Simon just turned 66 and is trying to decide whether to take his Social Security benefits today or to wait until he is 70. The risk-free rate of interest is 2%, and Simon anticipates that this rate will not change in the foreseeable future. If Simon decides to take his benefits at age 66 (his current age), he will get 12*$2,216 = $26,592 per year. If he waits 4 years, he will get $3,067 per month. 1) Simon estimates that he will die on his 85th birthday. Should he wait until 70 or take the Social Security now? Note: In doing this problem, assume that benefits are paid at the end of the year in which they are taken. Also assume that Simon will die exactly on his birthday. Your Retirement Benefit Estimate The amount you receive when you first start your benefits sets the base amount you will get for the rest of your life. You can get lower monthly payments for a longer period of time or higher monthly payments over a shorter period of Jime. Assuming you continue earning about the same amount, if you • wait to start your benefits at your full retirement age (66 Years and 00 Month(s) for you), your monthly benefit will be about..$2,216.00. • delay starting your benefits until age 70, your monthly benefit will be about.$3,067.00.

Simon just turned 66 and is trying to decide whether to take his Social Security benefits today or to wait until he is 70. The risk-free rate of interest is 2%, and Simon anticipates that this rate will not change in the foreseeable future. If Simon decides to take his benefits at age 66 (his current age), he will get 12*$2,216 = $26,592 per year. If he waits 4 years, he will get $3,067 per month. 1) Simon estimates that he will die on his 85th birthday. Should he wait until 70 or take the Social Security now? Note: In doing this problem, assume that benefits are paid at the end of the year in which they are taken. Also assume that Simon will die exactly on his birthday. Your Retirement Benefit Estimate The amount you receive when you first start your benefits sets the base amount you will get for the rest of your life. You can get lower monthly payments for a longer period of time or higher monthly payments over a shorter period of Jime. Assuming you continue earning about the same amount, if you • wait to start your benefits at your full retirement age (66 Years and 00 Month(s) for you), your monthly benefit will be about..$2,216.00. • delay starting your benefits until age 70, your monthly benefit will be about.$3,067.00.

Pfin (with Mindtap, 1 Term Printed Access Card) (mindtap Course List)

7th Edition

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Chapter14: Planning For Retirement

Section: Chapter Questions

Problem 2FPE

Related questions

Question

100%

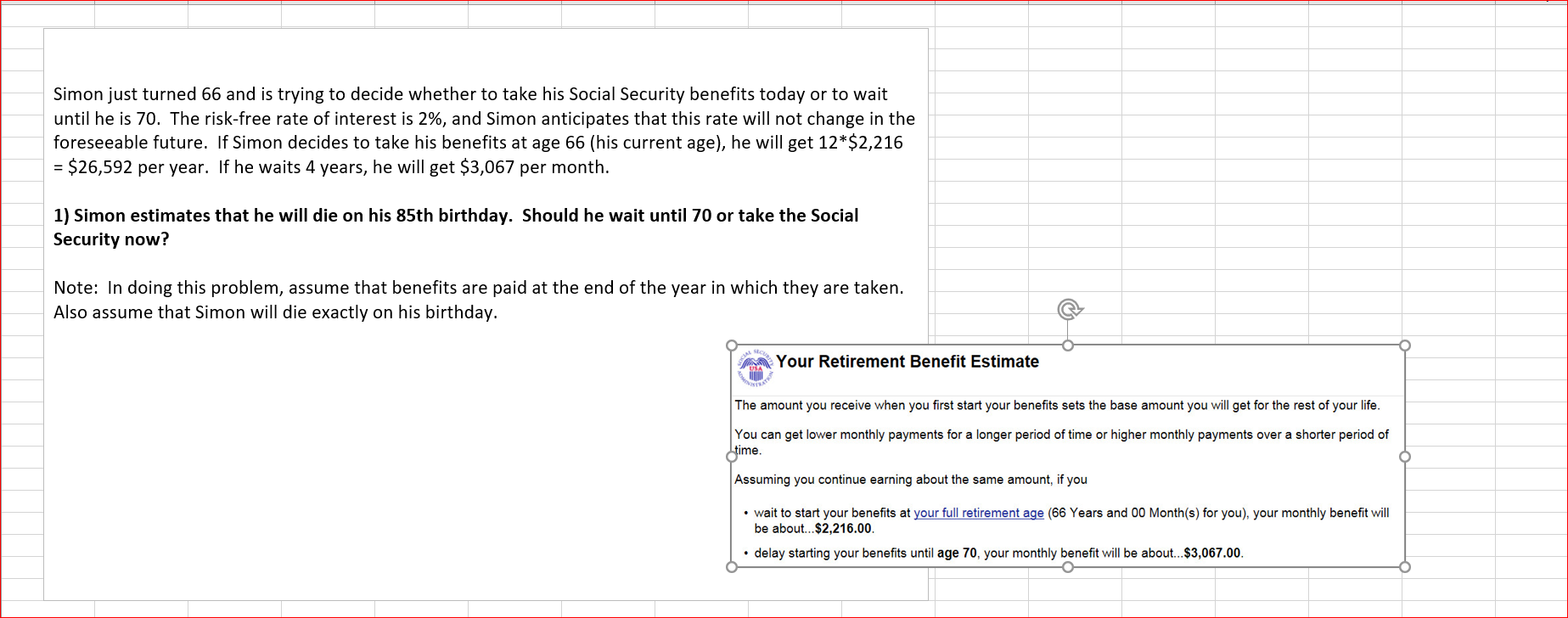

Transcribed Image Text:Simon just turned 66 and is trying to decide whether to take his Social Security benefits today or to wait

until he is 70. The risk-free rate of interest is 2%, and Simon anticipates that this rate will not change in the

foreseeable future. If Simon decides to take his benefits at age 66 (his current age), he will get 12*$2,216

= $26,592 per year. If he waits 4 years, he will get $3,067 per month.

1) Simon estimates that he will die on his 85th birthday. Should he wait until 70 or take the Social

Security now?

Note: In doing this problem, assume that benefits are paid at the end of the year in which they are taken.

Also assume that Simon will die exactly on his birthday.

Your Retirement Benefit Estimate

The amount you receive when you first start your benefits sets the base amount you will get for the rest of your life.

You can get lower monthly payments for a longer period of time or higher monthly payments over a shorter period of

Jime.

Assuming you continue earning about the same amount, if you

• wait to start your benefits at your full retirement age (66 Years and 00 Month(s) for you), your monthly benefit will

be about..$2,216.00.

• delay starting your benefits until age 70, your monthly benefit will be about.$3,067.00.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (…

Finance

ISBN:

9780357033609

Author:

Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning