Selected accounts of Farm Company are shown below as of January 31 of the current year, before any adjusting entries have been made. Farm Company's accounting year begins on January 1. 3. Debit Credit $12,600 Prepaid rent Supplies 9,900 Unearned service fees $18,000 Wages expense 24,000 Use the following information to prepare the necessary January 31 adjusting entries: (1) Prepaid rent represents rent for January, February, March, and April. (2) January 31 supplies on hand total $3,900. (3) Last month the firm received $18,000 of service fees in advance. One-half of these fees were earned during January. (4) Accrued wages not recorded at January 31 are $2,850. Selected accounts of Farm Company are shown below as of January 31 of the current year, before any adjusting entries have been made. Farm Company's accounting year begins on January 1. 3. Debit Credit $12,600 Prepaid rent Supplies 9,900 Unearned service fees $18,000 Wages expense 24,000 Use the following information to prepare the necessary January 31 adjusting entries: (1) Prepaid rent represents rent for January, February, March, and April. (2) January 31 supplies on hand total $3,900. (3) Last month the firm received $18,000 of service fees in advance. One-half of these fees were earned during January. (4) Accrued wages not recorded at January 31 are $2,850.

Selected accounts of Farm Company are shown below as of January 31 of the current year, before any adjusting entries have been made. Farm Company's accounting year begins on January 1. 3. Debit Credit $12,600 Prepaid rent Supplies 9,900 Unearned service fees $18,000 Wages expense 24,000 Use the following information to prepare the necessary January 31 adjusting entries: (1) Prepaid rent represents rent for January, February, March, and April. (2) January 31 supplies on hand total $3,900. (3) Last month the firm received $18,000 of service fees in advance. One-half of these fees were earned during January. (4) Accrued wages not recorded at January 31 are $2,850. Selected accounts of Farm Company are shown below as of January 31 of the current year, before any adjusting entries have been made. Farm Company's accounting year begins on January 1. 3. Debit Credit $12,600 Prepaid rent Supplies 9,900 Unearned service fees $18,000 Wages expense 24,000 Use the following information to prepare the necessary January 31 adjusting entries: (1) Prepaid rent represents rent for January, February, March, and April. (2) January 31 supplies on hand total $3,900. (3) Last month the firm received $18,000 of service fees in advance. One-half of these fees were earned during January. (4) Accrued wages not recorded at January 31 are $2,850.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 4PB: The following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal...

