitas. The transfer was made without recourse. Milpitas remits 90% of the factored amount and retains 10%. When Milpitas collects the receivables, it remits to Samson the retained amount less a 4% fee (4% of the total factored amount). Samson estimates the fair value of the last 10% of its receivables to be $60,000. P 7-8 Factoring of accounts receivable; without recourse • LO7-8 Required: Prepare the journal entry for Samson Wholesale Beverage for the transfer of accounts receivable on April 30, assuming the sale criteria are met.

Samson Wholesale Beverage Company regularly factors its accounts receivable with the Milpitas Finance Com- pany. On April 30, 2021, the company transferred $800,000 of accounts receivable to Milpitas. The transfer was made without recourse. Milpitas remits 90% of the factored amount and retains 10%. When Milpitas collects the receivables, it remits to Samson the retained amount less a 4% fee (4% of the total factored amount). Samson estimates the fair value of the last 10% of its receivables to be $60,000. P 7-8 Factoring of accounts receivable; without recourse • LO7-8 Required: Prepare the journal entry for Samson Wholesale Beverage for the transfer of accounts receivable on April 30, assuming the sale criteria are met.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter6: Cash And Receivables

Section: Chapter Questions

Problem 12E: Inferring Accounts Receivable Amounts At the end of 2019, Karras Inc. had a debit balance of 141,120...

Related questions

Question

Transcribed Image Text:Samson Wholesale Beverage Company regularly factors its accounts receivable with the Milpitas Finance Com-

pany. On April 30, 2021, the company transferred $800,000 of accounts receivable to Milpitas. The transfer was

made without recourse. Milpitas remits 90% of the factored amount and retains 10%. When Milpitas collects the

receivables, it remits to Samson the retained amount less a 4% fee (4% of the total factored amount). Samson

estimates the fair value of the last 10% of its receivables to be $60,000.

P 7-8

Factoring

of accounts

receivable;

without recourse

• LO7-8

Required:

Prepare the journal entry for Samson Wholesale Beverage for the transfer of accounts receivable on April 30,

assuming the sale criteria are met.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT