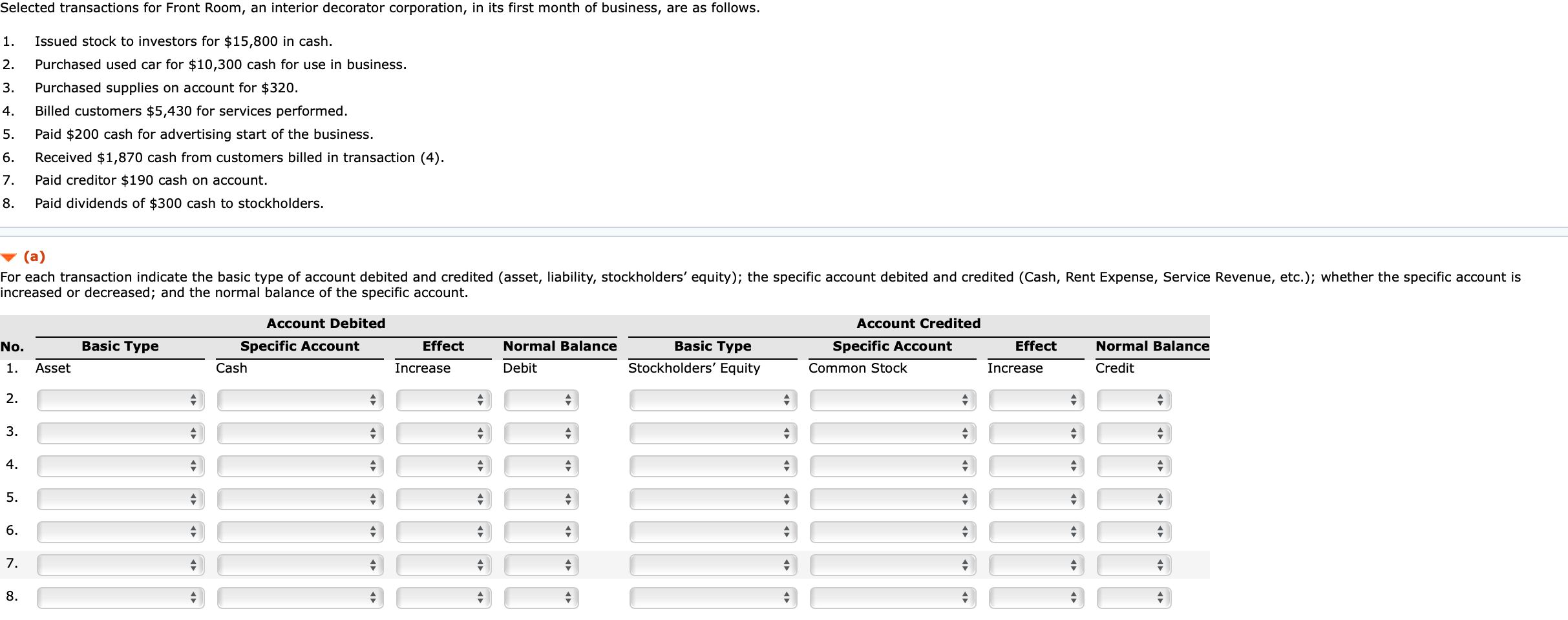

Selected transactions for Front Room, an interior decorator corporation, in its first month of business, are as follows. Issued stock to investors for $15,800 in cash. Purchased used car for $10,300 cash for use in business. Purchased supplies on account for $320. Billed customers $5,430 for services performed. Paid $200 cash for advertising start of the business. Received $1,870 cash from customers billed in transaction (4). Paid creditor $190 cash on account. Paid dividends of $300 cash to stockholders. 1. 2. 3. 4. 5. 6. 7. 8. (a) For each transaction indicate the basic type of account debited and credited (asset, liability, stockholders' equity); the specific account debited and credited (Cash, Rent Expense, Service Revenue, etc.); whether the specific account is increased or decreased; and the normal balance of the specific account. Account Debited Account Credited No. Basic Type Basic Type Specific Account Effect Normal Balance Specific Account Effect Normal Balance Stockholders' Equity Debit Credit 1. Asset Cash Increase Common Stock Increase 2. 4. 5. 6. 7. 8. 3. 5.

Selected transactions for Front Room, an interior decorator corporation, in its first month of business, are as follows. Issued stock to investors for $15,800 in cash. Purchased used car for $10,300 cash for use in business. Purchased supplies on account for $320. Billed customers $5,430 for services performed. Paid $200 cash for advertising start of the business. Received $1,870 cash from customers billed in transaction (4). Paid creditor $190 cash on account. Paid dividends of $300 cash to stockholders. 1. 2. 3. 4. 5. 6. 7. 8. (a) For each transaction indicate the basic type of account debited and credited (asset, liability, stockholders' equity); the specific account debited and credited (Cash, Rent Expense, Service Revenue, etc.); whether the specific account is increased or decreased; and the normal balance of the specific account. Account Debited Account Credited No. Basic Type Basic Type Specific Account Effect Normal Balance Specific Account Effect Normal Balance Stockholders' Equity Debit Credit 1. Asset Cash Increase Common Stock Increase 2. 4. 5. 6. 7. 8. 3. 5.

Excel Applications for Accounting Principles

4th Edition

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Gaylord N. Smith

Chapter1: Business Transactions (ptrans)

Section: Chapter Questions

Problem 2R: On June 1 of the current year, Wilson Wood opened Woodys Web Services. This sole proprietorship had...

Related questions

Question

Transcribed Image Text:Selected transactions for Front Room, an interior decorator corporation, in its first month of business, are as follows.

Issued stock to investors for $15,800 in cash.

Purchased used car for $10,300 cash for use in business.

Purchased supplies on account for $320.

Billed customers $5,430 for services performed.

Paid $200 cash for advertising start of the business.

Received $1,870 cash from customers billed in transaction (4).

Paid creditor $190 cash on account.

Paid dividends of $300 cash to stockholders.

1.

2.

3.

4.

5.

6.

7.

8.

(a)

For each transaction indicate the basic type of account debited and credited (asset, liability, stockholders' equity); the specific account debited and credited (Cash, Rent Expense, Service Revenue, etc.); whether the specific account is

increased or decreased; and the normal balance of the specific account.

Account Debited

Account Credited

No.

Basic Type

Basic Type

Specific Account

Effect

Normal Balance

Specific Account

Effect

Normal Balance

Stockholders' Equity

Debit

Credit

1.

Asset

Cash

Increase

Common Stock

Increase

2.

4.

5.

6.

7.

8.

3.

5.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Recommended textbooks for you

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781305084087

Author:

Cathy J. Scott

Publisher:

Cengage Learning