Related questions

Question

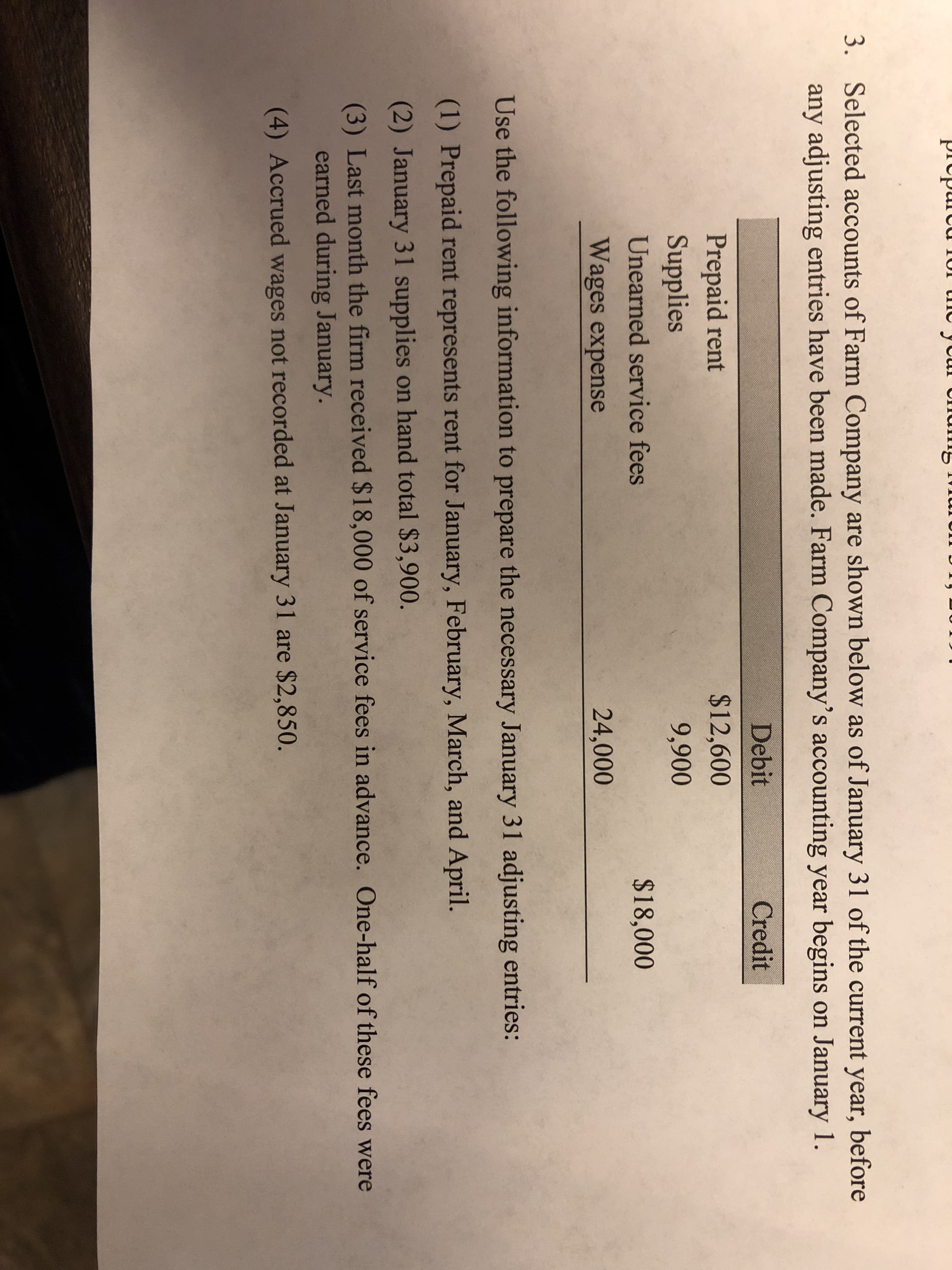

Transcribed Image Text:Selected accounts of Farm Company are shown below as of January 31 of the current year, before

any adjusting entries have been made. Farm Company's accounting year begins on January 1.

3.

Debit

Credit

$12,600

Prepaid rent

Supplies

9,900

Unearned service fees

$18,000

Wages expense

24,000

Use the following information to prepare the necessary January 31 adjusting entries:

(1) Prepaid rent represents rent for January, February, March, and April.

(2) January 31 supplies on hand total $3,900.

(3) Last month the firm received $18,000 of service fees in advance. One-half of these fees were

earned during January.

(4) Accrued wages not recorded at January 31 are $2,850.

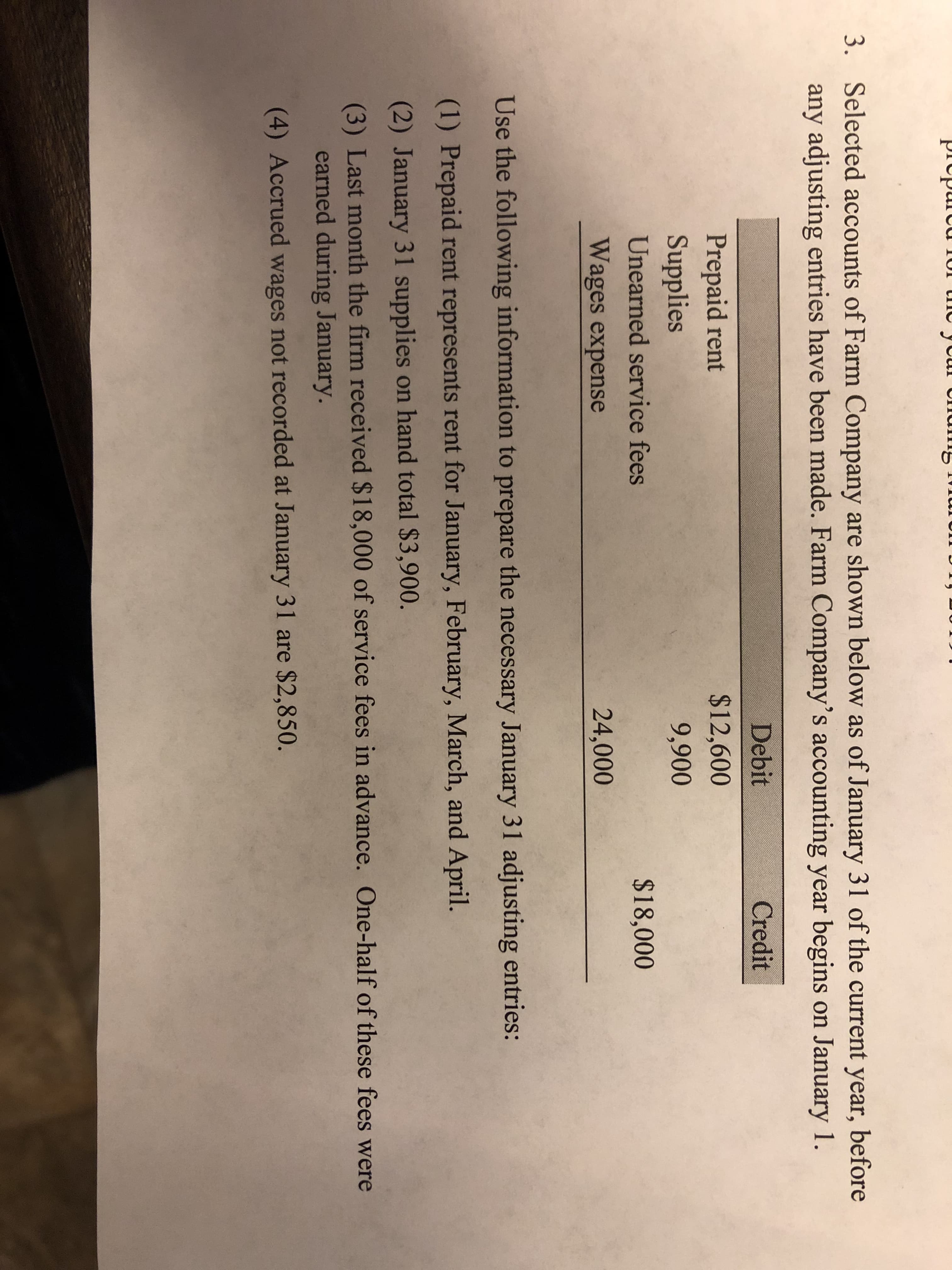

Transcribed Image Text:Selected accounts of Farm Company are shown below as of January 31 of the current year, before

any adjusting entries have been made. Farm Company's accounting year begins on January 1.

3.

Debit

Credit

$12,600

Prepaid rent

Supplies

9,900

Unearned service fees

$18,000

Wages expense

24,000

Use the following information to prepare the necessary January 31 adjusting entries:

(1) Prepaid rent represents rent for January, February, March, and April.

(2) January 31 supplies on hand total $3,900.

(3) Last month the firm received $18,000 of service fees in advance. One-half of these fees were

earned during January.

(4) Accrued wages not recorded at January 31 are $2,850.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:

9781337679503

Author:

Gilbertson

Publisher:

Cengage

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning