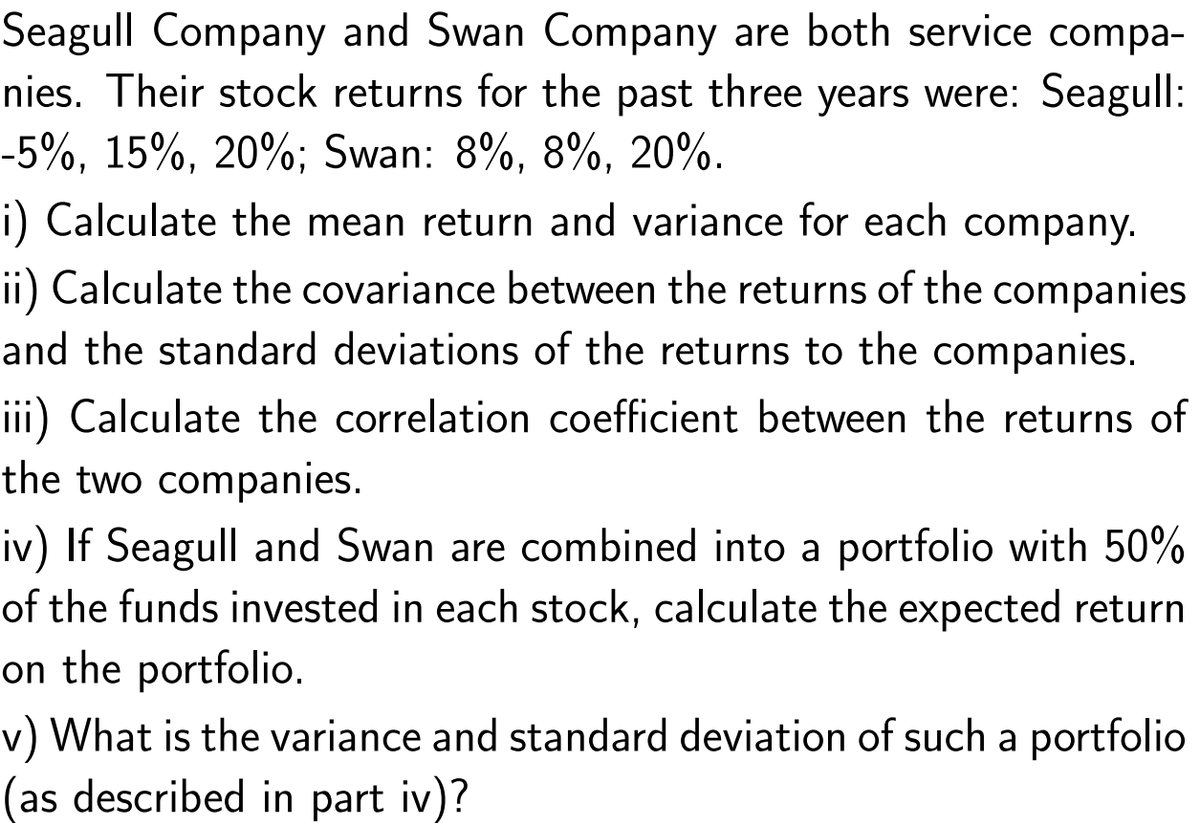

Seagull Company and Swan Company are both service compa- nies. Their stock returns for the past three years were: Seagull: -5%, 15%, 20%; Swan: 8%, 8%, 20%. i) Calculate the mean return and variance for each company. ii) Calculate the covariance between the returns of the companies and the standard deviations of the returns to the companies. iii) Calculate the correlation coefficient between the returns of the two companies. iv) If Seagull and Swan are combined into a portfolio with 50% of the funds invested in each stock, calculate the expected return on the portfolio. v) What is the variance and standard deviation of such a portfolio (as described in part iv)?

Seagull Company and Swan Company are both service compa- nies. Their stock returns for the past three years were: Seagull: -5%, 15%, 20%; Swan: 8%, 8%, 20%. i) Calculate the mean return and variance for each company. ii) Calculate the covariance between the returns of the companies and the standard deviations of the returns to the companies. iii) Calculate the correlation coefficient between the returns of the two companies. iv) If Seagull and Swan are combined into a portfolio with 50% of the funds invested in each stock, calculate the expected return on the portfolio. v) What is the variance and standard deviation of such a portfolio (as described in part iv)?

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

18th Edition

ISBN:9780079039897

Author:Carter

Publisher:Carter

Chapter10: Statistics

Section10.3: Measures Of Spread

Problem 1GP

Related questions

Question

Transcribed Image Text:Seagull Company and Swan Company are both service compa-

nies. Their stock returns for the past three years were: Seagull:

-5%, 15%, 20%; Swan: 8%, 8%, 20%.

i) Calculate the mean return and variance for each company.

ii) Calculate the covariance between the returns of the companies

and the standard deviations of the returns to the companies.

iii) Calculate the correlation coefficient between the returns of

the two companies.

iv) If Seagull and Swan are combined into a portfolio with 50%

of the funds invested in each stock, calculate the expected return

on the portfolio.

v) What is the variance and standard deviation of such a portfolio

(as described in part iv)?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, statistics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL

Glencoe Algebra 1, Student Edition, 9780079039897…

Algebra

ISBN:

9780079039897

Author:

Carter

Publisher:

McGraw Hill

Big Ideas Math A Bridge To Success Algebra 1: Stu…

Algebra

ISBN:

9781680331141

Author:

HOUGHTON MIFFLIN HARCOURT

Publisher:

Houghton Mifflin Harcourt

Holt Mcdougal Larson Pre-algebra: Student Edition…

Algebra

ISBN:

9780547587776

Author:

HOLT MCDOUGAL

Publisher:

HOLT MCDOUGAL