SECTION A: ANSWER ALL QUESTIONS 1. Financial intermediation is? A. Savers being matched with borrowers. B. A person with surplus giving money to a bank, who in turn lend it to a borrower. C. A process that is more effective than direct finance. D. All of the above.

SECTION A: ANSWER ALL QUESTIONS 1. Financial intermediation is? A. Savers being matched with borrowers. B. A person with surplus giving money to a bank, who in turn lend it to a borrower. C. A process that is more effective than direct finance. D. All of the above.

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter17: Financial Markets

Section: Chapter Questions

Problem 1SCQ: Answer these three questions about early-stage corporate finance: Why do very small companies tend...

Related questions

Question

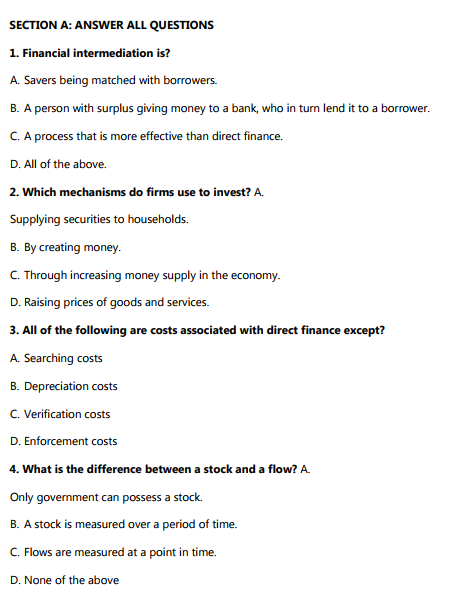

Transcribed Image Text:SECTION A: ANSWER ALL QUESTIONS

1. Financial intermediation is?

A. Savers being matched with borrowers.

B. A person with surplus giving money to a bank, who in turn lend it to a borrower.

C. A process that is more effective than direct finance.

D. All of the above.

2. Which mechanisms do firms use to invest? A.

Supplying securities to households.

B. By creating money.

C. Through increasing money supply in the economy.

D. Raising prices of goods and services.

3. All of the following are costs associated with direct finance except?

A. Searching costs

B. Depreciation costs

C. Verification costs

D. Enforcement costs

4. What is the difference between a stock and a flow? A.

Only government can possess a stock.

B. A stock is measured over a period of time.

C. Flows are measured at a point in time.

D. None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning