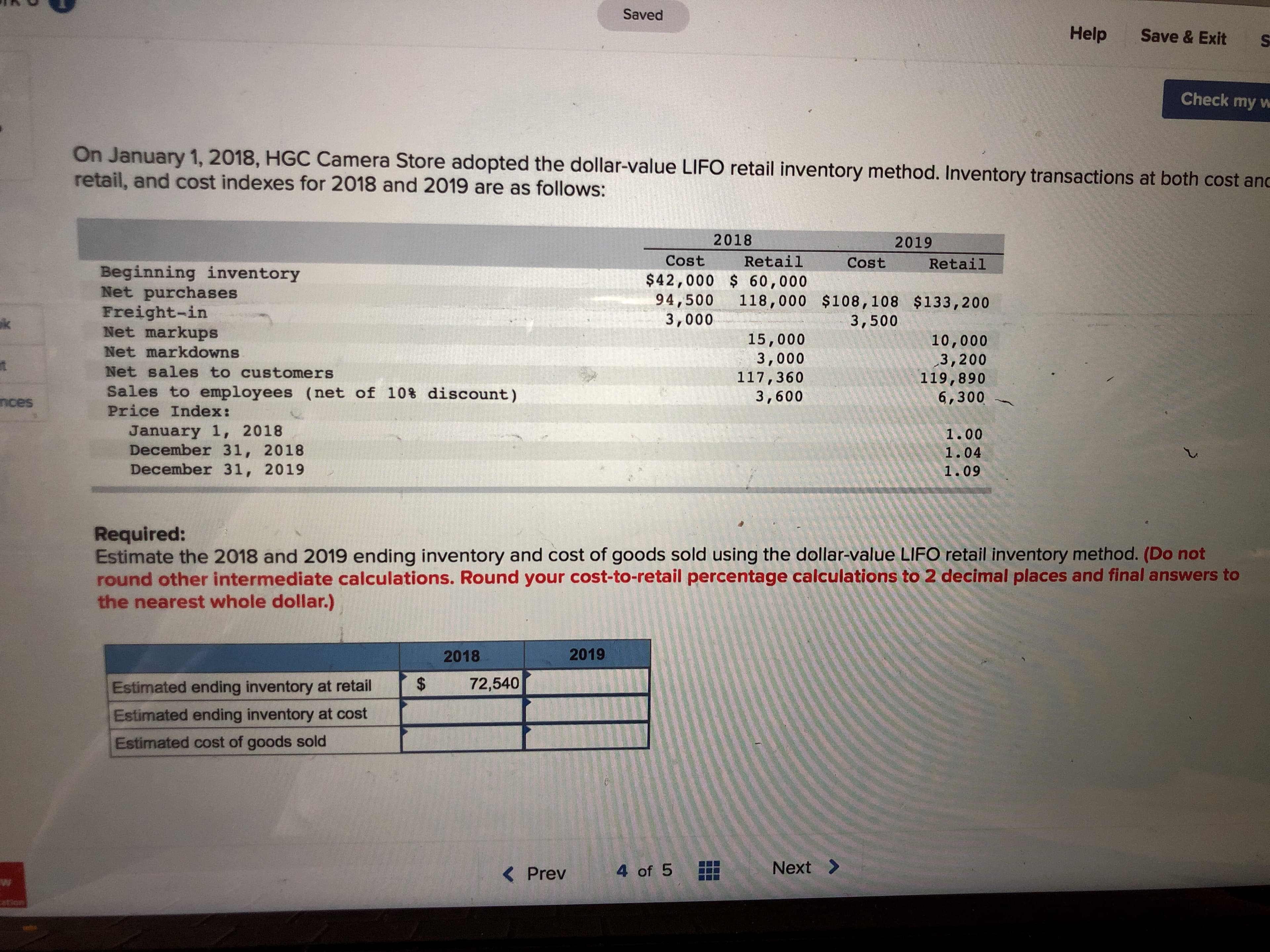

Saved Help Save & Exit S Check my w On January 1, 2018, HGC Camera Sto retail, and cost indexes for 2018 and 2019 are as follows re adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost an 2018 Cost Retail 2019 Cost Retail Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers sales to employees (net of 10% discount) Price Index: $42,000 60,000 94,500 118,000 $108,108 $133,200 3,000 3,500 15,000 3,000 117,360 3,600 10,000 3,200 119,890 6,300 nces January 1, 2018 December 31, 2018 December 31, 2019 1.00 1.04 1.09 Required: Estimate the 2018 and 2019 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. (Do not round other intermediate calculations. Round your cost-to-retail percentage calculations to 2 decimal places and final answers to the nearest whole dollar.) 2018 2019 Estimated ending inventory at retail72,540 Estimated ending inventory at cost Estimated cost of goods sold < Prev 4of 5 Next >

Saved Help Save & Exit S Check my w On January 1, 2018, HGC Camera Sto retail, and cost indexes for 2018 and 2019 are as follows re adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost an 2018 Cost Retail 2019 Cost Retail Beginning inventory Net purchases Freight-in Net markups Net markdowns Net sales to customers sales to employees (net of 10% discount) Price Index: $42,000 60,000 94,500 118,000 $108,108 $133,200 3,000 3,500 15,000 3,000 117,360 3,600 10,000 3,200 119,890 6,300 nces January 1, 2018 December 31, 2018 December 31, 2019 1.00 1.04 1.09 Required: Estimate the 2018 and 2019 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. (Do not round other intermediate calculations. Round your cost-to-retail percentage calculations to 2 decimal places and final answers to the nearest whole dollar.) 2018 2019 Estimated ending inventory at retail72,540 Estimated ending inventory at cost Estimated cost of goods sold < Prev 4of 5 Next >

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 50E: Inventory Costing Methods Crandall Distributors uses a perpetual inventory system and has the...

Related questions

Question

I computed 72,540 but is checked wrong why?

Transcribed Image Text:Saved

Help Save & Exit S

Check my w

On January 1, 2018, HGC Camera Sto

retail, and cost indexes for 2018 and 2019 are as follows

re adopted the dollar-value LIFO retail inventory method. Inventory transactions at both cost an

2018

Cost Retail

2019

Cost Retail

Beginning inventory

Net purchases

Freight-in

Net markups

Net markdowns

Net sales to customers

sales to employees (net of 10% discount)

Price Index:

$42,000 60,000

94,500 118,000 $108,108 $133,200

3,000

3,500

15,000

3,000

117,360

3,600

10,000

3,200

119,890

6,300

nces

January 1, 2018

December 31, 2018

December 31, 2019

1.00

1.04

1.09

Required:

Estimate the 2018 and 2019 ending inventory and cost of goods sold using the dollar-value LIFO retail inventory method. (Do not

round other intermediate calculations. Round your cost-to-retail percentage calculations to 2 decimal places and final answers to

the nearest whole dollar.)

2018

2019

Estimated ending inventory at retail72,540

Estimated ending inventory at cost

Estimated cost of goods sold

< Prev

4of 5

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,