show. Identify all of the possible tax implications of this giveaway and explain what you think the tax treatment is for each.

show. Identify all of the possible tax implications of this giveaway and explain what you think the tax treatment is for each.

Chapter10: Deductions And Losses: Certain Itemized Deductions

Section: Chapter Questions

Problem 32P

Related questions

Question

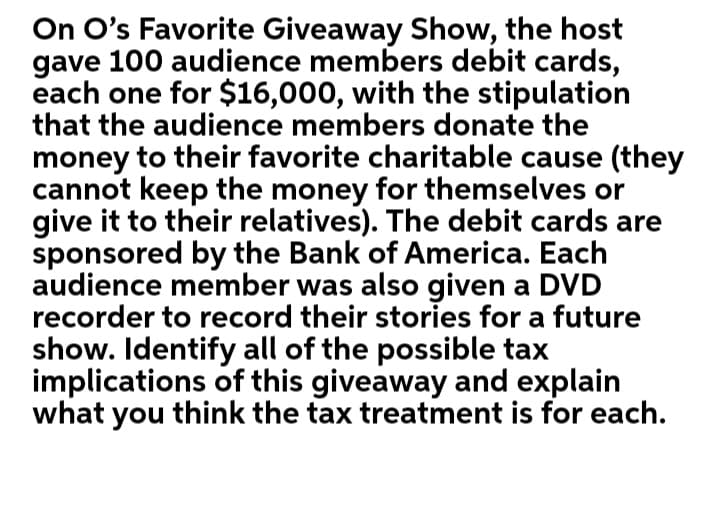

Transcribed Image Text:On O's Favorite Giveaway Show, the host

gave 100 audience members debit cards,

each one for $16,000, with the stipulation

that the audience members donate the

money to their favorite charitable cause (they

cannot keep the money for themselves or

give it to their relatives). The debit cards are

sponsored by the Bank of America. Each

audience member was also given a DVD

recorder to record their stories for a future

show. Identify all of the possible tax

implications of this giveaway and explain

what you think the tax treatment is for each.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT