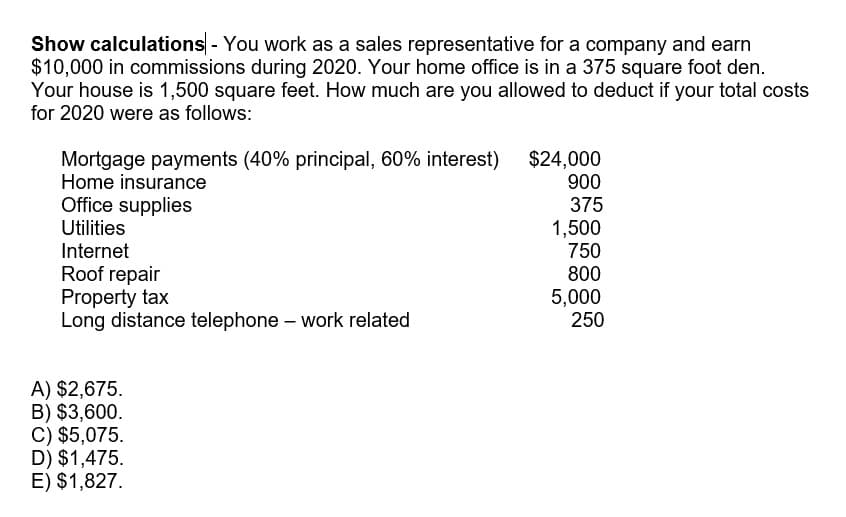

Show calculations - You work as a sales representative for a company and earn $10,000 in commissions during 2020. Your home office is in a 375 square foot den. Your house is 1,500 square feet. How much are you allowed to deduct if your total costs for 2020 were as follows: Mortgage payments (40% principal, 60% interest) Home insurance $24,000 900 375 Office supplies Utilities 1,500 750 Internet Roof repair Property tax Long distance telephone – work related 800 5,000 250

Show calculations - You work as a sales representative for a company and earn $10,000 in commissions during 2020. Your home office is in a 375 square foot den. Your house is 1,500 square feet. How much are you allowed to deduct if your total costs for 2020 were as follows: Mortgage payments (40% principal, 60% interest) Home insurance $24,000 900 375 Office supplies Utilities 1,500 750 Internet Roof repair Property tax Long distance telephone – work related 800 5,000 250

Chapter5: Introduction To Business Expenses

Section: Chapter Questions

Problem 63P

Related questions

Question

100%

Transcribed Image Text:Show calculations - You work as a sales representative for a company and earn

$10,000 in commissions during 2020. Your home office is in a 375 square foot den.

Your house is 1,500 square feet. How much are you allowed to deduct if your total costs

for 2020 were as follows:

$24,000

900

Mortgage payments (40% principal, 60% interest)

Home insurance

Office supplies

Utilities

Internet

Roof repair

Property tax

Long distance telephone – work related

375

1,500

750

800

5,000

250

A) $2,675.

B) $3,600.

C) $5,075.

D) $1,475.

E) $1,827.

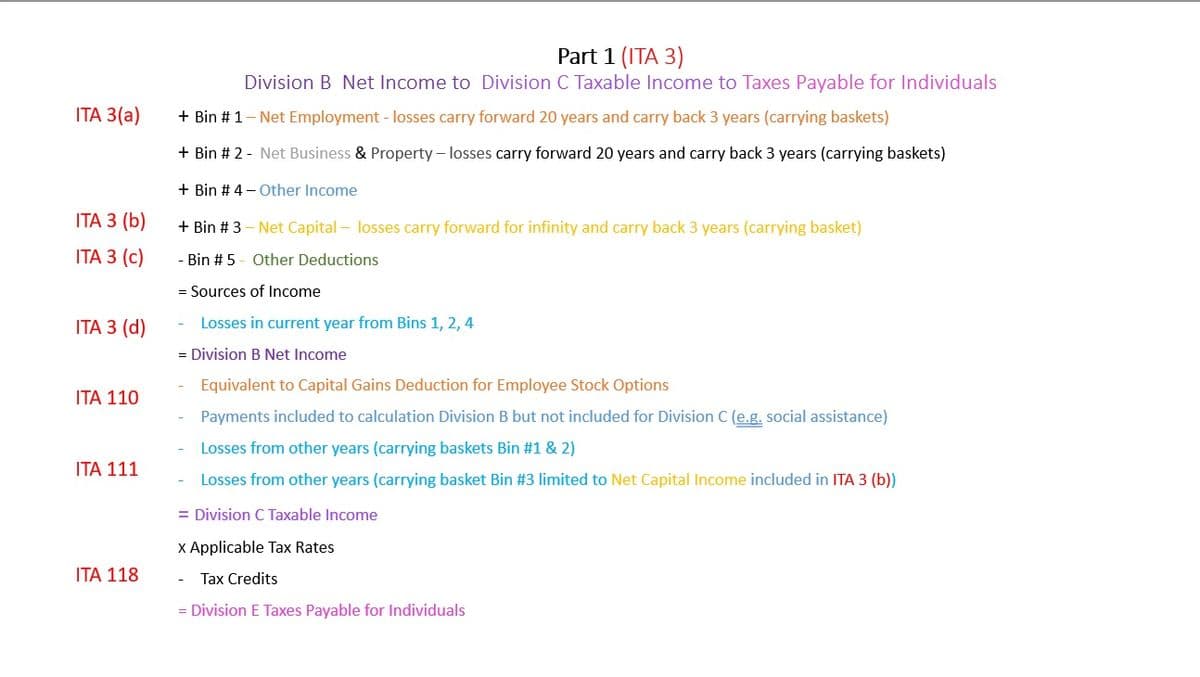

Transcribed Image Text:Part 1 (ITA 3)

Division B Net Income to Division C Taxable Income to Taxes Payable for Individuals

ITА 3(a)

+ Bin #1- Net Employment - losses carry forward 20 years and carry back 3 years (carrying baskets)

+ Bin # 2 - Net Business & Property – losses carry forward 20 years and carry back 3 years (carrying baskets)

+ Bin # 4 - Other Income

ITА 3 (b)

+ Bin # 3 – Net Capital – losses carry forward for infinity and carry back 3 years (carrying basket)

IТА З (c)

- Bin # 5 - Other Deductions

= Sources of Income

ITA 3 (d)

Losses in current year from Bins 1, 2, 4

= Division B Net Income

Equivalent to Capital Gains Deduction for Employee Stock Options

ITA 110

Payments included to calculation Division B but not included for Division C (e.g. social assistance)

- Losses from other years (carrying baskets Bin #1 & 2)

ITA 111

Losses from other years (carrying basket Bin #3 limited to Net Capital Income included in ITA 3 (b)

= Division C Taxable Income

x Applicable Tax Rates

ΙΤΑ 118

Tax Credits

= Division E Taxes Payable for Individuals

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College