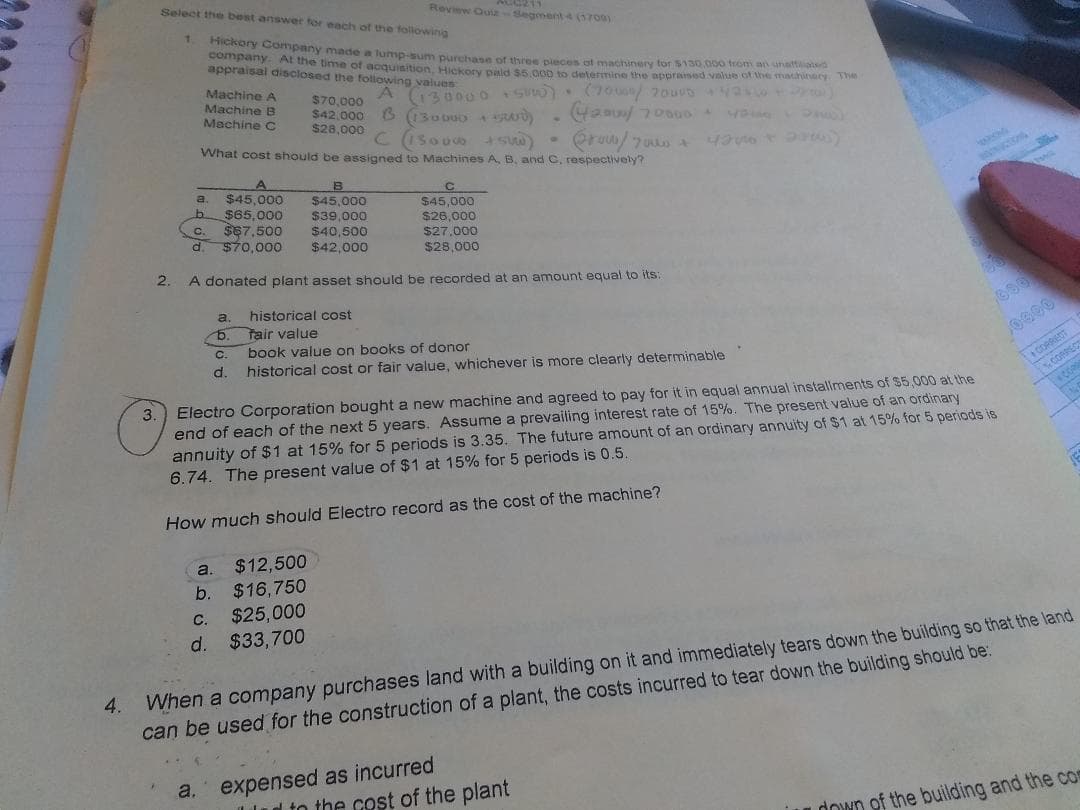

Select the best answer for each of the following Review Ouiz-Segment 4 (3700) 1 Hickory Company made a lump-sum purchase of three pieces ot machinery tor s130,000 from an unatttsd company. At the time of acquisition, Hickory paid $5,000 to determine the appraised value of the machinory The appraisal disclosed the following values Machine A Machine B Machine C A i30000 S & (130000 C isous S $70,000 $42,000 $28,000 0 20u va What cost should be assigned to Machines A, B, and C, respectively? 94ch A $45,000 $45,000 $45,000 b $65,000 $67,500 $70,000 $39,000 $26,000 $27,000 C. $40,500 $42,000 $28,000 2. A donated plant asset should be recorded at an amount equal to its: historical cost Tair value a. C. book value on books of donor CORRIES consicos d. historical cost or fair value, whichever is more clearly determinable a tnepent Electro Corporation bought a new machine and agreed to pay for it in equal annual installments of $5,000 at the 3. end of each of the next 5 years. Assume a prevailing interest rate of 15%. The present value of an ordinary annuity of $1 at 15% for 5 periods is 3.35. The future amount of an ordinary annuity of $1 at 15% for 5 periods is 6.74. The present value of $1 at 15% for 5 periods is 0.5 How much should Electro record as the cost of the machine? $12,500 $16,750 a. b. $25,000 $33,700 С. d. When a company purchases land with a building on it and immediately tears down the building so that the land can be used for the construction of a plant, the costs incurred to tear down the building should be 4. a. expensed as incurred d to the cost of the plant down of the building and the co

Select the best answer for each of the following Review Ouiz-Segment 4 (3700) 1 Hickory Company made a lump-sum purchase of three pieces ot machinery tor s130,000 from an unatttsd company. At the time of acquisition, Hickory paid $5,000 to determine the appraised value of the machinory The appraisal disclosed the following values Machine A Machine B Machine C A i30000 S & (130000 C isous S $70,000 $42,000 $28,000 0 20u va What cost should be assigned to Machines A, B, and C, respectively? 94ch A $45,000 $45,000 $45,000 b $65,000 $67,500 $70,000 $39,000 $26,000 $27,000 C. $40,500 $42,000 $28,000 2. A donated plant asset should be recorded at an amount equal to its: historical cost Tair value a. C. book value on books of donor CORRIES consicos d. historical cost or fair value, whichever is more clearly determinable a tnepent Electro Corporation bought a new machine and agreed to pay for it in equal annual installments of $5,000 at the 3. end of each of the next 5 years. Assume a prevailing interest rate of 15%. The present value of an ordinary annuity of $1 at 15% for 5 periods is 3.35. The future amount of an ordinary annuity of $1 at 15% for 5 periods is 6.74. The present value of $1 at 15% for 5 periods is 0.5 How much should Electro record as the cost of the machine? $12,500 $16,750 a. b. $25,000 $33,700 С. d. When a company purchases land with a building on it and immediately tears down the building so that the land can be used for the construction of a plant, the costs incurred to tear down the building should be 4. a. expensed as incurred d to the cost of the plant down of the building and the co

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter2: Asset And Liability Valuation And Income Recognition

Section: Chapter Questions

Problem 5QE

Related questions

Question

100%

please answer question 3

Transcribed Image Text:Select the best answer for each of the following

Review Ouiz-Segment 4 (3700)

1

Hickory Company made a lump-sum purchase of three pieces ot machinery tor s130,000 from an unatttsd

company. At the time of acquisition, Hickory paid $5,000 to determine the appraised value of the machinory The

appraisal disclosed the following values

Machine A

Machine B

Machine C

A

i30000 S

& (130000

C isous S

$70,000

$42,000

$28,000

0 20u va

What cost should be assigned to Machines A, B, and C, respectively?

94ch

A

$45,000

$45,000

$45,000

b

$65,000

$67,500

$70,000

$39,000

$26,000

$27,000

C.

$40,500

$42,000

$28,000

2.

A donated plant asset should be recorded at an amount equal to its:

historical cost

Tair value

a.

C.

book value on books of donor

CORRIES

consicos

d.

historical cost or fair value, whichever is more clearly determinable

a tnepent

Electro Corporation bought a new machine and agreed to pay for it in equal annual installments of $5,000 at the

3.

end of each of the next 5 years. Assume a prevailing interest rate of 15%. The present value of an ordinary

annuity of $1 at 15% for 5 periods is 3.35. The future amount of an ordinary annuity of $1 at 15% for 5 periods is

6.74. The present value of $1 at 15% for 5 periods is 0.5

How much should Electro record as the cost of the machine?

$12,500

$16,750

a.

b.

$25,000

$33,700

С.

d.

When a company purchases land with a building on it and immediately tears down the building so that the land

can be used for the construction of a plant, the costs incurred to tear down the building should be

4.

a. expensed as incurred

d to the cost of the plant

down of the building and the co

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning