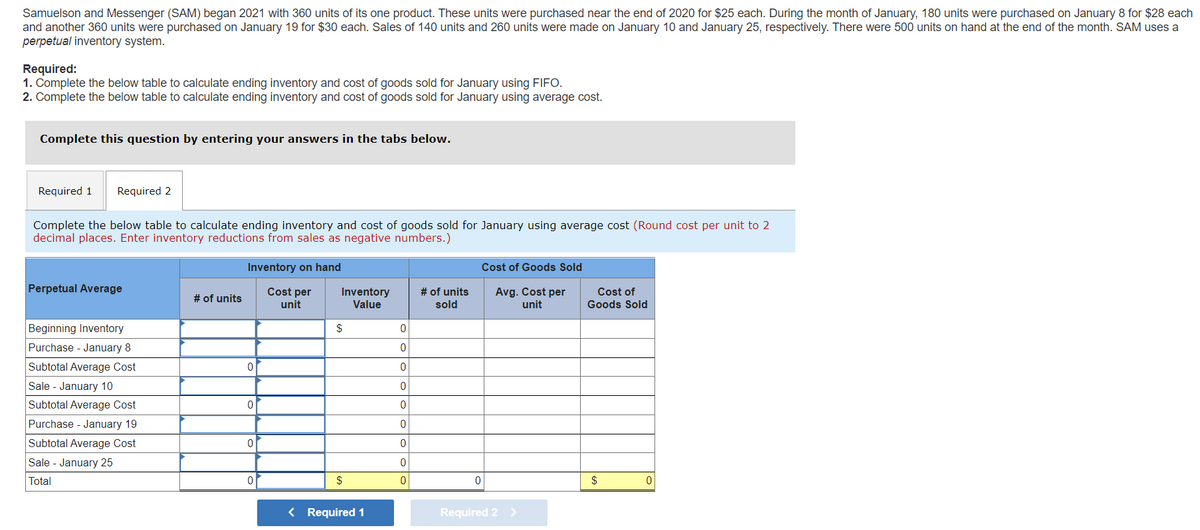

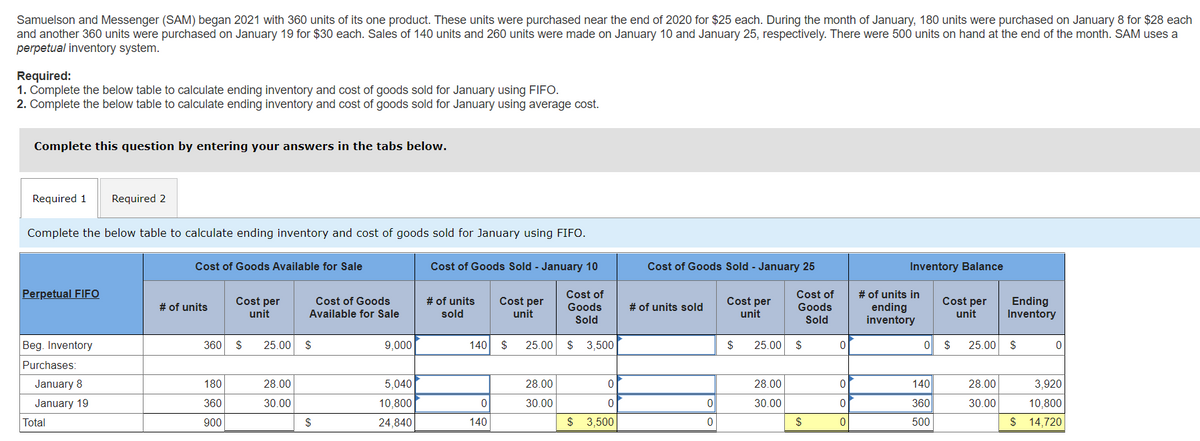

Samuelson and Messenger (SAM) began 2021 with 360 units of its one product. These units were purchased near the end of 2020 for $25 each. During the month of January, 180 units were purchased on January 8 for $28 each and another 360 units were purchased on January 19 for $30 each. Sales of 140 units and 260 units were made on January 10 and January 25, respectively. There were 500 units on hand at the end of the month. SAM uses a perpetual inventory system. Required: 1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. 2. Complete the below table t calculate ending inventory and cost of goods sold for January using average cost. Complete this question by entering your answers in the tabs below.

Samuelson and Messenger (SAM) began 2021 with 360 units of its one product. These units were purchased near the end of 2020 for $25 each. During the month of January, 180 units were purchased on January 8 for $28 each and another 360 units were purchased on January 19 for $30 each. Sales of 140 units and 260 units were made on January 10 and January 25, respectively. There were 500 units on hand at the end of the month. SAM uses a perpetual inventory system. Required: 1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO. 2. Complete the below table t calculate ending inventory and cost of goods sold for January using average cost. Complete this question by entering your answers in the tabs below.

Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Don R. Hansen, Maryanne M. Mowen

Chapter20: Inventory Management: Economic Order Quantity, Jit, And The Theory Of Constraints

Section: Chapter Questions

Problem 7E: Ottis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The...

Related questions

Question

Transcribed Image Text:Samuelson and Messenger (SAM) began 2021 with 360 units of its one product. These units were purchased near the end of 2020 for $25 each. During the month of January, 180 units were purchased on January 8 for $28 each

and another 360 units were purchased on January 19 for $30 each. Sales of 140 units and 260 units were made on January 10 and January 25, respectively. There were 500 units on hand at the end of the month. SAM uses a

perpetual inventory system.

Required:

1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO.

2. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Complete the below table to calculate ending inventory and cost of goods sold for January using average cost (Round cost per unit to 2

decimal places. Enter inventory reductions from sales as negative numbers.)

Perpetual Average

Beginning Inventory

Purchase - January 8

Subtotal Average Cost

Sale - January 10

Subtotal Average Cost

Purchase - January 19

Subtotal Average Cost

Sale - January 25

Total

# of units

Inventory on hand

Cost per

unit

0

0

0

0

Inventory

Value

$

$

< Required 1

0

0

0

0

0

0

0

0

0

# of units

sold

0

Cost of Goods Sold

Avg. Cost per

unit

Required 2 >

Cost of

Goods Sold

$

0

Transcribed Image Text:Samuelson and Messenger (SAM) began 2021 with 360 units of its one product. These units were purchased near the end of 2020 for $25 each. During the month of January, 180 units were purchased on January 8 for $28 each

and another 360 units were purchased on January 19 for $30 each. Sales of 140 units and 260 units were made on January 10 and January 25, respectively. There were 500 units on hand at the end of the month. SAM uses a

perpetual inventory system.

Required:

1. Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO.

2. Complete the below table to calculate ending inventory and cost of goods sold for January using average cost.

Complete this question by entering your answers in the tabs below.

Required 1 Required 2

Complete the below table to calculate ending inventory and cost of goods sold for January using FIFO.

Perpetual FIFO

Beg. Inventory

Purchases:

January 8

January 19

Total

Cost of Goods Available for Sale

# of units

Cost per

unit

360 S

180

360

900

Cost of Goods

Available for Sale

25.00 $

28.00

30.00

$

9,000

5,040

10,800

24,840

Cost of Goods Sold - January 10

Cost of

Goods

Sold

25.00 $ 3,500

# of units

sold

Cost per

unit

140 $

0

140

28.00

30.00

0

0

$3,500

Cost of Goods Sold - January 25

# of units sold

0

0

Cost per

unit

$

Cost of

Goods

Sold

25.00 $

28.00

30.00

$

0

0

0

0

Inventory Balance

# of units in

ending

inventory

Cost per

unit

140

360

500

0 $ 25.00 $

Ending

Inventory

28.00

30.00

$

0

3,920

10,800

14,720

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning