Six Measures of Solvency or Profitability The following data were taken from the financial statements of Gates Inc. for the current fiscal year. Property, plant, and equipment (net) $1,725,000 Liabilities: Current liabilities $150,000 Note payable, 6%, due in 15 years 750,000 Total liabilities $900.000

Six Measures of Solvency or Profitability The following data were taken from the financial statements of Gates Inc. for the current fiscal year. Property, plant, and equipment (net) $1,725,000 Liabilities: Current liabilities $150,000 Note payable, 6%, due in 15 years 750,000 Total liabilities $900.000

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter9: Metric-analysis Of Financial Statements

Section: Chapter Questions

Problem 9.4.20P

Related questions

Question

Please answer all questions with explanations thx

Transcribed Image Text:еBook

Calculator

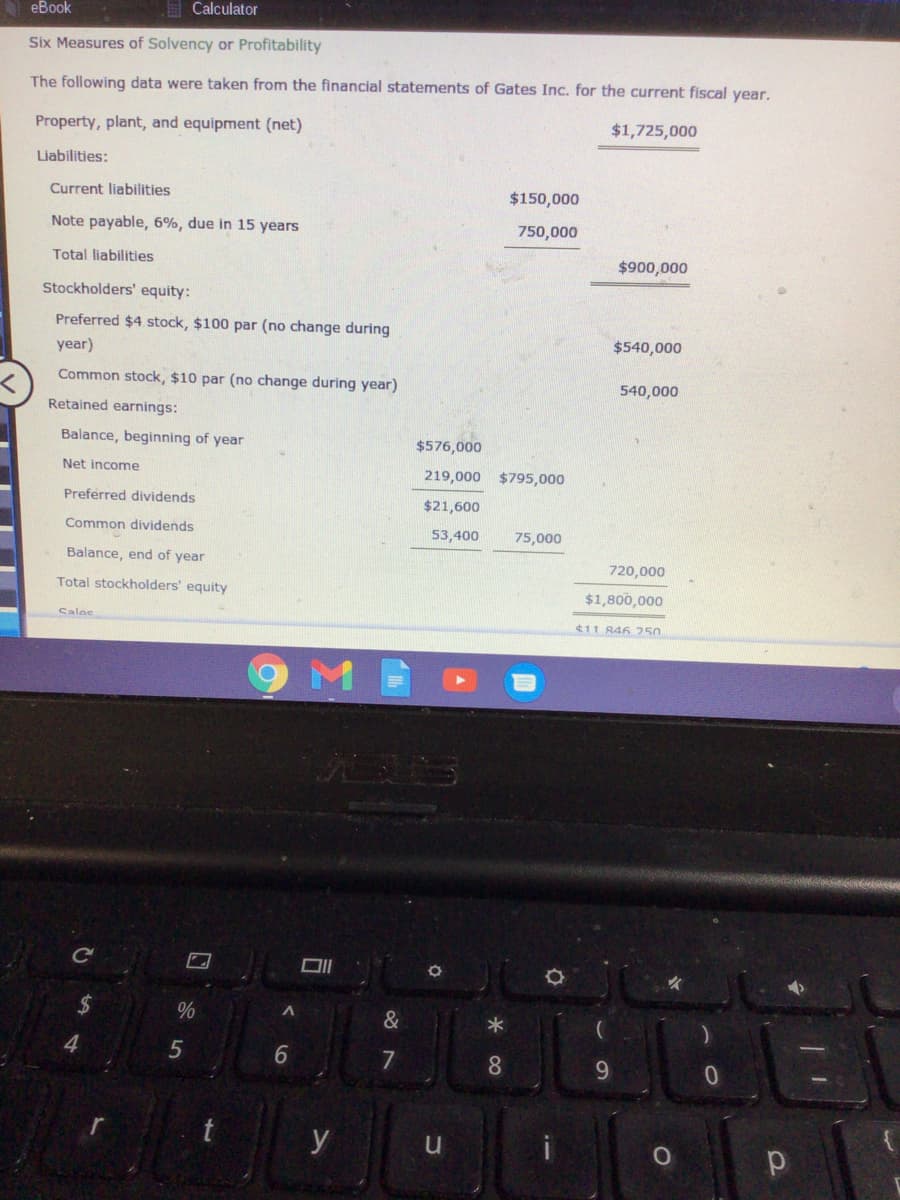

Six Measures of Solvency or Profitability

The following data were taken from the financial statements of Gates Inc. for the current fiscal year.

Property, plant, and equipment (net)

$1,725,000

Liabilities:

Current liabilities

$150,000

Note payable, 6%, due in 15 years

750,000

Total liabilities

$900,000

Stockholders' equity:

Preferred $4 stock, $100 par (no change during

$540,000

year)

Common stock, $10 par (no change during year)

540,000

Retained earnings:

Balance, beginning of year

$576,000

Net income

219,000 $795,000

Preferred dividends

$21,600

Common dividends

53,400

75,000

Balance, end of year

720,000

Total stockholders' equity

$1,800,000

Saloc

11 846 250

9ME

NES

%24

%

4

7

9.

y

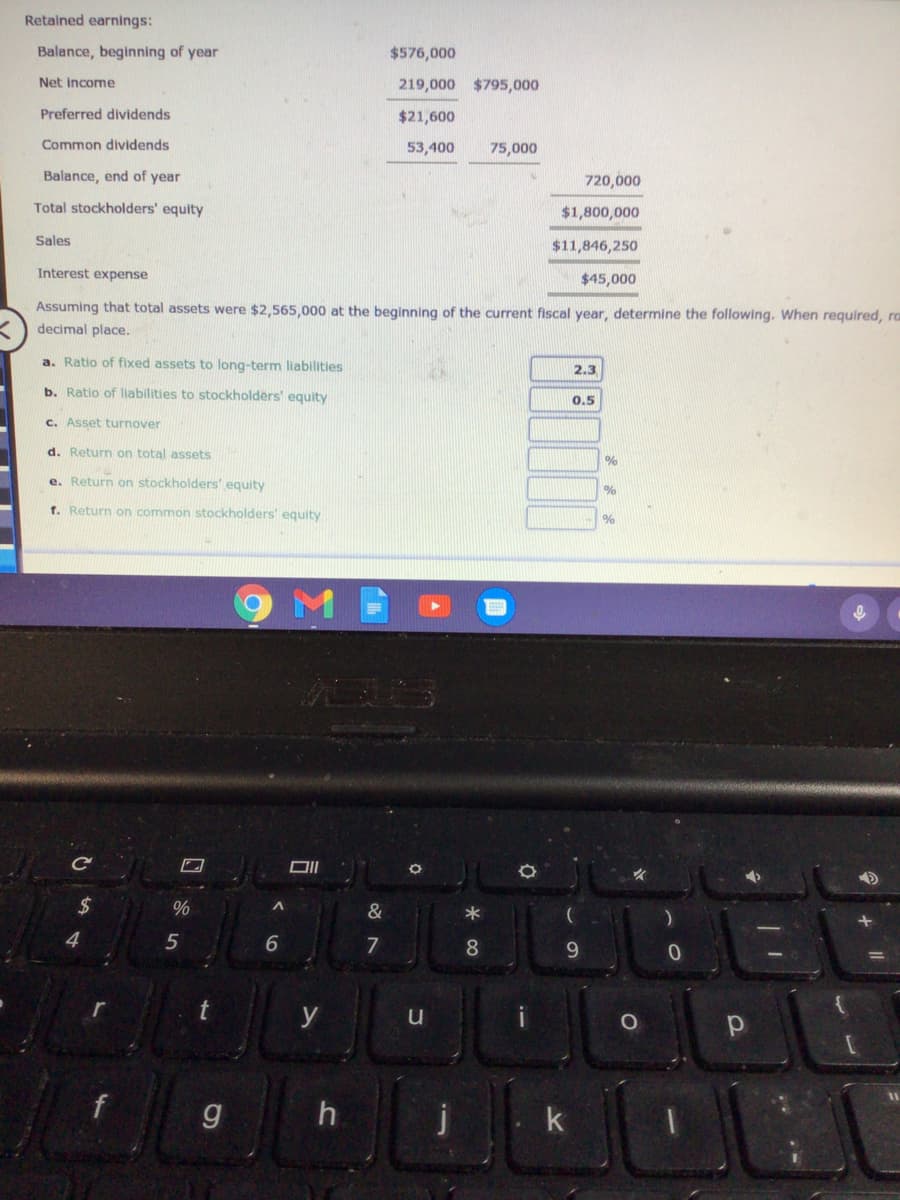

Transcribed Image Text:Retained earnings:

Balance, beginning of year

$576,000

Net income

219,000 $795,000

Preferred dividends

$21,600

Common dividends

53,400

75,000

Balance, end of year

720,000

Total stockholders' equity

$1,800,000

Sales

$11,846,250

Interest expense

$45,000

Assuming that total assets were $2,565,000 at the beginning of the current fiscal year, determine the following. When required, ra

decimal place.

a. Ratio of fixed assets to long-term liabilities

2.3

b. Ratio of liabilities to stockholders' equity

0.5

c. Asset turnover

d. Return on total assets

%

e. Return on stockholders' equity

f. Return on common stockholders' equity

%

ABS

24

&

4

6.

8

9.

t

y

u

k

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning