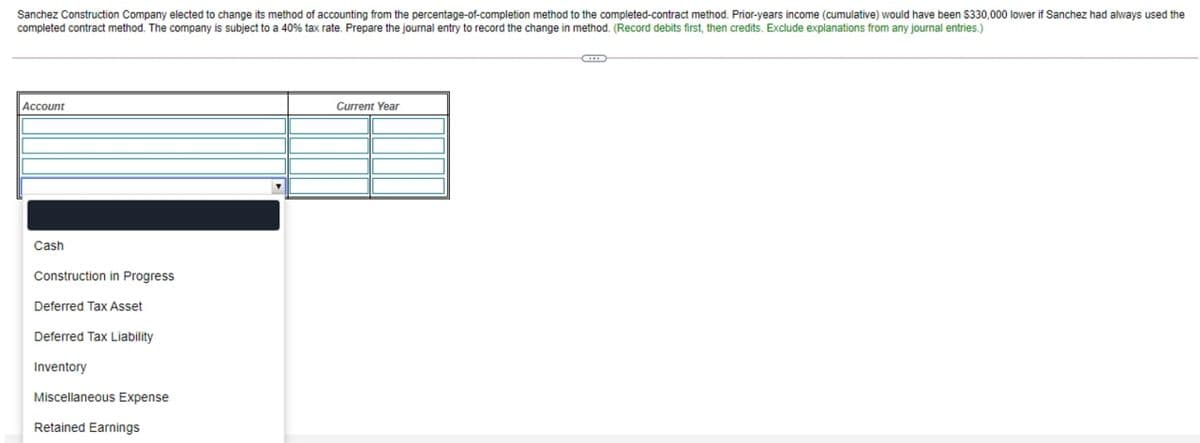

Sanchez Construction Company elected to change its method of accounting from the percentage-of-completion method to the completed-contract method. Prior-years income (cumulative) would have been S330,000 lower if Sanchez had always used the completed contract method. The company is subject to a 40% tax rate. Prepare the journal entry to record the change in method. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Current Year Cash Construction in Progress Deferred Tax Asset Deferred Tax Liability Inventory Miscellaneous Expense Retained Earnings

Sanchez Construction Company elected to change its method of accounting from the percentage-of-completion method to the completed-contract method. Prior-years income (cumulative) would have been S330,000 lower if Sanchez had always used the completed contract method. The company is subject to a 40% tax rate. Prepare the journal entry to record the change in method. (Record debits first, then credits. Exclude explanations from any journal entries.) Account Current Year Cash Construction in Progress Deferred Tax Asset Deferred Tax Liability Inventory Miscellaneous Expense Retained Earnings

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter18: Accounting For Income Taxes

Section: Chapter Questions

Problem 9MC: Brooks Company reported a prior period adjustment of 512,000 in pretax financial "income" and...

Related questions

Question

I need the answer as soon as possible

Transcribed Image Text:Sanchez Construction Company elected to change its method of accounting from the percentage-of-completion method to the completed-contract method. Prior-years income (cumulative) would have been $330,000 lower if Sanchez had always used the

completed contract method. The company is subject to a 40% tax rate. Prepare the journal entry to record the change in method. (Record debits first, then credits. Exclude explanations from any journal entries.)

Account

Current Year

Cash

Construction in Progress

Deferred Tax Asset

Deferred Tax Liability

Inventory

Miscellaneous Expense

Retained Earnings

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage